Last Updated on: March 22nd, 2025

- Licensed Agent

- - @M-LifeInsurance

Whole life insurance is more than just a policy to protect your loved ones; it also serves as a financial tool that accumulates cash value over time. Unlike term life insurance, whole life insurance provides lifelong coverage while growing in value. But how does this cash value build-up, and how can you use it? In this guide, we’ll break down the mechanics of whole life insurance cash value in a simple and easy-to-understand manner.

What is Whole Life Insurance?

Whole life insurance is a type of permanent life insurance that offers coverage for your entire life. It combines a death benefit with a cash value component, which grows over time. This makes it an attractive option for individuals looking for both financial protection and a savings component.

Key Features of Whole Life Insurance:

- Lifelong Coverage: Coverage lasts your entire lifetime, as long as premiums are paid.

- Guaranteed Death Benefit: A payout is given to beneficiaries upon the policyholder’s death.

- Fixed Premiums: Your premiums remain consistent throughout the policy term.

- Cash Value Growth: A portion of your premiums accumulates as cash value.

- Dividend Earnings: Some policies offer dividends that can enhance cash value growth.

How Does Whole Life Insurance Build Cash Value?

The cash value in a whole life insurance policy grows over time through several mechanisms:

1. Premium Payments

Each time you make a premium payment, a portion goes toward the cost of insurance and policy fees, while the remaining amount is allocated to the cash value account. Over time, as you continue to make regular premium payments, your cash value steadily grows, providing a financial safety net that can be used in various ways.

2. Interest Accumulation

The cash value grows at a guaranteed rate, often set by the insurance company. Some policies also offer additional dividends, further enhancing growth. This makes whole life insurance a reliable and predictable savings vehicle compared to riskier investment options. The interest component of the policy is structured to ensure steady accumulation, even during economic downturns.

3. Dividend Earnings (For Participating Policies)

If you have a participating whole life insurance policy, your insurer may pay dividends based on the company’s financial performance. These dividends can be:

- Reinvested to increase cash value

- Used to purchase additional coverage

- Taken as cash payouts

These dividends, while not guaranteed, can significantly enhance the overall value of your policy, giving you additional financial flexibility over time. Some policyholders use dividends as an additional income stream, while others reinvest them for faster cash value growth.

4. Tax-Deferred Growth

The cash value grows tax-deferred, meaning you don’t have to pay taxes on the growth until you withdraw it. This allows your savings to accumulate more efficiently over time, making whole life insurance an attractive option for those looking for tax-advantaged financial planning. The longer you keep your policy active, the greater the tax-deferred benefits, which can lead to substantial savings over the years.

Ways to Use the Cash Value in Your Whole Life Insurance

Once your policy has built significant cash value, you can access it in several ways:

1. Taking a Policy Loan

You can borrow against your cash value with a policy loan. It’s typically offered at lower interest rates than personal loans and does not require credit approval. The flexibility of a policy loan allows you to access funds for emergencies, business opportunities, or large expenses without disrupting your financial stability.

2. Making a Partial Withdrawal

You can withdraw some of the cash value, but this may reduce your death benefit if not repaid. This option is useful for short-term financial needs, such as funding education, home improvements, or other planned expenses.

3. Paying Premiums

If your cash value has grown enough, you can use it to cover premium payments. This can be particularly helpful during retirement when your income may be limited, allowing you to maintain your policy without additional out-of-pocket costs.

4. Surrendering the Policy

If you decide to cancel your policy, you will receive the accumulated cash value minus any fees or surrender charges. However, surrendering your policy should be carefully considered, as it means forfeiting the death benefit and potential long-term financial growth.

5. Supplementing Retirement Income

Many policyholders use their cash value as a source of supplemental income during retirement. Unlike other retirement accounts, whole life insurance cash value can be accessed without penalties, making it a valuable addition to a diversified retirement strategy. This can help retirees maintain their lifestyle and cover unexpected expenses without relying solely on pensions or Social Security.

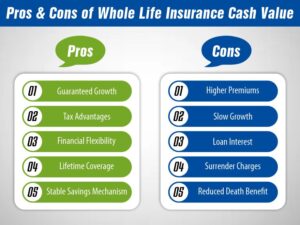

Pros and Cons of Whole Life Insurance Cash Value

Pros:

- Guaranteed Growth: Cash value grows at a fixed rate.

- Tax Advantages: Growth is tax-deferred, and loans are tax-free.

- Financial Flexibility: You can borrow against it or use it for premiums.

- Lifetime Coverage: No need to renew or worry about policy expiration.

- Stable Savings Mechanism: Provides a reliable financial cushion that is not affected by market fluctuations.

Cons:

- Higher Premiums: More expensive than term life insurance.

- Slow Growth: Takes years to accumulate significant cash value.

- Loan Interest: Borrowing against it incurs interest.

- Surrender Charges: Canceling the policy early may result in high fees.

- Reduced Death Benefit: If cash value is withdrawn or borrowed, it can decrease the payout to beneficiaries.

Who Should Consider Whole Life Insurance?

Whole life insurance is best for individuals who:

How Much Does Life Isurance Cost?

- Want permanent coverage with a guaranteed death benefit.

- Are looking for a stable, long-term financial tool.

- Want to leave an inheritance or cover estate taxes.

- Prefer a tax-advantaged way to save money over time.

- Seek a policy that offers both protection and wealth accumulation.

FAQs About Whole Life Insurance Cash Value

1. How long does it take to build significant cash value?

It depends on the policy, but typically, significant cash value accumulates after 10-20 years. The longer the policy remains active, the greater the growth potential.

2. Can I lose the cash value in my policy?

No, the cash value is guaranteed, but withdrawing or borrowing can reduce the death benefit. Proper financial planning can help you maximize benefits without compromising the policy’s primary purpose.

3. What happens to the cash value when I die?

The cash value does not go to your beneficiaries unless you have a rider that includes it in the death benefit. Most insurers pay out only the death benefit, and the accumulated cash value is absorbed by the company.

4. Can I cash out my whole life insurance policy?

Yes, but surrendering the policy means losing the death benefit and may incur fees. Always review the financial implications before making a decision.

5. Is whole life insurance a good investment?

It’s a conservative, low-risk financial tool but may not provide the same returns as other investment options. However, for those seeking stability, lifelong coverage, and tax-deferred growth, it remains a valuable component of financial planning.

Conclusion

Whole life insurance provides lifelong protection and a growing cash value component, making it a reliable financial tool. While it requires higher premiums than term life insurance, the benefits of guaranteed cash growth, tax advantages, and borrowing options make it an attractive choice for many. If you’re considering whole life insurance, consult with a financial advisor to determine if it fits your long-term financial goals.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.