Last Updated on: February 3rd, 2025

- Licensed Agent

- - @M-LifeInsurance

Introduction:

What you’re searching for is life insurance that gives safety and an incentive to make investments. Maybe that solution is variable whole life insurance. So what is it, and how does it perform?

Here we break down variable whole life insurance, from the way it works to its benefits, varieties of charges, and the way it might be proper for you. This guide explores variable whole life insurance, what it is, and the way it differs from different life insurance options. In particular, we’ll also go over the investment element and its benefits, giving both monetary protection and greater increase opportunities.

Defining Variable Whole Life Insurance

Variable whole life insurance is a shape of permanent life insurance, with capabilities every so often combined, life insurance and an investment feature. This policy, like all permanent life insurance, lasts for the insured’s entire existence instead of for a hard and fast length of time. Variable whole life insurance, however, is going a step in addition with the aid of allowing policyholders to region the coin cost component of their policy in a spreading away of investment alternatives.

Some of the investment options may be stock funds, bonds, or a number of both. The concept is to grow the capacity to develop the accrued coin price of the policy through the years. now not only a protective financial tool, but it’s also a way of growing your wealth.

Guaranteed death benefits is one of the important centers of variable whole life insurance. The backside line is that regardless of what the investments paid out, the beneficiary will receive a payout for the insured’s loss of life. The collected coins value can range primarily based on the investment performance. so in case you’ll nevertheless be here in future years, it’s something to reflect on while you decide if this coverage is right for you.

How Does Variable Whole Life Insurance Work?

– The Basic Structure

A variable whole life insurance policy has two main components: the death benefit and the cash value.

- Guaranteed Death Benefit: This is how much they would get when you die. As long as premiums are paid and the policy is still on the books the death benefit is guaranteed.

- Cash Value: The investment component of the policy. Part of your premium bills go into a cash value account over the years. The cash price rises and falls in keeping with how properly your investments do—whether or not you pick out a stock price range, bond funds, or a mixture of both.

The cash price of the variable complete lifestyles coverage coverage can be a lot more dynamic compared to traditional whole life insurance, where the cash fee grows at a hard and fast fee. Since it gives the ability to pick investment alternatives, it’s more appealing to those who are satisfied with marketplace fluctuations and would really like their policy to probably grow in fee over a shorter length.

– Premium Payments

Premiums charged for variable whole life insurance are more often than not higher than for time period life insurance, as well as for any other kind of permanent life insurance. The reason is that a part of what you pay into your top rate is going in the direction of your funding account, and you have to pay to have those investments controlled. The higher rates are to pay for the greater functions and extra cash earned.

This is crucial to add that, though premiums are better, they may be usually flexible. There are some instances, however, wherein you could modify your top-class payments or pass them altogether, so long as there’s sufficient cash price within the policy to cover the cost.

Understanding the Key Features of Variable Whole Life Insurance

1. Permanent Coverage: Lifelong Protection for Your Loved Ones

Among the high-quality features of variable whole life insurance is it gives everlasting insurance. Variable whole life insurance insurance isn’t like term life insurance, which expires after a specific duration in one imprtant aspect

Variable whole life insurance offers coverage for the policyholder’s complete life, so long as rates are paid.

It is specifically useful for those who want to make certain that in whatever year their beneficiary passes away, they’re financially steady. It’s guaranteed coverage with the death benefit paid out on the insured’s death. Premiums are paid over the life of the policy so long as they’re made, and the amount of the dying benefit depends upon the performance of the investments.

Key Benefits of Permanent Coverage:

- Lifelong Security: Coverage that keeps on going without having an expiry date after, say, a set number of years.

- Guaranteed Death Benefit: Offers a payout to your loved ones upon your death.

- Financial Planning: It can be the cornerstone of long-term planning.

2. Investment Potential: Growing Your Cash Value Based on Performance

A standout feature of variable whole life insurance is its investment potential. The coverage lets in the collected cash price to develop primarily based on the overall performance of numerous investments you could pick out. These investments can consist of stock finances, bond funds, or an aggregate of each, supplying you with a chance to develop your coverage’s cash value over time.

The investment feature is what differentiates variable whole life insurance from other permanent existence coverage merchandise, which include traditional complete life coverage, which generally offers fixed interest fees for cash value growth.

