Last Updated on: June 27th, 2025

- Licensed Agent

- - @M-LifeInsurance

When someone passes at a young age and has a mortgage left, has kids going to kindergarten, and a wife who relies on him. An instant thought comes to your mind. What will happen to my family when I die?

Then you start planning to buy life insurance. Among so many options available, 15-year term life insurance would be the best option for you. In this guide, we’ll explain everything about 15-year term life insurance, including its benefits, cost, rates, and how it compares with other term lengths. We’ll also touch on the best options for seniors.

What is a 15-Year Term Life Insurance Policy?

You can clearly understand by its name that the 15-year term life insurance will cover you for a fixed time period that is 15 years. The insurance company will pay a death benefit to the family. If the policyholder passes away within 15 years of the policy. If the person is still alive after 15 years, the policy will automatically expire, and there will be no payout. For that, you have to renew or convert the policy.

Is a 15-Year Term Life Insurance Policy Right for You?

When buying a 15-year term life insurance policy, you must ask yourself some questions like:

How much debt do you currently have?

When will your children become financially independent?

Will my family struggle financially if I pass away in the next 15 years?

These thoughts will help you to make a better decision on whether a 15-year term is best for you or not.

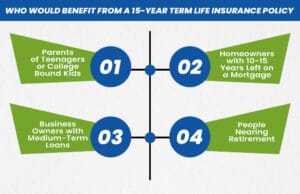

Who would benefit from a 15-year term life insurance policy?

Most people buy 15-year term life insurance when they are in their 40s or 50s. This insurance policy will cover most of the financial responsibilities, like paying bills, rent or mortgage, loans, and supporting family members.

A couple in their 40s, both doing jobs to cover the daily expenses, having kids, their education, and paying the mortgage. All these expenses are relying on their two jobs. Now they don’t need any lifelong insurance coverage. They just want to protect their kids and expenses during this important time. A 15-year term life insurance is the best option for them, offering them stress-free life, covering the mortgage, living expenses, and kids’ education. If one of them passes away unexpectedly. This insurance will provide focused financial security.

Other than this, some age groups also benefit from 15-year term life insurance

1. Parents of Teenagers or College-Bound Kids

15-year term life insurance is best to protect your family’s money during the years of your child’s education

2. Homeowners with 10-15 Years Left on a Mortgage

This insurance will make sure that your mortgage is paid off if something happens to you before the term ends.

3. Business Owners with Medium-Term Loans

Life insurance can cover a business loan or act as a key person policy for business continuity.

4. People Nearing Retirement

A 15-year term will provide you with extra protection until you reach retirement age.

Benefits of 15-Year Term Life Insurance

15-year term life insurance is the best option because the death benefit and the monthly instalments remain the same throughout the 15 years. This will help you to plan better and more easily. And also, it makes sure that there is no increase in the monthly payments, and you will not get burdened by any increase.

How Much Does Life Isurance Cost?

What happens after the 15 years of your term are up?

Once you reach the end of your 15-year term, life insurance will end. You will have a few options. The first option is that you simply let your policy expire if you and your family no longer need the coverage. But if you still want your policy to stay active, you need to renew it, or you can buy new 15-year term life insurance or some other insurance policy that will fit your needs. Make sure that you talk to your insurance agent if you are interested.

15-Year Term Life Insurance Cost

The cost depends on so many factors. These factors are;

- Age

- Gender

- Health status

- Tobacco use

- Coverage amount

- Insurer’s underwriting criteria

Most people think that buying life insurance is so expensive, but the truth is that it is affordable and simple. Your monthly payments depend on your age. A person who is healthy and 30 years old will pay less amount but a 50-year-old man will pay a little more. This cost table will help you to get a better understanding.

| Age / Sex | $250,000 Coverage | $500,000 Coverage | $1,000,000 Coverage |

| 25-Year-Old Female | $10–$13 | $14–$18 | $22–$27 |

| 25-Year-Old Male | $11–$14 | $17–$22 | $30–$36 |

| 35-Year-Old Female | $15–$18 | $22–$26 | $37–$42 |

| 35-Year-Old Male | $17–$22 | $27–$34 | $45–$55 |

| 45-Year-Old Female | $27–$33 | $40–$48 | $68–$80 |

| 45-Year-Old Male | $32–$40 | $50–$62 | $88–$110 |

| 55-Year-Old Female | $60–$70 | $100–$115 | $170–$200 |

| 55-Year-Old Male | $75–$95 | $125–$145 | $210–$250 |

Why do people choose level term policies?

- Monthly payments stay the same, making it easier to plan your budget

- This will cost less than long-term life insurance plans

- It is a great choice for short to medium-term coverage needs

- This gives you comfort and security to your family and loved ones

15-Year Term Life Insurance Rates vs. Other Terms

When you are buying a term life insurance, you may understand how 15-year policies stack up against others.

| Term Length | Cost Comparison | Best For |

| 10 Years | Lower than 15 | Short-term needs |

| 15 Years | Balanced option | Medium-term responsibilities |

| 20 Years | Higher than 15 | Longer-term obligations |

| 30 Years | Highest cost | Long mortgages or young dependents |

Tips for Buying 15-Year Term Life Insurance

- Buy your policy early if you are older or have health issues.

- Must check at least 3 or 4 companies and compare the pricing

- Search for the best insurance company that is trusted and treats people well.

- Always think about your health before buying the policy.

- Ask the insurance agent to get help and find the right company.

Final Thoughts

15-year term life insurance is a very smart and affordable choice for people who want protection but for a too long time. This policy is very easy and useful to cover the financial responsibilities, like your mortgage, education costs, and other daily life expenses during your peak earning years. Always compare the prices, talk to the agent, and find the best possible insurance company to protect your family and loved ones.

Ready to protect your loved ones? Get a 15-year term life insurance quote today and make a smart decision that secures your family’s future without overpaying. With affordable payments and good coverage, don’t wait, take the first step toward safeguarding your loved ones and their future now. Compare 15-year term life insurance quotes today and lock in affordable coverage while you’re still eligible.

FAQs

What is 15-year term life insurance?

It is a life insurance policy that covers you for 15 years. If you pass away during this time, your family gets paid. After 15 years, the policy will end, and you will have to apply to renew it.

For which age group is 15-year term life insurance?

People in their 40s or 50s with mortgages, kids, or loans often choose this to protect their family during important years.

What is the cost of 15-year term life insurance?

Cost depends on age, health, gender, and coverage amount. Younger and healthier people pay less.

What happens after 15 years?

After 15 years when the time ends. Your 15-year term life insurance will expire. You have to renew it or apply for another term insurance policy.

Why choose a 15-year term over other lengths?

15-year term life insurance is a balanced option for the medium term. This will support you to pay your mortgage and help you in your kids’ education. It’s a balanced, affordable option for medium-term needs like paying off a mortgage or supporting kids’ education.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.