Are you considering whole life insurance as a means of protecting your loved ones financially? Well! Mutual of Omaha offers a variety of options tailored to your needs. They not only offer you a plan according to your requirements but also help you estimate your insurance coverage via an insurance calculator.

If you’re interested to know more about it, welcome to our guide on Mutual of Omaha whole life insurance calculator and how to effectively utilize their insurance calculator. In this blog post, we’ll explore what whole life insurance entails, why Mutual of Omaha might be the right choice for you, and how to use their calculator to estimate premiums and coverage.

Understanding Whole Life Insurance

Before we dive into Mutual of Omaha’s offerings, let’s first understand what whole life insurance is. Whole life insurance is a type of permanent life insurance that provides coverage for your whole life, as long as premiums are paid. Unlike term life insurance, which only covers you for a specified period, whole life insurance offers lifelong protection and builds cash value over time.

One of the key features of whole life insurance is its cash value component. A portion of your premium payments goes towards building cash value, which grows tax-deferred over time. This cash value can be accessed through policy loans or withdrawals, providing you with a source of funds for various purposes such as supplementing retirement income, paying for college tuition, or covering emergency expenses.

Another advantage of this insurance policy is its guaranteed death benefit, which ensures that your beneficiaries will receive a payout upon your death, regardless of when it occurs, as long as premiums are kept up to date.

Whole life insurance provides financial protection and peace of mind for you and your loved ones. It offers stability, predictability, and long-term value, making it a valuable component of your overall financial plan.

Why Choose Mutual of Omaha Whole Life Insurance?

Choosing Mutual of Omaha whole life insurance offers multiple benefits that cater to your unique needs and provide peace of mind for the future. Here are several compelling reasons why Mutual of Omaha stands out:

1- Financial Stability

Mutual of Omaha boasts a long-standing reputation for financial strength and stability. With over a century of experience in the insurance industry, you can trust Mutual of Omaha to be there for you when it matters most.

2- Customized Coverage

Mutual of Omaha offers a range of whole life insurance policies tailored to your specific requirements. Whether you’re seeking basic coverage or additional features such as living benefits or accelerated death benefits, Mutual of Omaha has options to suit your needs.

3- Flexible Premiums

With Mutual of Omaha, you have the flexibility to choose premium payment options that align with your budget and financial goals. Whether you prefer a level premium throughout the life of the policy or a shorter payment period, Mutual of Omaha can accommodate your preferences.

4- Cash Value Growth

Mutual of Omaha’s whole life insurance policies accumulate cash value over time, providing a valuable asset that you can access during your lifetime. This cash value can be utilized for emergencies, supplemental retirement income, or other financial needs.

5- Exceptional Customer Service

Mutual of Omaha is committed to providing top-notch customer service and support throughout your insurance journey. From initial inquiries to claims processing, you can rely on Mutual of Omaha’s dedicated team to assist you every step of the way.

6- Competitive Rates

Mutual of Omaha strives to offer competitive rates for its whole life insurance policies, ensuring that you receive excellent value for your premium dollars.

7- Additional Benefits

Depending on the policy you choose, Mutual of Omaha may offer additional benefits such as guaranteed cash value growth, dividend payments, and flexible policy loan options.

In a nutshell, Mutual of Omaha’s whole life insurance combines financial stability, customized coverage options, flexible premiums, and exceptional customer service to provide you with a comprehensive insurance solution that meets your needs and exceeds your expectations. With Mutual of Omaha, you can feel confident knowing that your financial future is in good hands.

Using the Mutual of Omaha Whole Life Insurance Calculator

Now that you understand the basics of whole life insurance and why Mutual of Omaha is a reputable provider, let’s explore how to use their whole life insurance calculator.

Utilizing the Mutual of Omaha Whole Life Insurance Calculator is a smart move when planning for your financial future. This user-friendly tool empowers you to make informed decisions about your whole life insurance coverage. Here’s how to get the most out of it:

- Access the Calculator

Visit the Mutual of Omaha website and navigate to the whole life insurance section. Locate the Whole Life Insurance Calculator tool, usually prominently displayed for easy access.

How Much Does Life Isurance Cost?

- Input your Information

The calculator will prompt you to enter various details, including your age, gender, health status, desired coverage amount, and preferred premium payment frequency. Be sure to input accurate information for the most precise estimate.

- Review the Results

Once you’ve inputted your information, the calculator will generate an estimated premium amount based on your inputs. It may also present you with different policy options and coverage amounts to consider.

- Adjust as Needed

If the estimated premium is higher than estimated, you can adjust your inputs to see how different factors affect the cost of coverage. For instance, you might explore different coverage amounts or premium payment frequencies to find a plan that fits your budget.

- Consult with an Expert

If you have questions or need assistance, don’t hesitate to reach out to a Mutual of Omaha insurance agent. They can provide personalized guidance and help you navigate your options effectively.

By using the Mutual of Omaha Whole Life Insurance Calculator, you can gain valuable insights into your insurance needs and confidently select a policy that aligns with your financial goals. Take advantage of this powerful tool to secure your future with peace of mind.