How Investment Performance Affects Your Cash Value

The cash value of your variable whole life insurance policy grows primarily based on the performance of the funding alternatives you select. When the market performs nicely, your cash value can grow at a faster rate, but if the investments perform poorly, the boom can be slower or maybe negative.

- Stock funds: Generally provide better increase capability but include extra danger due to market volatility.

- Bond funds: Typically provide extra balance but with decreased boom capability as compared to stocks.

As a policyholder, you’ve got the flexibility to exchange among different funding alternatives,, relying on your financial goals and threat tolerance. While the cash price can fluctuate, the assured loss of life benefit will stay intact, protecting your beneficiaries.

How Much Does Life Isurance Cost?

3. Flexible Premiums: Adjust Your Payments as Needed

Another appealing function of variable whole life insurance is its flexible premium shape. Unlike term life insurance, in which you pay a fixed top rate for a set term, variable whole life insurance lets in you to adjust your premium bills to fit your financial scenario.

However, it’s crucial to note that even as charges are bendy, there is a minimal premium that have to be maintained to keep the policy in force. If you choose to reduce your premiums, the gathered cash value can help cover the distinction, making sure that the policy remains active. If the cash fee is insufficient, you can need to pay better premiums or modify your funding allocation.

Benefits of Flexible Premiums:

- Adjustable Payments: You can modify your premium amounts as your financial situation changes.

- Cash Value Buffer: The accumulated cash value can help cover premium payments in case of financial hardship.

- Greater Control: Gives you more control over how much you pay for your insurance coverage.

4. Higher Premiums: Understanding the Costs of the Investment Component

One of the key matters to recollect while selecting variable whole life insurance is that the charges are normally higher than those for term life insurance. This is due to the fact variable whole life insurance consists of an investment aspect that allows you to doubtlessly develop the coins fee through the years.

The higher charges are essential to fund each the fee of lifestyles insurance insurance and the investment options available inside the coverage. While the better cost might also look like a downside, it’s critical to keep in mind that the cash fee increase gives the capability for financial returns that term life coverage does not provide.

Why Are Premiums Higher?

- Investment Component: A portion of the premium is going towards investments—the investments that make up the policy’s cash price.

- Administration Costs: The insurer wishes to manage the investments and administrative components of the policy.

- Guaranteed Death Benefit: The top-rate payments have to be sufficient to cowl both the assured death gain and the fluctuating cash fee.

It’s important to carefully take into account the lengthy-time period costs related to variable whole life insurance because the higher rates can add up over the years. But, for people who are seeking both financial safety and the potential for investment growth, these better rates may be worthwhile funding.

Supporting Data: The Impact of Investment Performance on Cash Value Growth

One of the most important attractions of variable whole-life coverage is the capability for the accrued cash value to develop based totally on the hobby price connected to the overall performance of decided-on investments. The hobby charge of your policy’s investments can differ depending on the marketplace situation; however, the common return on the policy’s investment components often falls inside a selection that displays the underlying property.

How Does the Investment Interest Rate Impact Cash Value?

The interest rate on the investment portion of your variable whole life insurance policy is crucial in determining how much the cash value will grow over time. If you choose to invest in higher-risk options like stock funds, you may see higher growth potential, but the returns can be volatile. On the other hand, safer options like bond funds may offer more stability but with lower potential growth.

In general, higher interest rates mean faster growth of the accumulated cash value, which can benefit you in several ways:

- Increased Cash Value: Higher investment returns lead to a larger cash value, which can be used for future policy loans or withdrawals.

- Potential for Dividends: Strong investment performance may result in policy dividends, which can be reinvested or used to pay premiums.

- Greater Flexibility: With a higher cash value, you have more options to adjust premiums or take out loans against the policy.

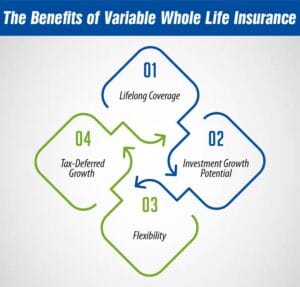

The Benefits of Variable Whole Life Insurance

There are several key benefits to selecting variable whole life insurance, in particular for individuals seeking out permanent insurance and investment capability.

1. Lifelong Coverage

As mentioned in advance, variable whole existence insurance offers lifelong safety. This makes it a super preference for folks who need to make certain that their beneficiaries are blanketed, no matter when they skip away.

