Future planning requires great importance, especially when you aim to protect the financial well-being of your family members. Financial and estate planning requires two essential tools, which are life insurance policies and wills. The two tools follow separate functions while appearing comparable at first glance. The following text explains how these two planning elements function separately and together while explaining their essential applications.

Life Insurance vs. Will: Basic Definitions

What is a Life Insurance Policy?

Your life insurance policy functions as a contractual agreement with an insurance organization. Policyholders make regular payments to their insurance provider, who returns a death benefit payment to their selected beneficiaries upon death. Your family receives financial assistance through life insurance coverage after your death.

Key Features of Life Insurance:

- Provides financial protection for dependents.

- Pays a lump sum to beneficiaries upon the policyholder’s death.

- Proceeds typically bypass probate and are received quickly.

- Can help cover debts, funeral expenses, and ongoing living costs.

- Offers tax advantages, as most life insurance payouts are tax-free.

- Some policies build cash value, which can be borrowed against.

Two main types of life insurance exist term life and whole life insurance, providing temporary coverage and permanent coverage with cash value accumulation, respectively. Your choice between life insurance policies depends on how you want to use the insurance and how it will benefit your financial situation and family.

What is a Will?

A will is a legal document that outlines how you want your assets and property distributed after you pass away. It also allows you to name an executor to handle your estate and appoint guardians for minor children.

Key Features of a Will:

- Specifies how assets like property, savings, and personal belongings should be distributed.

- Can appoint a guardian for minor children.

- Must go through probate (legal process of validating and executing the will).

- Can be contested in court by family members or creditors.

- Allows you to specify your funeral and burial wishes.

- Can establish trusts for children, dependents, or charities.

A will enable you to determine both the distribution of your property and the management of your estate as per your instructions. Your estate will follow state-defined distribution when you die without a will even though your preferences remain unaddressed.

Do I Need a Will if I Have Life Insurance?

The fact that someone owns life insurance does not eliminate the need for a will because these two benefits serve different purposes. The financial protection provided by life insurance benefits recipients without specifying the distribution of assets including property along with investments and personal belongings.

Your assets not included in life insurance coverage can be distributed correctly through a will, which takes care of all your possessions. A will becomes necessary to determine inheritance since state laws dictate asset distribution when a person passes away while lacking this legal document.

A properly executed will help establish the clear distribution of your property. Your will sets funeral arrangements while it selects an administrator for your assets and avoids family disagreements about asset distribution.

Life Insurance Beneficiary vs. Will Beneficiary

Life Insurance Beneficiary

A life insurance beneficiary is the person or entity you name in your policy to receive the death benefit. It can be:

- A spouse or partner

- Children

- A trust

- A charitable organization

- A business partner

The process of life insurance payout bypasses probate so your beneficiaries receive their money without delay. The death benefit from a life insurance policy helps beneficiaries secure urgent monetary assistance for debts as well as the expense of burial arrangements and day-to-day living expenses.

Will Beneficiary

A will beneficiary designates the recipient of assets defined in a created will that may include money or property and other valuable items. The assets allocated in a will need to pass through probate before distribution which may result in delays and produce additional legal costs.

Probate might require months or extend up to years of processing so you should create careful plans about it. A proper alignment of life insurance policy beneficiaries with what you want ensures no disputes or confusion arise in your end.

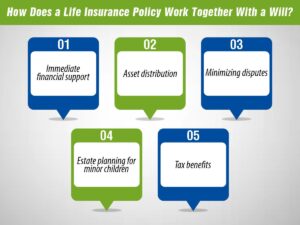

How Does a Life Insurance Policy Work Together With a Will?

A life insurance policy and a will can complement each other in your estate plan. Here’s how:

- Immediate financial support: Life insurance provides quick funds to cover funeral costs, debts, or daily expenses for your family.

- Asset distribution: A will ensure that assets like property, business shares, and personal belongings go to the right people.

- Minimizing disputes: Clearly defining beneficiaries in both documents reduces confusion and potential legal battles among family members.

- Estate planning for minor children: A will can establish a trust for children, while life insurance provides the funds to support them.

- Tax benefits: Life insurance payouts are usually tax-free, whereas some inherited assets from a will may be subject to estate taxes.

Life insurance policies may fund trusts that provide financial support to your child during their development if they are young. Your will contains specific directives which determine guardianship choices, along with provisions for the extended care of beneficiaries.

Who Needs a Will and Who Needs Life Insurance?

You Need Life Insurance If:

- You have dependents who rely on your income.

- You want to cover outstanding debts (mortgage, loans, etc.).

- You want to provide financial security for your spouse or children.

- You own a business and need protection for your business partners.

- You have a large estate and want to provide liquidity for estate taxes.

- You want to leave a financial gift for a charity or loved one.

You Need a Will If:

- You have assets such as property, savings, or valuable belongings.

- You have minor children and need to appoint a guardian.

- You want to prevent disputes over asset distribution.

- You want to specify funeral arrangements and personal wishes.

- You want to establish a trust for future financial planning.

- You have a blended family and want to specify asset distribution.

Can You Put Life Insurance Benefits in a Trust?

Yes, you can place life insurance benefits in a trust. A life insurance trust helps control how and when the payout is distributed to beneficiaries. This is useful if you:

How Much Does Life Isurance Cost?

- Want to protect the payout from creditors.

- Have minor children who shouldn’t receive a lump sum immediately.

- Want to reduce estate taxes for large estates.

- Want to provide structured payouts to beneficiaries over time.

Frequently Asked Questions (FAQs)

Can a will override a life insurance policy?

No, a will cannot override a life insurance policy. The beneficiary listed on your policy will receive the payout, regardless of what your will states.

What happens if I don’t name a beneficiary on my life insurance policy?

If no beneficiary is named, the insurance payout typically goes to your estate, which may delay the distribution due to probate.

Do life insurance payouts get taxed?

Most life insurance payouts are tax-free for beneficiaries. However, if the policy is part of a taxable estate, estate taxes may apply.

Can I change my life insurance beneficiary at any time?

Yes, you can change your beneficiary at any time, as long as the policy does not have an irrevocable beneficiary designation.

How often should I update my will and life insurance policy?

It’s best to review both documents every few years or after major life events like marriage, divorce, childbirth, or a significant financial change.

You Need Both a Will and Life Insurance

The functions of life insurance and a will overlap only through shared utility. Life insurance provides safety by delivering immediate monetary compensation to beneficiaries, which helps them pay for urgent costs comprising funeral expenses along with debt payments and maintenance requirements. Your assets together with your property, savings, and personal possessions, will be distributed through a will according to your chosen specifications. The estate planning document enables you to choose guardians for your minor children while determining your final arrangements. Both life insurance protection through a policy and proper documentation of a will offer complete protection for your family while ensuring monetary security.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.