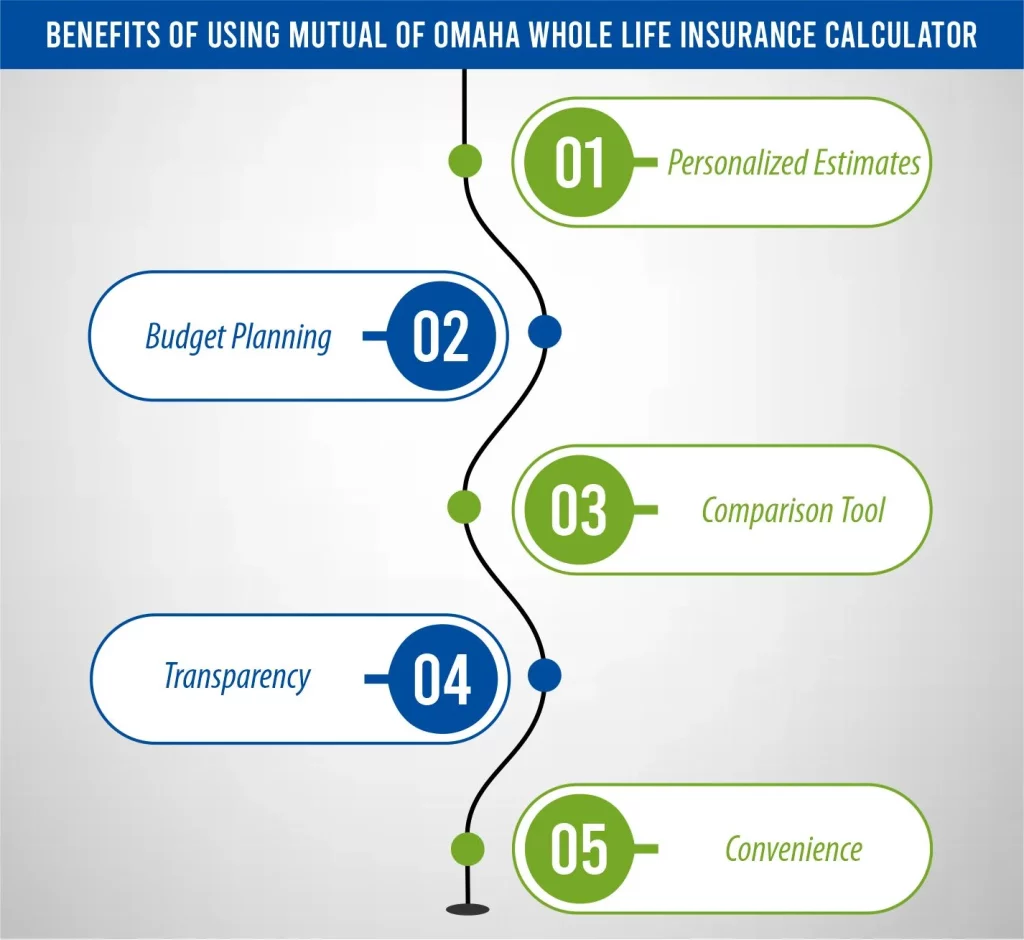

Benefits of Using Mutual of Omaha Whole Life Insurance Calculator

Using Mutual of Omaha Whole Life Insurance Calculator offers a multitude of benefits, empowering you to make well-informed decisions about your financial future. Here are some of the key advantages:

1- Personalized Estimates

The calculator provides personalized estimates based on your specific information, including age, gender, health status, desired coverage amount, and premium payment preferences. This tailored approach ensures that you receive accurate insights into your potential coverage options.

2- Budget Planning

By inputting different scenarios into the calculator, you can explore various coverage amounts and premium payment frequencies to find a plan that aligns with your budget. This helps you plan effectively for your financial goals and ensures that you’re comfortable with the premiums you’ll be paying.

3- Comparison Tool

The calculator allows you to compare different policy options and coverage amounts side by side. This enables you to evaluate the benefits and costs of each option, helping you choose the plan that best meets your needs and preferences.

4- Transparency

Using the calculator promotes transparency in the insurance process by providing clear estimates of premiums and coverage amounts. This transparency helps you understand the value you’re receiving for your premium dollars and ensures that there are no surprises down the line.

5- Educational Resource

The calculator serves as an educational resource, helping you gain a better understanding of whole life insurance and its implications for your financial future. By experimenting with different scenarios and exploring various policy options, you can become more knowledgeable about your insurance needs and make informed decisions.

6- Convenience

The calculator is easily accessible online, allowing you to use it at your convenience from the comfort of your home or office. You can run multiple scenarios, compare results, and make adjustments as needed, all with just a few clicks.

7- Expert Guidance

While the calculator provides valuable insights, you also have the option to consult with a Mutual of Omaha insurance agent for personalized guidance. An agent can help interpret the results, answer any questions you may have, and assist you in selecting the right policy for your needs.

The Bottom Line

Mutual of Omaha offers comprehensive whole-life insurance options designed to protect you and your loved ones financially. By using their whole life insurance calculator, you can get a better understanding of the coverage options available and how they align with your needs and budget. Whether you’re planning for your family’s future or looking to supplement your retirement income, Mutual of Omaha’s whole life insurance can provide peace of mind knowing that your loved ones will be taken care of financially.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.