2. Investment Growth Potential

With the funding function, variable complete existence coverage lets in you to develop your policy’s gathered cash cost. The flexibility to allocate your cash price to one of a kind investment alternatives offers you the capability to earn higher returns than conventional whole-life insurance policies, which generally provide fixed growth quotes.

3. Flexibility

The flexibility of variable whole life insurance is considered one of its key benefits. You can adjust your top-class bills, investment alternatives, and even the death benefit (in some cases) to suit your financial desires. This flexibility makes variable whole existence insurance a versatile alternative for lengthy-term economic making plans.

4. Tax-Deferred Growth

The accrued cash fee of your variable wholelife insurance policy grows on a tax-deferred foundation. This means you shouldn’t pay taxes on the boom until you withdraw the finances or take out a coverage mortgage. This tax benefit can help your policy’s cash value develop quicker in comparison to taxable funding alternatives.

5. Considerations and Risks

While variable whole life insurance gives many blessings, there are also a few dangers and considerations to keep in mind:

- Higher Premiums: The charges for variable entire life coverage are better than the ones for time period life insurance, which may be a barrier for a few individuals.

- Investment Risk: The cash price of your coverage is tied to the overall performance of investments. If the market plays poorly, the fee of your policy may additionally lower, and you may need to pay higher rates or reduce the demise gain to hold the coverage in pressure.

- Complexity: Variable whole life insurance is more complex than different life coverage alternatives, and it is able to require greater energetic control. You’ll need to screen your investment picks and ensure that your charges are paid in full.

Conclusion: Is Variable Whole Life Insurance Right for You?

Variable whole life insurance is a powerful tool for individuals who need permanent life insurance coverage with the delivered potential for funding growth. It offers lifelong safety, the possibility to grow gathered cash fee, and flexible top-rate bills. However, it also comes with higher charges, funding chance, and complexity compared to different life coverage options.

If you’re looking for economic protection and the ability for wealth-building, variable whole-life insurance is probably a great fit. Be certain to carefully evaluate your economic desires, risk tolerance, and long-term needs before committing to a policy. Consulting with an economic guide or insurance professional permits you to determine if variable whole life insurance is the right choice in your scenario.

Call to Action:

If you’re prepared to explore variable whole life insurance and see how it could fit into your financial plan, contact us these days. Our experts are right here that will help you understand your alternatives and guide you via the process of selecting the best policy on your needs.

FAQs

1. What is Variable Whole Life Insurance?

Variable whole life insurance is a type of permanent life insurance that offers each a death gain and an funding characteristic. This coverage lets in the policyholder to invest the cash fee part of the coverage in lots of funding options like inventory budget, bond funds, or a mixture of both. The funding element gives the policyholder the potential to develop the cash price through the years.

2. How Does Variable Whole Life Insurance Work?

Variable whole life insurance works by way of supplying a assured death advantage and a cash value account that grows based on the performance of the chosen investment alternatives. The charges you pay pass towards each the cost of life insurance and handling the investment issue. The coverage’s cash value can fluctuate depending on marketplace overall performance; however, the death benefits remain assured so long as charges are paid.

3. What Are the Benefits of Variable Whole Life Insurance?

The key benefits of variable whole life insurance include:

- Lifelong Coverage: Provides permanent protection for your loved ones.

- Investment Growth Potential: Allows you to grow the cash value of the policy based on your investment choices.

- Flexibility: You can adjust premiums, death benefits, and investment allocations based on your financial goals.

- Tax-Deferred Growth: The cash value grows tax-deferred, offering greater potential for growth compared to taxable accounts.

4. Is Variable Whole Life Insurance Expensive?

Yes, variable whole life insurance commonly has higher charges as compared to term life insurance. This is because the policy includes both existence insurance and the funding factor. The charges cover the value of dealing with the investments and making sure the guaranteed death benefit . However, the better cost comes with the potential for greater funding returns.

5. What Investment Options Are Available in Variable Whole Life Insurance?

With variable whole life insurance, you could choose from a whole lot of investment alternatives, inclusive of:

- Stock Funds: High ability for boom but with extra chance.

- Bond Funds: lower increase capability, however greater stability.

- Combination of Both: Diversifying investments for a balanced risk-to-praise ratio.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.