As you plan for the future, ensuring that your loved ones are cared for in the event of a nursing home stay is a priority. One financial tool that can provide peace of mind is a life insurance policy. However, there is often confusion surrounding whether nursing homes can access these funds.

In this blog post, we’ll explore the question: Can nursing homes take your life insurance from your beneficiary? We’ll debunk common myths and provide clarity on how you can use life insurance to cover nursing home care costs. Understanding your options and taking proactive steps can help you protect your assets and ensure that your loved ones are taken care of.

Let’s get started!

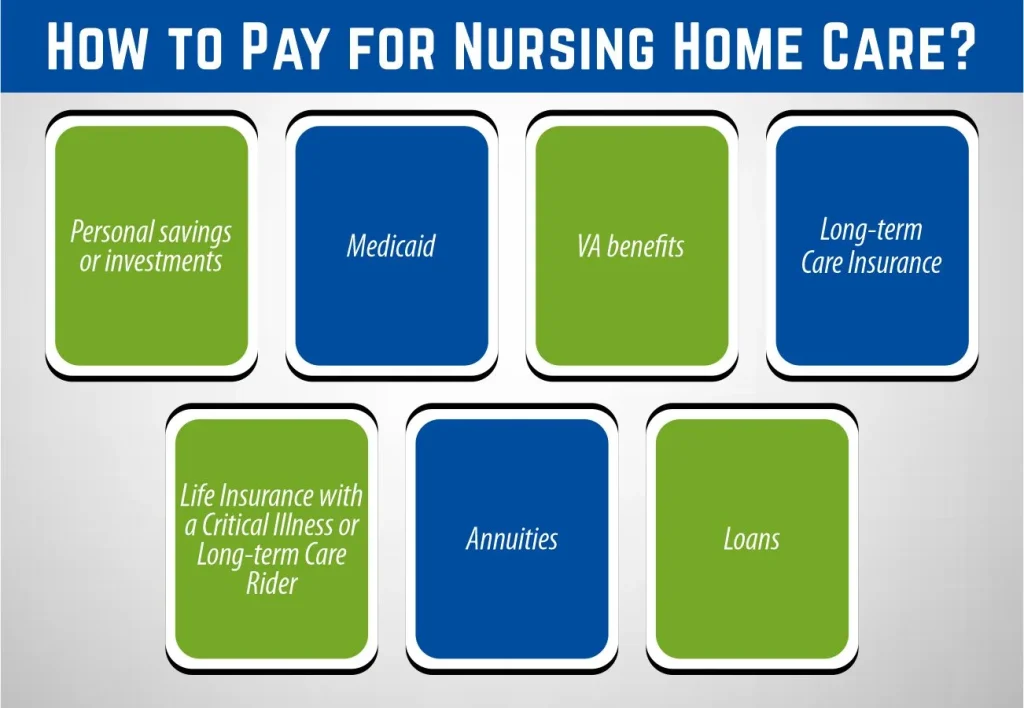

How to Pay for Nursing Home Care?

Paying for nursing home care can be a daunting prospect for many families, especially considering the high costs involved. Understanding the various payment options available is crucial in planning for long-term care needs. Here are some common ways individuals cover nursing home expenses:

1- Personal savings or investments

Using personal funds to pay for nursing home care is a straightforward option if you have sufficient savings or investments. However, it’s important to consider the long-term implications on your finances and whether these funds will be sustainable to cover the potentially high costs of long-term care.

2- Medicaid

Medicaid is a joint federal and state program that helps with medical costs for individuals with limited income and resources. It covers a range of long-term care services, including nursing home care, for eligible individuals. To qualify, you must meet income and asset requirements set by your state. Medicaid planning strategies can help protect assets and ensure eligibility.

3- VA Benefits

The Department of Veterans Affairs (VA) offers benefits for veterans and their spouses to help cover the cost of nursing home care. These benefits, known as Aid and Attendance or Housebound benefits, are available to veterans who served during wartime and meet certain criteria. Eligibility requirements can vary, so it’s important to check with the VA for specific details.

4- Long-term Care Insurance

Long-term care insurance is designed to cover the costs of long-term care services, including those provided in a nursing home. Policies vary in coverage and cost, so it’s important to review the terms carefully. Premiums for long-term care insurance can be expensive, and eligibility requirements may become stricter as you age or if you have existing health conditions.

5- Life Insurance with a Critical Illness or Long-term Care Rider

Some life insurance policies offer riders that provide benefits for long-term care needs. These riders can help cover nursing home costs, but they may come with additional premiums. It’s important to understand the terms of the rider and how it affects the death benefit of the policy.

6- Annuities

Annuities are financial products that provide a steady income stream for a specified period or life. Some annuities can be used to fund nursing home care by providing a regular payment to cover the costs. However, annuities can be complex financial products, and it’s important to understand the terms, fees, and tax implications before purchasing one for this purpose.

7- Loans

Using a loan, such as a home equity loan, can provide the funds needed to pay for nursing home care. However, taking on debt can have long-term financial implications, and it’s important to consider whether you’ll be able to repay the loan and how it will affect your overall financial situation.

Can Nursing Homes Take Your Life Insurance from Your Beneficiary?

No, nursing homes cannot take your life insurance policy from your beneficiary. Life insurance policies are typically considered the property of the policyholder and are protected from creditors, including nursing homes.

