Last Updated on: July 2nd, 2025

- Licensed Agent

- - @M-LifeInsurance

You are undocumented immigrants living in the US and want to protect your family and buy life insurance. Life insurance is the only thing that protects you during life’s most difficult situations. You also have the right to protect your family, no matter if you are an undocumented immigrant, but securing an insurance policy can be confusing and complicated for you. You can get life insurance, but under certain conditions. In this guide, we’ll cover how immigrants can get coverage no matter if they are documented or not, what the requirements are, and how to find the best policies available.

Can I Get Life Insurance as an Immigrant?

You are worried about the financial security of your family and thinking if i get the life insurance as an undocumented immigrant well we have a good news that yes you can get a life insurance while living in U.S. You have to follow a process, but don’t worry, this is possible; we will help you get life insurance.

Here are some key takeaways for a better understanding of documented and undocumented immigrants;

- Undocumented immigrants can take out life insurance, but under certain conditions.

- Green card holders can get life insurance easily. They have a good chance of getting the policy, depending on the visa type and duration of stay.

- For non-citizens, there are also some options to obtain, such as term life and whole life insurance policies.

- It’s a good idea to always talk with the experts for better options.

Life Insurance Options for Undocumented Immigrants

There are different types of life insurance options for non U.S. citizens depending on their situation. The most common option is term life insurance. This insurance will give coverage for a set number of years.

Another option is whole life Insurance, this insurance will provide you the coverage for your lifetime and also build cash value over time. This life insurance can be more expensive.

Eligibility Requirements for Undocumented Immigrants

To qualify for any one the these insurance policies, you need a valid ITIN and a U.S. address. There are some insurance companies that may ask for proof of income or a medical exam. But the options are limited for non-citizens as compared to U.S. citizens. There are so many trusted insurance companies that are offering coverage to undocumented citizens.

Can I Get Life Insurance Without a Social Security Number?

You can still get life insurance if you don’t have a Social Security Number (SSN),. There are many insurance companies that accept an Individual Taxpayer Identification Number (ITIN) as an alternative to an SSN.

- An ITIN is given by the IRS to people who don’t qualify for an SSN but still need to file taxes.

- Many undocumented immigrants have an ITIN and can use it when applying for life insurance.

If you don’t have an SSN or ITIN, your options will be so limited, but it’s still possible to qualify with other documents, especially through no-medical-exam or simplified issue policies.

Can Temporary Visa Holders Get Life Insurance?

The answer is yes, immigrants with temporary visas can get life insurance. Some insurance companies have rules based on your visa type and the duration of your visa. But many of the insurance companies that are providing policies to people who have temporary visas.

Best Life Insurance for Undocumented Immigrants

These are options for undocumented immigrants who don’t require a Social Security Number (SSN) or a lot of paperwork.

1. Guaranteed Issue Life Insurance

- No medical exam needed.

- No SSN is typically needed

- Higher premiums and lower coverage amounts

- Ideal for older undocumented immigrants or those with health issues

2. Simplified Issue Life Insurance

- Short health questionnaire

- May accept ITIN instead of SSN

- Coverage amounts are moderate

- Faster approval time

3. Final Expense Insurance (Burial Insurance)

- Designed to cover funeral and end-of-life costs

- Small face value ($5,000–$25,000)

- Often available without an SSN or medical exam

- Quick approval

4. Term Life Insurance (from ITIN-accepting companies)

- Offers higher death benefits at lower rates

- Typically requires a medical exam

- Must have ITIN or other proof of identity/residency

Companies That May Offer Policies to Undocumented Immigrants:

- Mutual of Omaha

- Transamerica

- Gerber Life

- AIG (for guaranteed issue)

- Ethos (for simplified underwriting)

Why Is Life Insurance for Undocumented Immigrants Important?

Life insurance for undocumented immigrants is important because they are also working hard, and help to develop the U.S. These immigrants have to support their families in the U.S. or other countries.

But most people don’t have the basic financial protection to keep their family and loved ones protected and safe. If something happens to them, here’s why life insurance for undocumented immigrants is important:

1. Financial Security for Loved Ones

If you pass away unexpectedly, life insurance can help your family pay for funeral costs, debts, and daily expenses. It protects them from financial hardship.

2. Support for Children and Spouses

If you are the only one who is earning for the family, life insurance can replace your income so this will support your family and children and make sure they meet their basic needs.

3. Peace of Mind

Living with undocumented status can be stressful. Having life insurance gives you peace of mind knowing your loved ones will be taken care of if anything happens.

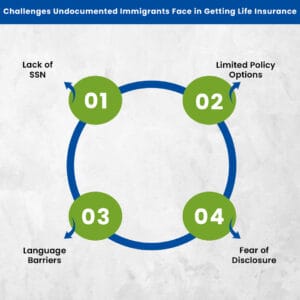

Challenges Undocumented Immigrants Face in Getting Life Insurance

Despite growing accessibility, undocumented immigrants may face the following challenges:

How Much Does Life Isurance Cost?

- Lack of SSN: Some insurers still require a Social Security Number.

- Limited Policy Options: Fewer choices in coverage types and face amounts.

- Language Barriers: Application and support documents are often only in English.

- Fear of Disclosure: Some fear that applying might expose their immigration status. (Note: Insurers do not report immigration status to authorities.)

Disclosing Immigration Status: What Life Insurance Applicants Should Know

It is very important to be honest about your immigration when you are applying for the insurance. Here are some of the reasons why;

- If you hide or lie about your immigration status. The company will immediately cancel your policy, and they also refuse to give you the death benefits later

- If you share your correct status, the insurance companies will help you to find the best policy for you according to your status and the policy that fits your needs.

- The insurance companies will make a fair decision after they understand the risks.

- You also have to be truthful because this will help you avoid legal issues, and you will not get any trouble.

- After your death, if a company finds out any lie, they might not give money to your family.

Always be honest with the company while buying, no matter if it affects your coverage or cost. Telling the truth means that you are protecting your family when they need it the most.

Final Thoughts

A US undocumented citizen can buy life insurance with the right documents. They also have the right to protect their family as they are working for the U.S. and developing the economy. Don’t let your immigration status stop you from securing your family’s future. Talk to a trusted agent today and take the first step toward lasting protection. You have different options to choose the best policy that will fit your needs. Make sure to tell the honest status of immigration ot the insurer and get the best options for you accordingly.

Frequently Asked Questions

Can I get life insurance if I’m undocumented but married to a U.S. citizen?

Yes, if you are married to a US citizen and an undocumented citizen, you can get life insurance. As your spouse is a citizen, this will help you to provide documentation and a joint address to the insurer.

What happens if I pass away and my family is in another country?

The life insurance benefit can be paid to beneficiaries living abroad. They will need to provide identification and sometimes notarized forms or banking details.

Will applying for life insurance risk deportation?

No. Insurance companies are private businesses and do not report to immigration authorities.

Can I get life insurance for my children if I’m undocumented?

Yes, many insurers offer life insurance for children, and your immigration status typically won’t affect your ability to purchase a child rider or separate policy.

Protect your family’s future today. Contact a trusted agent to explore life insurance options for undocumented immigrants. Start your coverage now!

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.