Are you looking for a reliable and affordable life insurance solution to protect your loved ones from the financial burden of final expenses? Look no further than Mutual of Omaha Living Promise. Mutual of Omaha is a trusted name in the insurance industry, known for its commitment to providing quality products and excellent customer service.

Mutual of Omaha Living Promise is a whole life insurance policy designed to provide coverage for final expenses, such as funeral costs, medical bills, and other end-of-life expenses. With its guaranteed acceptance, flexible coverage options, and cash value accumulation, the policy offers a range of benefits that make it a smart choice for individuals looking to secure their family’s financial future.

In this comprehensive guide, we will explore the features, benefits, and advantages of Mutual of Omaha Promise, helping you understand why it might be the right choice for you.

What is Mutual of Omaha Living Promise?

Mutual of Omaha Living Promise is a type of whole life insurance policy offered by Mutual of Omaha. It is specifically designed to provide coverage for final expenses, such as funeral costs, medical bills, and other end-of-life expenses. One of the key features of this policy is its guaranteed acceptance, which means you can qualify for this policy without the need for a medical exam. This makes it an ideal choice for individuals who may have health issues or pre-existing conditions.

The policy offers affordable premiums that are guaranteed to remain level for the life of the policy. This means you won’t have to worry about your premiums increasing as you get older. The policy also builds cash value over time, which you can borrow against or use to supplement your retirement income. Additionally, Mutual of Omaha’s Living Promise offers an accelerated death benefit rider that allows you to access a portion of your death benefit if you are diagnosed with a terminal illness.

Mutual of Omaha Company Background

Mutual of Omaha has a long and reputable history, having been in business since 1909. They offer a wide range of insurance products, including term life, whole life, universal life, long-term care, dental, accidental death, and Medicare supplements, among others. It’s worth noting that all life insurance products offered by Mutual of Omaha are issued under the name “United of Omaha.”

One of Mutual of Omaha’s key strengths is its financial stability, as evidenced by its high ratings from various rating agencies. A.M. Best rates them as A+ (Superior), Moody’s as A1 (Good), S&P Global as A+, and the Better Business Bureau as A+. These ratings indicate that Mutual of Omaha is well-positioned to fulfill its financial obligations and pay claims as they arise.

Overall, Mutual of Omaha is a trusted and financially sound insurance company that has been serving customers for over a century.

How does Mutual of Omaha Living Promise Work?

Mutual of Omaha Promise works like a traditional whole life insurance policy, but with a focus on providing coverage for final expenses. Here’s how it works:

1- Coverage

You choose a coverage amount based on your final expense needs. This amount will be paid out to your beneficiaries when you pass away, providing them with financial support during a difficult time.

2- Premiums

You pay premiums to keep the policy active. The premiums for this insurance policy are guaranteed to remain level for the life of the policy, meaning they won’t increase as you get older.

3- Guaranteed Acceptance

One of the key features of Mutual of Omaha Promise is its guaranteed acceptance. This means you can qualify for this policy without the need for a medical exam, regardless of your health status.

4- Cash Value Accumulation

The policy builds cash value over time, which you can borrow against or use to supplement your retirement income. This can provide an additional source of funds in times of need.

5- Death Benefit

When you pass away, your beneficiaries will receive the coverage amount you chose when you purchased the policy. They can choose to receive this amount as a lump sum payment, installment payments, or a combination of both.

