Last Updated on: September 10th, 2025

Thank you for reading this post, don't forget to subscribe!- Licensed Agent

- - @M-LifeInsurance

Some people find it so difficult and even impossible to get life insurance because of their health problems, risky jobs, and sometimes other dangerous hobbies. High-risk life insurance promise to help these people so that they get coverage and protect their family’s financial stability.

Definition of High-Risk Life Insurance

High-risk life insurance policies are specially designed for the people who have risky jobs and some other serious health problems. These policies cost you more beaucse of their strict rules and regulations,but they promise to help you and give you financial protection if they found something risky in your life.

How It Differs from Standard Policies

What is life insurance for high-risk applicants? These insurance plans differ from standard policies, which base their rates on health factors, because high-risk life insurance specializes in covering people who typically fail standard health checks. These policies often come with:

- Higher premiums due to increased risk

- Limited coverage options

- Additional medical underwriting or waiting periods

People requiring insurance coverage would be prevented from obtaining standard policies through the specific exclusion clauses incorporated into high-risk life insurance policies.

Types of High-Risk Life Insurance Policies

Term Life Insurance: offers coverage for a fixed period, typically 10 to 30 years. The policy offers lower costs for potential enrollees, but the qualification process becomes more challenging when their health condition is serious.

Whole Life Insurance: The insurance policy offers continuous lifetime protection while developing a cash value that provides financial security to beneficiaries.

Guaranteed Issue Life Insurance: The insurance does not need medical testing, which makes it suitable for people facing severe medical issues. The policy comes with elevated rates but reduced policy limits.

What is Considered High-Risk for Insurance?

Life insurance providers evaluate different elements to establish risk levels during application procedures. The insurance company might provide higher costs or restricted coverage choices or refuse to accept a high-risk applicant. Various factors lead to someone being considered a high-risk applicant.

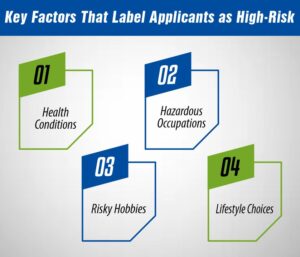

Key Factors That Label Applicants as High-Risk

When you are planning to buy this life insurance policy, the Insurance companies will look at your health, job, and lifestyle to decide how risky you are. These factors help determine the cost and conditions of life insurance.

- Health Conditions: People with diabetes, heart disease, cancer, or high blood pressure are considered higher risk by insurance companies.

- Hazardous Jobs: Dangerous jobs like mining, firefighting, and commercial fishing increase accident risk, so coverage may cost more.

- Risky Hobbies: Activities like skydiving, scuba diving, rock climbing, and car racing can make insurance harder to get or more expensive.

- Lifestyle Choices: Serious health problems or risky habits can affect whether you qualify for insurance and how much you pay.

How Insurers Assess Risk Levels

Factors that make people high-risk applicants vary, but insurers typically follow a thorough risk assessment process. This includes:

- Medical Underwriting: The healthcare professional needs to examine medical background and active health conditions along with personal behavior choices.

- Occupational & Lifestyle Evaluation: Evaluating job-related risks together with recreational activities undertaken by applicants.

- Statistical Data Analysis: Insurance professionals determine life expectancy alongside claim risk levels by studying statistical information.

Life Insurance Rate Classifications Explained

Life insurance companies classify applicants through rate classes that consider their health condition and lifestyle habits along with their overall risk status. Insurance policy premiums and coverage options depend on the risk classifications a client receives.

Overview of Rate Tiers

Insurance providers generally divide applicants into the following categories:

- Preferred: This category requires applicants to maintain health in excellent condition without serious medical problems, a disease-free family record, and no risky lifestyle choices. People in excellent health get access to the lowest available insurance premiums.

- Standard: This category includes people with standard health status who have limited existing medical issues, including treated high blood pressure. Rates differ slightly from those of the preferred coverage. Insurance costs within the premium band exceed those of the preferred package.

- Substandard (High-Risk): The coverage serves people who have major health problems or dangerous work environments or dangerous leisure activities. The applicants in this category must pay very steep premiums, and their policies may include various limitations.

How High-Risk Status Impacts Premiums

Life insurance rate classifications are heavily influenced by an applicant’s risk level. The substandard category applies to people with medical problems or who smoke and work at dangerous jobs thus leading to a specific premium structure.

- Higher Premiums: The higher premium charges exist to compensate for the elevated danger.

- Limited Coverage Options: Certain insurance policies apply both exclusions and waiting restrictions to coverage benefits.

- Additional Medical Exams: Additional detailed evaluation will precede final approval from the bank.

Case Study: Sample Rates for Smokers vs. Non-Smokers

To illustrate how rate classifications work, consider the following example:

- Non-Smoker (Preferred Rate): A healthy 35-year-old male can obtain a $500,000 term life policy through monthly payments of $25.

- Smoker (Substandard Rate): Smokers within the age range of 35 can face premium costs of $80/month because their health risks have escalated.

How Much Does High-Risk Life Insurance Cost?

High-risk life insurance is for people with health problems, dangerous jobs, or risky hobbies. This insurance policy usually costs you more than regular life insurance. Knowing these costs helps people plan better and choose the right coverage.

Average Cost Ranges for High-Risk Applicants

Insurance premiums for high-risk life coverage depend on the specific insurance provider and applicant’s health status and selected policy type. On average:

How Much Does Life Isurance Cost?

