Last Updated on: August 12fth, 2025

- Licensed Agent

- - @M-LifeInsurance

Life insurance is all about future protection. It gives money to your family or the person you choose at the time of buying. But sometimes, there are problems. What if two people fight over the policy payment? Or what to do if the insurance company refuses to pay the amount? Then one thing comes to mind is, can I sue to get the life insurance money? To get all the answers, you have to get through the article. In this article, we will explain:

- When you can sue for life insurance money

- Who should get the money

- How much might it cost to go to court

- And how to stop these problems before they happen

When Is It Okay to Sue for Life Insurance Money?

You can take the case to court to get life insurance money in a few different situations. This usually happens when:

- The insurance company says no to a claim that should be paid

- People are fighting over who should get the money

- Someone lied or gave false information about the policy

- There’s a problem with a recent change in who was named to get the money

Let’s break these scenarios down:

1. Denial of Life Insurance Claims

There are some reasons, and on behalf of these reasons, the insurance company denies the claims.

One of the most common reasons for the denial is that the person who bought the policy did not pay their insurance premiums on time.

Another reason is that the policyholder died during the first two years of the policy’s start. During this time, the company reviews the details very closely.

The third reason can be about the false information given to the company. Like you lie about your health issues. You have the right to take legal action if you believe that the denial is unjust.

2. Beneficiary Disputes

Sometimes, there is more than one person who claims the policy to get the money. When this kind of thing happens, legal action is needed to solve the issue. A court will look at a few things to decide who should get the money.

3. Fraud or Undue Influence

Sometimes, there are people who claim that the policyholder was forced to change the name of the beneficiary. These are the very hard and complicated situations. To prove this, you usually need strong evidence, like medical records and any statements from the people who witnessed the situation.

Who is Entitled to Life Insurance Proceeds?

The people who are named in the policy as the beneficiaries are the ones who have the right to take the insurance amount. But sometimes there are some legal problems that happen, these problems are;

- No one is named as the beneficiary

- The person who named died before the policyholder

- A court says the beneficiary is not valid because of things like fraud, a fake signature, or being forced to sign

Order of Priority

If no one is named as a beneficiary or the person has died, the money will go to the person’s spouse, children, or the closest family members, or the estate. These rules are not fixed. They can be changed by the local laws, and they will decide who gets the money.

Cost of Suing for Life Insurance Proceeds

Lawsuits can cost a lot of money. But before deciding to take legal action, it is very important to think about how much it will cost and what things you will gain and lose. There are legal fees, court costs, and these costs add up very quickly. It is a good idea to talk to your lawyer to see if the case is worth spending the money or not.

1. Attorney Fees

Some lawyers charge you by the hour, which means that you have to pay them for every hour they work on your case. Other lawyers work on a contingency basis, which means that they take a 33% and 40% of the money you get if you win the case.

2. Court Costs and Filing Fees

When you file a lawsuit, you will have to pay a filing fee. This is a cost the court charges to start your case. The fee can be anywhere from $100 to a few hundred dollars, depending on the court and location

3. Expert Witnesses

If your case involves things like fraud or medical records, you will need an expert to explain the details in court. This will make your case stronger. However, if you are hiring the experts, this will be very expensive, which also adds to the overall cost of the lawsuit.

4. Time and Emotional Toll

It takes a lot of time, sometimes months and even years, if you are fighting over a life insurance payout in court. These legal battles can be very stressful and emotional if the family members are arguing against each other.

How Much Does Life Isurance Cost?

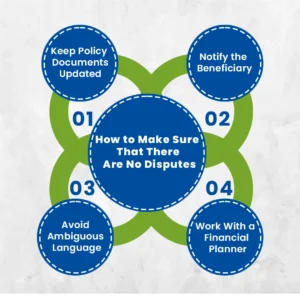

How to Make Sure That There Are No Disputes

To avoid messy disputes after death, policyholders and beneficiaries can take the following steps:

1. Keep Policy Documents Updated

Always ensure your beneficiary designations are current. Life events like divorce, remarriage, or the birth of a child should trigger a review.

2. Notify the Beneficiary

Make sure to let the person know that you named them as a beneficiary, if they know that they are named, also make sure to tell them the basics, that how to file a claim and where to find the policy. This will help them get the money faster and avoid any problems later.

3. Avoid Ambiguous Language

You have to make sure that you’re writing the legal name when adding the beneficiary. This will help to avoid confusion in the future, and the right person will get the insurance payout.

4. Work With a Financial Planner

A financial planner or estate attorney can help set up trusts or other legal tools to ensure your wishes are followed and reduce the chance of disputes.

Final Words

So, it is legally right and allowed if you want to sue for the insurance payout, but it’s very important to know your rights, also the laws in your state, and getting help from a lawyer will be helpful for you.

To avoid these problems, it helps to plan before taking any legal action. This means having clear papers, keeping your policy up to date, and talking openly with everyone involved. If you already have a problem with your claim, act quickly to protect your rights and stay calm.

Need Help With a Life Insurance Dispute?

If you’re facing issues with a denied claim or a disagreement over who should get the money, don’t wait. Talk to our trusted financial advisor today to understand your options and protect your rights.

FAQs

1. Can I sue to get life insurance money?

Yes, you can sue if the insurance company is not paying you the insurance amount, if there is a fight over who should get the money, or if there was fraud or wrong changes made to the policy.

2. Who gets the life insurance money?

The money usually goes to the people named as beneficiaries in the policy. If no one is named or they have passed away, the money may go to the spouse, children, or the estate.

3. How much does it cost to sue for life insurance?

The cost of filing a case can be so expensive. You have to pay lawyer fees, court filing fees, and extra costs if you need expert witnesses.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.