Last Updated on: May 19th, 2025

- Licensed Agent

- - @M-LifeInsurance

Intoduction

When it comes to protecting the financial future of your family, life insurance is often associated with young parents or working adults. However, there’s growing interest in securing life insurance for grandparents, especially as families seek to cover final expenses, manage end-of-life costs, or leave a legacy. Whether you’re wondering, “Can I get life insurance on my grandmother?” or looking for the best life insurance for grandparents, this guide covers everything you need to know.

Can You Get Life Insurance on Your Grandparents?

The short answer is yes—but there are conditions. To legally obtain life insurance on a grandparent, you must meet two essential requirements:

- Insurable Interest: You must demonstrate that you would suffer a financial loss if your grandparent were to pass away. As a grandchild or adult child, this typically applies if you are covering their medical or living expenses.

- Consent: Your grandparent must provide written and informed consent to the policy. You cannot legally get life insurance on your grandmother or grandfather without their knowledge.

Questions like “Can I get life insurance on my grandma?” or “Can I get life insurance on my grandmother without her consent?” come up often. The answer is no—consent is always required by law.

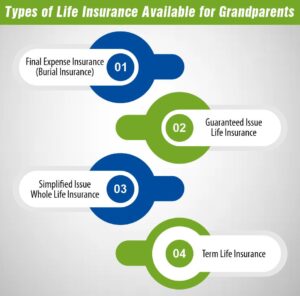

Types of Life Insurance Available for Grandparents

1. Final Expense Insurance (Burial Insurance)

- Designed specifically to cover funeral and burial costs

- Policies typically range from $5,000 to $25,000

- Often requires no medical exam

- Ideal for seniors aged 50 to 85

2. Guaranteed Issue Life Insurance

- No health questions or exams required

- Coverage is guaranteed if you’re within the age range (usually 50-80)

- Two-year waiting period for full death benefit

- Higher premiums but lower barriers to entry

3. Simplified Issue Whole Life Insurance

- Minimal health questions, no exam

- Offers lifelong coverage and builds cash value

- Higher benefit amounts than final expense insurance

4. Term Life Insurance

- Provides coverage for a set period (10, 15, or 20 years)

- Less common for those over 70

- Lower premiums but requires better health

Best Life Insurance for Grandparents in 2025

If you’re searching for the best life insurance for grandparents, here are top options to consider:

| Insurance Provider | Best For | Age Range | Medical Exam | Coverage Amount |

| Mutual of Omaha | Final Expense | 45-85 | No | $2,000 – $40,000 |

| AIG Guaranteed Issue | Guaranteed Coverage | 50-80 | No | $5,000 – $25,000 |

| Colonial Penn | Easy Approval | 50-85 | No | Up to $50,000 |

| Globe Life | Term Options | 60-75 | Sometimes | $5,000 – $100,000 |

| Transamerica | High Coverage | 65-85 | Yes (for term) | $25,000+ |

Each policy has unique benefits depending on your grandparent’s age, health, and desired coverage. Compare providers and get personalized quotes to find the best fit.

How Much Does Life Insurance for Grandparents Cost?

The cost of life insurance depends on several factors:

- Age and health of your grandparent

- Type of policy (term vs whole life vs guaranteed issue)

- Coverage amount

- Insurance provider

Sample Premium Estimates (Monthly):

- Final Expense (Age 70, $10,000 coverage): $45–$70/month

- Guaranteed Issue (Age 75, $15,000 coverage): $80–$120/month

- Term Life (Age 65, $50,000 for 10 years): $60–$90/month

Real-World Scenario:

Jane, a 38-year-old granddaughter, takes out a $15,000 final expense policy on her 78-year-old grandmother. Her monthly premium is $68. After her grandmother passes, the policy helps cover the funeral costs without creating financial stress.

Why Get Life Insurance for a Grandparent?

- Cover Funeral & Burial Costs

Funerals can cost $7,000–$12,000. Life insurance helps avoid out-of-pocket expenses. - Settle Debts or Medical Bills

Seniors may leave behind credit card debt, personal loans, or unpaid medical expenses. - Leave a Financial Legacy

A small policy can provide financial support to grandchildren or be used for education funds. - Emotional and Financial Relief

During the painful time following the death of a grandparent, having coverage eases the financial burden and helps the family focus on healing. - Support Estate Planning

Life insurance benefits can be used to ensure smooth estate transitions or charitable giving.