As long as you have named a beneficiary to receive the proceeds of your life insurance policy, the nursing home responsible for your care cannot claim any of the death benefits from your policy. Your beneficiary will have the authority to decide how to use the money from the policy, whether it’s for paying final expenses, paying off debts, or covering day-to-day living expenses.

It’s important to ensure that you have named a beneficiary for your life insurance policy and that your beneficiary information is up to date to avoid any potential issues. If your estate is the beneficiary of your life insurance policy, a nursing home might be able to make a claim against your estate for any outstanding costs of care.

Using Life Insurance to Pay for Nursing Home Care

Using life insurance to pay for nursing home care can be a viable option for those who want to cover their long-term care costs without depleting their savings or burdening their loved ones. Here are four ways you can use life insurance to pay for nursing home care:

1- Life Settlement

A life settlement involves selling your life insurance policy to a third party for a lump sum cash payment. The buyer takes over the premium payments and receives the death benefit when you pass away. The cash from the settlement can be used to cover nursing home costs. However, keep in mind that selling your policy means your beneficiaries won’t receive the death benefit.

2- Viatical Settlement

Similar to a life settlement, a viatical settlement involves selling your life insurance policy to a third party. However, viatical settlements are specifically for individuals who are terminally ill or have a life expectancy of two years or less. The cash from the settlement can be used to pay for nursing home care, but again, your beneficiaries won’t receive the death benefit.

3- Accelerated Death Benefit Rider

Some life insurance policies come with an accelerated death benefit rider, which allows you to access a portion of your death benefit. At the same time, you’re still alive if you’re diagnosed with a terminal illness or a specified medical condition. The money can be used to cover nursing home costs, and your beneficiaries will receive the remaining death benefit when you pass away.

How Much Does Life Isurance Cost?

4- Hybrid Life Insurance Policy

A hybrid life insurance policy combines a traditional life insurance policy with a long-term care benefit. If you need long-term care, such as nursing home care, the policy will pay out a portion of the death benefit to cover those costs. If you don’t need long-term care, your beneficiaries will receive the full death benefit when you pass away.

Using life insurance to pay for nursing home care can provide financial security and peace of mind knowing that your long-term care needs are covered. However, it’s important to carefully review your policy and consult with a financial advisor to understand the terms and implications of using your life insurance in this way.

Does Life Insurance Affect Medicaid Eligibility?

Yes, life insurance can affect Medicaid eligibility for long-term care. Medicaid is a government program that helps individuals with limited income and assets pay for medical costs, including long-term care services such as nursing home care. When determining Medicaid eligibility, the cash value of a life insurance policy is considered an asset.

In most states, if the cash value of your life insurance policy exceeds a certain threshold (typically around $1,500), it may be counted as an asset for Medicaid eligibility purposes. If your life insurance policy has a cash value above this threshold, you may need to “spend down” or reduce your assets to qualify for Medicaid.

There are several ways you can reduce the cash value of your life insurance policy to meet Medicaid’s asset limits:

- Cashing Out the Policy: You can surrender your life insurance policy and receive the cash value.

- Surrendering the Policy: You can surrender your life insurance policy and receive the cash value.

- Transferring the Policy: You can transfer ownership of your life insurance policy to a family member or irrevocable trust. However, there is a Medicaid “look-back period” during which any asset transfers are scrutinized, and you may be penalized for transferring assets to qualify for Medicaid.

It’s important to note that not all life insurance policies have a cash value. Term life insurance policies, for example, do not accumulate cash value and are typically not counted as an asset for Medicaid eligibility. However, whole life insurance policies and other permanent life insurance policies that accumulate cash value can affect Medicaid eligibility.

Conclusion

In the end, hope this blog helps you find answers to the question “Can nursing homes take your life insurance from your beneficiary”. Nursing homes cannot take your life insurance from your beneficiary if you’ve designated one. However, there are considerations regarding Medicaid eligibility and using life insurance to cover long-term care costs. It’s essential to understand your options, plan ahead, and seek professional guidance to ensure your assets are protected and your long-term care needs are met.

Frequently Asked Questions (FAQs)

1- Can I use my life insurance to pay for assisted living expenses?

Yes, you can use your life insurance policy to pay for assisted living expenses, depending on the policy terms and coverage. Some policies may offer benefits for assisted living costs, while others may not. It’s essential to review your policy or consult with your insurance provider for specific details.

2- What happens to my life insurance if I move to a nursing home?

Your life insurance policy remains in effect if you move to a nursing home. However, you may need to consider how to pay the premiums, especially if you’re using the policy to cover nursing home costs. Some policies may have provisions for premium waivers or accelerated benefits for long-term care needs.

3- Can I purchase a new life insurance policy if I’m already in a nursing home?

It may be challenging to purchase a new life insurance policy if you’re already in a nursing home, as insurance companies may consider you a higher risk. However, some insurers offer specialized policies for individuals in nursing homes or long-term care facilities. It’s best to consult with an insurance agent who specializes in such policies to explore your options.

4- Will my life insurance premiums increase if I use the policy to pay for nursing home care?

Using your life insurance policy to pay for nursing home care may not directly impact your premiums. However, accessing the policy’s cash value or accelerated death benefits may reduce the death benefit or affect the policy’s overall performance. It’s advisable to consult with your insurance provider to understand the implications.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.