Last Updated on: July 8th, 2025

- Licensed Agent

- - @M-LifeInsurance

Buying life insurance and looking for something that will not break the bank today, and it will still protect you tomorrow? Then you are at the right place. Modified whole life insurance allows you go to plan to protect your family and future. It would be the smart choice with a lot of things and gives you long-term peace. But do you want to know how it works, or is it the right fit for you or not? In this article, we break down everything you need to know about modified whole life insurance: the cost, the benefits, and how it works, so you can make a confident, informed decision.

How Does Modified Whole Life Insurance Work?

Modified whole life insurance is a type of permanent life insurance that offers lifelong coverage. This life insurance is just like the traditional whole life insurance, but the main difference is how the premiums are structured. In the first few years, usually between five to ten years, the monthly payments are lower, and this is making it more affordable at the start. After this fixed period, the premiums are fixed at a fixed amount, then this amount will be the same for the rest of the policyholder’s life.

This life insurance is the best option for people who want the benefits of whole life insurance but want to pay lower premiums early due to limited income or budget. It’s especially helpful for those who expect their income to grow over time. Like traditional whole-life insurance, modified whole-life policies also build cash value over time. The policy provides coverage for the person’s entire life,

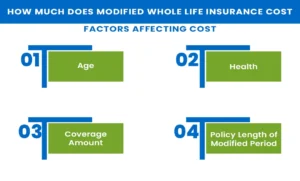

How Much Does Modified Whole Life Insurance Cost?

The cost of the modified whole life insurance depends on a few factors. These include the age of the person who buys the insurance policy, their health, coverage amount, and the length of the modified premium period. Here is the explanation of how;

Factors Affecting Cost

- Age: Younger people who buy this life insurance generally pay lower premiums.

- Health: If your health is good, it means that you have to pay less premiums.

- Coverage Amount: If you have higher death benefits, it means that the premiums will increase.

- Policy Length of Modified Period: If the modified period is longer, you might pay a little more at the start, but the higher premium increase will happen later. This gives you more time with lower payments before they go up.

Traditional Whole Life Insurance and Modified Whole Life Insurance

Both policies are types of permanent life insurance, and this means that they provide lifelong coverage and build cash value over time. You will take this cash value amount whenever you need it. However, they are different when it comes to how you pay the premiums. Let’s have a look.

| Feature | Traditional Whole Life Insurance | Modified Whole Life Insurance |

| Premiums | Fixed and level throughout the policy term | Lower initially, increases after a modified period |

| Premium Increase | No increase | Increase after 5-10 years |

| Cash Value Growth | Builds steadily over time | Builds over time but may be slower initially |

| Coverage Duration | Lifetime coverage | Lifetime coverage |

| Cost Predictability | Easy to budget with fixed premiums | Requires planning for a premium jump |

| Ideal For | Those who want stable, predictable premiums | Those expecting income growth or short-term affordability needs |

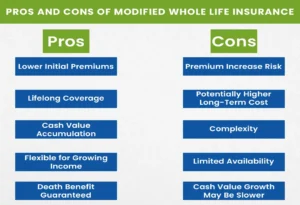

Pros and Cons of Modified Whole Life Insurance

Like any money-related product. Modified whole life insurance also has some good points and some drawbacks. Knowing the pros and cons can help you to decide if this life insurance type is right for you or not.

Pros

- Lower Initial Premiums

You have to pay less in the beginning, and this will make it easier to afford when your budget is limited at the start.

- Lifelong Coverage

This policy will cover your entire life, not just for a set number of years like term insurance.

- Cash Value Accumulation

Another good thing about this policy is that it builds the cash value. You can borrow the amount from the cash value, and it will be used when you need it.

- Flexible for Growing Income

It will be a good choice if you expect your income to go up in the future since you’ll pay more later.

- Death Benefit Guaranteed

As long as you keep paying the premiums, your loved ones will get the death benefit when you pass away.

Cons

- Premium Increase Risk

Premiums increase after the modified period, which cannot become affordable. The higher payments might be hard to afford.

- Potentially Higher Long-Term Cost

In the long run, this type of policy can cost more overall than traditional whole-life insurance.

- Complexity

The way an insurance company changes the premiums it can be very confusing for you. So its important to plan carefully and understand how this policy works.

- Limited Availability

Your options will be limited because not all the insurance companies are providing this policy.

- Cash Value Growth May Be Slower

Since you pay less at the beginning, the cash value may grow more slowly compared to regular whole-life insurance.

How Much Does Life Isurance Cost?

Who Should Consider Modified Whole Life Insurance?

Modified Whole Life Insurance can be a good choice for you if:

- You want lifetime coverage but need lower payments at the beginning.

- You think your income will go up in the next few years.

- You like the idea of building cash value while staying covered for life.

- You’re okay with starting with lower payments that later become fixed and predictable.

But if you prefer to keep the same payments from the start and can afford higher premiums right away, then Traditional Whole Life Insurance might be a better fit for you.

Conclusion

Modified whole life insurance is the best option for you if your income is low and you want whole life coverage, but before buying this life insurance policy, make sure to talk to an agent and get all the information. It’s smart to compare this with traditional whole life insurance to see which one fits your budget and goals better. Though both policies are the type of permanent life insurance there is a difference. Talking to a licensed insurance agent can help you understand your options and pick the best plan for your needs.

Frequently Asked Questions (FAQs)

1: How long does the modified premium period last?

Usually, the modified life insurance lasts from 5 to 10 years, but this can change depending on the policy.

2: Can I switch from modified whole life to traditional whole life insurance later?

Some insurers allow conversion or changes, but this depends on the policy terms.

3: Is the death benefit guaranteed?

Yes, as long as premiums are paid, the death benefit is guaranteed for life.

4: Can I borrow against the cash value?

Yes, most modified whole life policies allow policy loans or withdrawals against the accumulated cash value.

5: What happens if I can’t pay the increased premium after the modified period?

You risk policy lapse, losing coverage, and accumulated cash value unless you have other options like reduced paid-up insurance or extended-term insurance.

Ready to Protect Your Future?

Ready to secure lifelong protection with affordable premiums? Contact a licensed insurance agent today to find the best Modified Whole Life Insurance plan for you!

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.