Death of a Grandparent: The Emotional Side

Losing a grandparent is emotionally devastating. Having life insurance in place can ease logistical and financial stress. Incorporate death of grandparent quotes to honor their memory:

“A grandparent’s love is forever in our hearts.”

“When a grandparent dies, a library burns to the ground.”

These quotes can also be used in memorial services or life celebration ceremonies.

Additionally, families should consider including final wishes in the policy documentation to ensure the legacy and values of their loved one are respectfully preserved.

How to Talk to Grandparents About Life Insurance

Discussing life insurance can feel uncomfortable. Here are tips for a smooth conversation:

- Be Respectful: Acknowledge their autonomy and explain your concern comes from love.

- Focus on the Benefits: Highlight how it helps the family and honors their legacy.

- Offer to Handle the Details: Many seniors are overwhelmed by paperwork—help simplify the process.

- Share Real Examples: If someone you know benefited from such a policy, share that story.

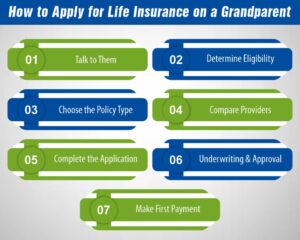

How to Apply for Life Insurance on a Grandparent

Here is a step-by-step guide to securing life insurance for your grandmother or grandfather:

- Talk to Them

Explain the reasons for getting coverage and assure them it’s for peace of mind. - Determine Eligibility

Consider age, health condition, and policy type. - Choose the Policy Type

Decide between final expense, term, or guaranteed issue policies. - Compare Providers

Get at least three quotes to compare pricing and benefits. - Complete the Application

Provide accurate information and ensure your grandparent consents to the policy. - Underwriting & Approval

Most guaranteed issue policies offer fast approvals with minimal paperwork. - Make First Payment

Most policies go into effect once the first premium is paid.

How Much Does Life Isurance Cost?

What to Do When the Grandparent Passes Away

When the insured grandparent passes, follow these steps to make a claim:

- Contact the insurance company immediately

- Submit the death certificate and claim form

- Provide proof of identification as a beneficiary

- Receive the payout (typically within 7–30 days)

Keep a copy of the policy and contact details in an easily accessible location.

Legal Considerations & Tax Implications

Before purchasing a policy, consult with a financial advisor or insurance specialist to understand legal and tax-related outcomes. Some key things to note:

- Proceeds from life insurance are typically not taxable to beneficiaries.

- If a policy builds cash value, there could be tax implications if withdrawn.

- State laws may affect policy ownership and benefit disbursement.

Common Mistakes to Avoid

- Not Getting Consent: Always obtain written permission to avoid legal issues.

- Choosing the Wrong Policy Type: Match coverage to your grandparent’s health and needs.

- Overpaying: Some providers charge high premiums for low coverage. Always compare.

- Waiting Too Long: Premiums increase significantly with age.

- Ignoring Fine Print: Understand waiting periods, exclusions, and benefit structures.

FAQs About Life Insurance for Grandparents

Q: Can I get life insurance on my grandmother?

Yes, with her consent and if you have an insurable interest.

Q: Is final expense insurance better for seniors?

It’s often the best option for grandparents due to low coverage needs and no medical exam.

Q: What if my grandparent has health issues?

Guaranteed issue life insurance is a great alternative.

Q: How soon does the policy go into effect?

Most policies have a 2-year waiting period for natural death but cover accidental death immediately.

Q: Can grandchildren be beneficiaries?

Yes, grandchildren can be named as beneficiaries depending on the policy.

Q: Can I take out a policy without telling my grandparent?

No. Legal consent is always required.

Q: Can life insurance help with estate planning?

Yes. It can be used to equalize inheritances, settle debts, or donate to a cause.

Conclusion

Choosing life insurance for a grandparent isn’t just about money—it’s about love, responsibility, and preparing for the future. Whether you’re seeking life insurance for a grandmother or life insurance for a grandfather, there are flexible, affordable options tailored to meet their needs.

With the right plan, you can honor their legacy, support your family, and gain peace of mind knowing everything is taken care of. Take the next step by discussing coverage options with your loved one today and explore quotes from top-rated providers.

Because planning ahead is the ultimate gift of love.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.