- Mild Health Risks (e.g., controlled high blood pressure): $50–$100 per month for a $250,000 term policy.

- Moderate Risks (e.g., diabetes, obesity, smoking): $100–$250 per month.

- Severe Risks (e.g., cancer history, heart disease, extreme sports participation): $250+ per month, with some policies exceeding $500.

These figures highlight how risk factors directly influence premium costs.

Variables Affecting Premiums

Several factors determine how much high-risk life insurance costs, including:

- Age: Older application candidates experience higher premium prices due to their elevated mortality hazards.

- Health Severity: Medical condition severity along with risk factor severity determines premium costs.

- Policy Type: The cost of term policies is typically inexpensive, yet premiums on whole and guaranteed issue policies rise because they provide lifetime coverage.

Strategies to Lower Costs

Strategies to Lower Costs

Applicants can take steps to reduce their life insurance costs, such as:

- Improving Health: Rates improve when individuals learn to control their chronic diseases while maintaining weight health and quitting the smoking habit.

- Choosing a Term Policy: Term life insurance provides better affordability compared to whole and guaranteed-issue life insurance types.

- Comparing Providers: An insurance policy search through an independent agent will help identify companies specializing in acceptance of high-risk clients.

How to Find the Right High-Risk Life Insurance Policy

Finding a life insurance policy becomes more difficult for high-risk applicants, but the proper methodology leads to suitable coverage. Your knowledge about options combined with choosing proper providers will significantly impact your chances of success.

Working with Specialized High-Risk Life Insurance Carriers

Not every insurance provider accepts applicants with risky conditions. Some insurance providers focus exclusively on offering coverage for people who have healthcare needs and dangerous occupations and risky recreational activities. These carriers:

- Organizational underwriting guidelines need clear directions for handling risk groups specifically.

- The insurance company provides expanded coverage possibilities, which traditional insurers lack.

- The insurance premiums through Medicare might be more affordable compared to standard general insurance plans.

With the help of an agent familiar with high-risk rates, it is possible to find the right companies.

Comparing Quotes and Policy Features

There is a need to compare different policies, more so when it comes to high-risk life insurance policies. Consider the following:

- Premium Costs: Therefore, consider looking at monthly or annual packaging of the product based on the risk level.

- Coverage Amounts: Make sure that your policy is capable of giving your family the level of financial security that will be enough for them.

- Exclusions & Waiting Periods: Some policies come with provisions on some conditions as to how much money will be paid out.

Importance of Transparency in Medical Underwriting

Medical underwriting is a process that has a huge say on the eligibility and the premiums to be charged. It is crucial to disclose information about previous and current health issues and habits because:

- Misrepresentation can lead to denied claims.

- There are some insurance companies who can offer better rates for those who actively manage their health.

- Full disclosure ensures you get a policy that truly protects your loved ones.

Top High-Risk Life Insurance Carriers

Accessing life insurance when one is a high-risk applicant can be quite difficult, but certain carriers work with high-risk candidates due to medical conditions, hazardous professions, or lifestyles.

Review of Insurers Specializing in High-Risk Coverage

Several insurance organizations specialize in high-risk applicants and offer a friendly market with flexible underwriting and reasonable prices. Some top options include:

- Prudential: The health insurer provides coverage to individuals who have a history of diabetes or smoke history as their medical condition.

- AIG: The company provides guaranteed-issue policies that do not require medical tests and benefit people who have severe health risks.

- Mutual of Omaha: Offers competitive high-risk products with customizable limit amounts.

- Banner Life: A good choice for individuals with well-managed chronic conditions.

- Transamerica: this company will offer you the best and competitive rates for those who are in hazardous occupations or with high-risk hobbies.

Pros and Cons of Guaranteed-Issue vs. Medically Underwritten Policies

People with high health risks can get two main types of life insurance:

Guaranteed-Issue Life Insurance

Pros:

- No medical exam needed.

- Almost everyone is accepted.

- Good for serious health problems.

Cons

- Costs more.

- Covers less money.

- May have a waiting period before full benefits.

Medically Underwritten Life Insurance

Pros

- Costs less if health is okay.

- Can cover more money.

- Usually no waiting period.

Cons

- Must do a medical exam.

- Could be denied if health is too risky.

FAQs

Can I get coverage with a terminal illness?

Yes, but only guaranteed-issue life insurance is available. No medical exam is needed, coverage is small ($5,000–$50,000), and full benefits may take 2–3 years. If death occurs before then, premiums with interest are refunded.

How long does underwriting take for high-risk cases?

Usually 4–8 weeks, depending on medical complexity and extra reports needed. Guaranteed-issue or simplified policies are faster, often approved in days, but premiums are higher.

Are there exclusions in high-risk policies?

Yes. Common exclusions include:

- Pre-existing conditions.

- Risky activities

- Suicide

Conclusion

The insurance coverage for individuals with medical conditions or hazardous occupations and risky lifestyles exists as high-risk life insurance. Homeowners should face difficulty finding insurance, yet comprehending insurer assessment practices alongside researching suitable policies improves their chances of securing proper coverage. People who apply to high-risk programs will encounter elevated insurance prices coupled with additional underwriting rules, yet they can select among different policy types like guaranteed-issue and medically underwritten solutions.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.