Last Updated on: August 25th, 2025

- Licensed Agent

- - @M-LifeInsurance

Life insurance is not just about money, it is all about love, care and peace of mind. Life insurance plans show your family that you are thinking of them, even when you are no longer here. For seniors, legacy life insurance is a way to give your family comfort instead of worry. It can help pay for funeral costs, take care of any unpaid loan, and make sure your loved ones have money when you pass away. This way, your family can spend time remembering you and healing, without worrying about paying bills.

In this guide, we’ll explain everything you need to know about legacy life insurance for seniors, including rates, reviews of top insurance companies, key benefits, and helpful tips on how to choose the best plan for your needs and budget

Table of Contents

ToggleWhat Is Senior Legacy Life Insurance?

Senior Legacy Life Insurance is a type of life insurance that is specifically designed for seniors, usually aged 50 and above, who want to leave a financial legacy for their families. These policies are often permanent like whole life insurance rather than term life. That means the coverage will last for a lifetime and builds a cash value.

Unlike the other regular life insurance plans, seniors legacy life insurance is specifically designed for older adults. These policies are made to be simple, affordable and easy to qualify for, even if you have health issues. There is no medical exam in these plans, and coverage is simple.

Importance Of Senior Legacy Life Insurance

Senior Legacy Life Insurance is important for seniors who want to take care of their family’s financial needs. It can pay for funeral costs, unpaid bills, and any surprise expenses, so your loved ones don’t have to worry about any surprise expenses. It also gives you peace of mind, knowing you can leave a helpful financial gift for your family.

Here’s why Senior Legacy Life Insurance matters:

Covers Final Expenses

This plan helps to make sure that your loved ones and your family will not have to struggle to pay for the funeral and other end of life expenses.

Leaves a Financial Legacy

The plan also provides funds that can be left to children, grandchildren, or a spouse

Debt Protection

It also prevents outstanding loans from becoming a burden on your family.

Affordable Options for Seniors

Policies are available even for those with health challenges

Peace of Mind

Seniors can feel confident knowing their family won’t have money problems after they pass away.

Benefits of Senior Legacy Life Insurance

When comparing your options, it’s important to understand the benefits of senior legacy life insurance:

No Medical Exam in Most Cases

Many plans do not need a full medical exam. You usually only answer a few simple health questions, and this is making it easier and faster to get coverage.

Lifetime Coverage

Whole life insurance stays active for your entire life as long as you keep paying the monthly or yearly premiums. This means your family will always be protected.

How Much Does Life Isurance Cost?

Cash Value Growth

Some life insurance plans let you save money over time. You can borrow this money if you need it. This can help you pay for emergencies or surprise expenses.

Affordable Rates

Because coverage amounts are usually smaller, monthly payments are easier to manage. This is great for seniors living on a fixed income.

Customizable Coverage

You have an option that you can choose the amount of coverage that works best for you and your family. This makes the policy fit your needs and budget and keep your family protected.

Quick Approval

Simplified applications will make sure that you get the life insurance approved in short time and get the regular plans, so you don’t have to wait long to be protected

Senior Legacy Life Insurance Rates

For the legacy life insurance there are no fixed rates, it depends on your age, gender and amount of coverage you want. So the prices can fluctuate according to these factors. But generally, the younger ones can purchase the policy at lower premiums. Let’s have a look at the estimated rates for the legacy life insurance. Keep in mind that these rates are not fixed and just for general information.

- Age 55–65: $30 – $70/month for $10,000 coverage

- Age 66–75: $50 – $120/month for $10,000 coverage

- Age 76–85: $90 – $200/month for $10,000 coverage

Men usually pay a little more than women because women tend to live longer. Health can affect the cost, but some policies are guaranteed issues, which means you get approved no matter what your health is.

Senior Life Insurance Company Legitimacy

There is a common question that many seniors ask about, ” Is this senior life insurance company real and safe?” The answer depends on the insurance company. Big, well-known insurance companies with good financial ratings are safe and trustworthy. But some companies might push “senior legacy” plans that are not always the best deal.

To make sure a senior life insurance company is legitimate, first check its financial rating to see if it is a strong insurance company from which you are going to buy a plan. Read reviews from real customers to know their experiences. Make sure the company is licensed in your state by checking with your local Department of Insurance. Finally, read the policy details carefully before you sign anything.

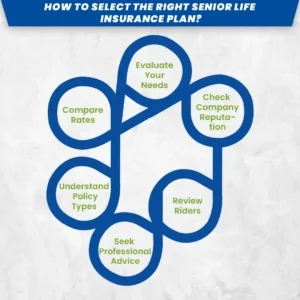

How to Select the Right Senior Life Insurance Plan?

There are many senior life insurance options, so it’s important to pick the right one. Here is a simple step-by-step way to that what to choose:

Evaluate Your Needs

Before buying the legacy life insurance plan, you have to think about why you need this policy. You want it to cover the funeral expenses or you want a larger amount to leave as a gift for your family and loved ones. So knowing your purpose will help you to choose the right plan.

Compare Rates

Look at options and plans from different insurance companies. This helps you find a plan that is affordable and fits your budget. Don’t just pick the first option you see.

Check Company Reputation

Read reviews from other seniors about the insurance company. Make sure the company is reliable, pays claims on time, and provides good customer service.

Understand Policy Types

There are different types of policies: guaranteed issue (no health questions), simplified issue (few health questions), or whole life (builds cash value). Pick the type that matches your health and what you need from the policy.

Review Riders

Some policies offer extra benefits called riders. These can include things like accidental death coverage or the ability to get part of the money early if you become very sick. Check if these are useful for you.

Seek Professional Advice

A professional insurance agent can help you to get the best plan according to your needs and preferences.

Final Thoughts

Choosing Senior Legacy Life Insurance is a smart way for seniors to protect their families and loved ones. Having this plan will help to make sure that your family and loved ones will not have to pay the heavy bills if something happens to you, and also you get peace of mind in your retirement. Just make sure to look at the plans when buying the policy. The most important thing is to understand your needs. By learning why this insurance matters and how to choose the right plan, you can make sure your family is cared for and leave a lasting gift for them.

Compare plans now with Mlife insurance and choose the right Senior Legacy Life Insurance to protect your family’s future.

FAQs About Senior Legacy Life Insurance

1. How are senior life insurance plans different from traditional ones?

Regular life insurance policies need a medical exam,it gives a higher coverage and this policy is for the young people. While senior legacy life insurance is made for the older adults, also there is no medical exam, and mainly help to cover the funeral expenses.

2. Can you choose the coverage amount for senior legacy life insurance?

Yes. Seniors can usually choose coverage amounts ranging from $5,000 to $50,000 depending on their budget and financial goals.

3. Can I get a senior insurance plan if I have health issues?

Absolutely. Many senior legacy life insurance policies are “guaranteed issue,” meaning approval is guaranteed regardless of health conditions. However, these may have slightly higher premiums or waiting periods for full benefits.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.

Comments are closed.