Key Points

- Policy exclusions list

- Suicide clause rules

- Contestability period info

- Drug overdose coverage

- Accidental death limits

- Claim denial reasons

Life insurance is always about helping and protecting your family financially when you are no more. But there’s so many people who don’t know that not every death is covered by a life insurance policy. Every policy has certain rules, conditions and exclusions that decide when a payout will or will not happen. Understanding these will help you to avoid claim denial and ensure that your family receives the benefit smoothly. In this article we will discuss when life insurance will not pay the death benefit.

What Death Does Life Insurance Not Cover?

Life insurance policy does not cover all the causes of death. While most of the natural and accidental deaths are included, some cases are excluded. There are some common reason for non-payment that include the suicide within a specific time, any illegal activity or false information on the application.

- For example, if someone passes away due to the suicide during the first two years of the policy, the claim is usually denied

- If that happened while committing a crime or under the influence of drugs, then the insurance company might reject the payout

So it is very important for you to read your policy very carefully to know that what kind of death are not covered by the insurance company

Life Insurance Suicide Clause Explained

As your side clause is a stranded rule in most of the life insurance policies. It means that if the insured person dies by suicide in the first one or two years after buying the policy, then the insurance company will not pay the debt benefit.

This role protects insurance companies for people who might buy a policy with the intent of ending their life soon after for financial benefits

After this period like usually two years so suicide is generally covered and the family can receive the claim as normal.

Life Insurance Contestability Period

The contestability period is another important part of life insurance policy. It usually last for two years from the start date of your policy.

During this time the insurance company can review or investigate any claim closely. If they find that the person gives false or incomplete information on their application like hiding their health condition or smoking habit, then they can deny the claim or cancel the policy.

So it is very important to always give honest and full information whenever you are applying for a life insurance policy.

What Does Term Life Insurance Not Cover?

Don’t life insurance provide you the coverage for a fixed number of years like you can buy the policy for 10, 20 or 30 years. However, just like the other type of life insurance this plan does not cover everything.

Here are a few examples of what term life insurance is not cover

- Death caused by suicide in the first two years

- Death caused by engaging and dangerous hobbies like skydiving if it is not disclosed

- Death caused by participating in illegal activities or crimes

- Death due to drug overdose or substance abuse

If the person dies after the policy term ends, then the insurance also will not pay any benefit until the policy is renewed.

Does Life Insurance Cover Drug Overdose?

This depend on situation and policy terms

- If the overdose was accidental and not due to illegal drug use then some of the policies can cover it

- But if it was intentional or involved in illegal drugs, it is usually excluded.

What Exclusions Apply to Life Insurance?

Every life insurance policy includes a list of exclusions which are situations where no payment will be made. There are some common life insurance policy exclusions that include these things

- Suicide clause within first 1 or 2 years

- Death due to any illegal act

- Death while intoxicated or drug overdose

- Death from risky hobbies like racing or skydiving

- Fraud or false information on the insurance application

Does Life Insurance cover Accidental Death

He has most of the life insurance policies to cover accidental death. In fact, some even offer an accidental death benefit rider which will provide extra payout if the person dies in an accident. However, accidents caused by the trunk driving, drug use and breaking any law cannot be covered.

So while accidental deaths are usually included. There are still conditions that must be met for the payout to happen.

What Are The Reasons Life Insurance Will Not Pay Out

There are so many reasons that why a life insurance claim may be denied, these things include

How Much Does Life Isurance Cost?

- False information like hiding through medical conditions, age or smoking habits

- If you miss any monthly premiums, then the policy and laps

- Suicide with an ex exclusion period like usually within the two years

- Death during I need a legal activity like driving without a license or theft

- Drug or alcohol influence like that, you do intoxication or overdose

- Expired policy terms like that occur after the policy term ends.

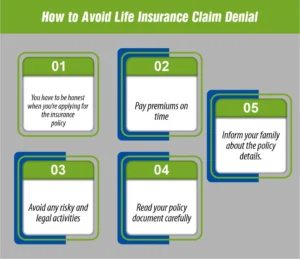

How to Avoid Life Insurance Claim Denial

you have to make sure that your loved ones will get the benefit easily. You can avoid life insurance claim denial by doing the following things.

- You have to be honest when you’re applying for the insurance policy

- Pay premiums on time

- Avoid any risky and legal activities

- Read your policy document carefully

- Inform your family about the policy details.

Final Thoughts

Life insurance offers you great financial protection but only if you understand what it does not cover. Knowing the exclusions will help you to avoid any mistake. You always have to be open in touch with your insurance company, always pay your premiums on time and keep your records very clear so that your loved ones will not have any trouble getting the support they deserve.

Secure your family’s future today! Choose M-Life Insurance for reliable coverage, simple plans, and complete peace of mind. Get your free quote now!

FAQS

Life insurance does not include all types of deaths. It usually does not cover this suicide in first two years, death caused by drug or alcohol, dread while doing illegal activity and death from any dangerous hobby.

Life insurance companies will not pay if you lied or hide any health information when you are applying, if the policy is not active because you have stopped paying the premiums, if the person dies during the crime or due to any drug overdose and the policy expired before the person’s death.

Anything that is not related to personal life or death is not part of the life insurance for example car damage, home repair or hospital bills are not covered.

Non-life insurance covers everything other than life. It means that it will help you to protect your health and money while you are alive.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.