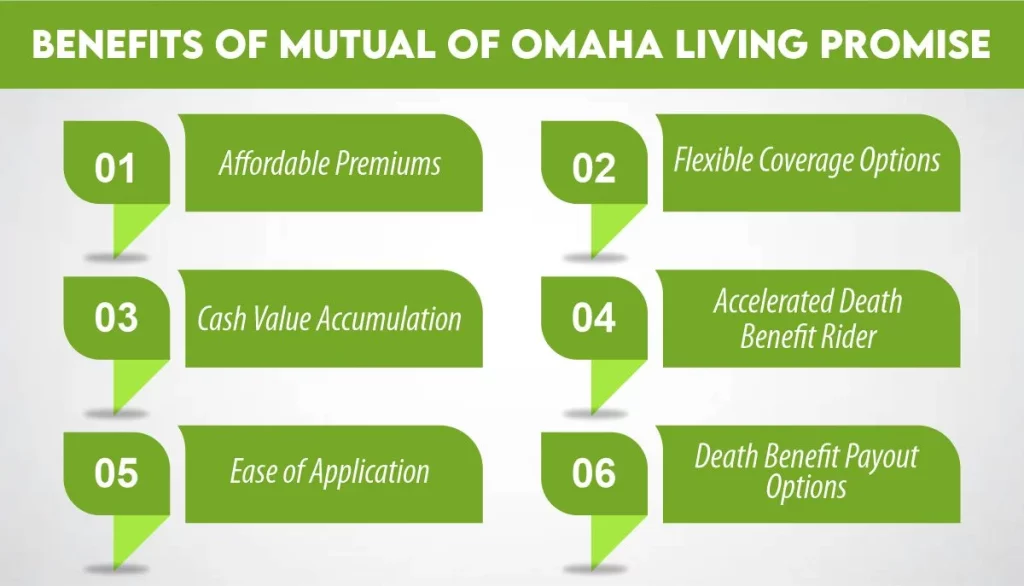

Benefits of Mutual of Omaha Living Promise

- Affordable Premiums

The policy offers affordable premiums that are guaranteed to remain level for the life of the policy. This means you won’t have to worry about your premiums increasing as you get older.

- Flexible Coverage Options

Mutual of Omaha Promise offers flexible coverage options to suit your needs and budget. You can choose a coverage amount that aligns with your final expense needs, ensuring that your loved ones are not burdened with financial obligations when you pass away.

- Cash Value Accumulation

It builds cash value over time, which you can borrow against or use to supplement your retirement income. This can provide an additional source of funds in times of need.

- Accelerated Death Benefit Rider

The plans offers an accelerated death benefit rider that allows you to access a portion of your death benefit if you are diagnosed with a terminal illness. This can help cover medical expenses and ensure that you receive the care you need.

How Much Does Life Isurance Cost?

- Ease of Application

Applying for Mutual of Omaha Promise is easy and convenient. You can apply online or through a licensed insurance agent, and the approval process is quick, with coverage typically starting within a few days of application.

- Death Benefit Payout Options

Mutual of Omaha Promise offers several payout options for the death benefit, allowing your beneficiaries to choose how they receive the funds. They can opt for a lump sum payment, installment payments, or a combination of both.

Cost of Mutual of Omaha Living Promise

The cost of Mutual of Omaha Promise can vary based on several factors, including your age, gender, health status, and the coverage amount you choose. However, the policy is designed to be an affordable option for individuals looking to cover their final expenses.

Here’s an example table outlining the estimated monthly premiums for Mutual of Omaha Promise based on age and coverage amount. Please note that actual premiums may vary based on individual factors and are subject to underwriting.

| Age | $10,000 Coverage | $15,000 Coverage | $20,000 Coverage |

| 50 | $30.00 | $45.00 | $60.00 |

| 55 | $35.00 | $52.50 | $70.00 |

| 60 | $40.00 | $60.00 | $80.00 |

| 65 | $50.00 | $75.00 | $100.00 |

| 70 | $65.00 | $97.50 | $130.00 |

| 75 | $90.00 | $135.00 | $180.00 |

| 80 | $125.00 | $187.50 | $250.00 |

| 85 | $175.00 | $262.50 | $350.00 |

To get an accurate quote for Mutual of Omaha Promise, it’s best to contact a licensed insurance agent who can provide you with a personalized quote based on your circumstances. They can help you determine the coverage amount that’s right for you and provide you with information on the cost of the policy.

How to Buy Mutual of Omaha Living Promise?

Buying Mutual of Omaha Promise is a straightforward process. Here’s a general overview of how to do it:

Research and Decide: Before buying, research the policy to understand its features, benefits, and costs. Determine if it meets your needs for final expense coverage.

Application: Complete an application form with the help of your agent. You’ll need to provide personal information such as your age, health status, and coverage amount.

Underwriting: Mutual of Omaha will review your application and may ask for additional information, such as medical records or a phone interview, to assess your eligibility.

Approval: Once your application is approved, you’ll receive your policy documents. Review them carefully to ensure they reflect the coverage you applied for.

Payment: Pay your premiums as outlined in your policy. The premiums for Mutual of Omaha Promise are typically paid monthly, but other payment options may be available.

Coverage Start: Your coverage will start once your first premium is paid and your policy is in force. You’ll receive a policy document confirming your coverage.

Review Regularly: Periodically review your policy to ensure it still meets your needs. You may be able to make changes to your coverage if necessary.

It’s important to work with a licensed insurance agent who can guide you through the process and help you make informed decisions about your coverage.

Conclusion

Mutual of Omaha Living Promise is a comprehensive and affordable life insurance solution designed to provide financial security and peace of mind for you and your loved ones. With its guaranteed acceptance, flexible coverage options, and cash value accumulation, it offers a range of benefits that make it a smart choice for individuals looking to protect their families from the financial burden of final expenses. Consider Mutual of Omaha Promise for your life insurance needs and secure a brighter future for your loved ones.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.