Are you a self-employed entrepreneur looking to secure your family’s financial future? Life insurance might be the answer. As a self-employed individual, you wear many hats, from managing your business to balancing your finances. However, have you considered what would happen to your loved ones if something were to happen to you?

Life insurance for self-employed individuals is not just a safety net; it’s a crucial investment in your family’s future. It provides financial protection for your loved ones and ensures that your hard-earned assets are preserved. In this guide, we’ll explore the importance of life insurance for self-employed individuals, the types of insurance available, and how to determine the right coverage for your needs.

Join us as we explore how life insurance can offer peace of mind and security in an ever-changing world.

Can you get Life Insurance if you are Self-Employed?

Yes, self-employed individuals can get life insurance. Life insurance is particularly important for self-employed individuals because they don’t have the same benefits and financial safety nets that traditional employees often have. The insurance plan can provide financial protection for your loved ones and business interests in the event of your death.

However, when you are applying for life insurance for self-employed individual, you’ll need to provide proof of income, such as tax returns or profit and loss statements, to demonstrate your financial stability. It’s also important to consider your coverage needs and the type of policy that best suits your situation.

Types of Life Insurance for Self-Employed Individuals

Self-employed individuals have several options when it comes to choosing life insurance. Here are the main types to consider:

1- Term Life Insurance

This type of insurance provides coverage for a specific period, such as 10, 20, or 30 years. It offers a straightforward approach with fixed premiums and a death benefit paid out if you pass away during the term. Term life insurance is typically more affordable, making it a popular choice for self-employed individuals looking for basic coverage.

2- Whole Life Insurance

Whole life insurance offers coverage for your entire life, as long as premiums are paid. It comes with a cash value component that grows over time, providing a source of savings that you can borrow against or withdraw from. While whole life insurance tends to have higher premiums compared to term life, it offers lifelong protection and an investment component.

3- Universal Life Insurance

Universal life insurance is a flexible form of permanent life insurance that allows you to adjust your premium payments and death benefits as your needs change. It offers more flexibility in terms of premium and death benefits compared to whole life insurance. Additionally, universal life policies may accumulate cash value over time, similar to whole life insurance.

4- Variable Life Insurance

Variable life insurance combines a death benefit with an investment component, allowing you to invest in a variety of sub-accounts such as stocks, bonds, and mutual funds. The cash value of the policy fluctuates based on the performance of these investments. While variable life insurance offers the potential for higher returns, it also comes with greater risk and may require active management of the investment component.

Choosing the right type of life insurance for self-employed depends on your individual needs, budget, and financial goals. Consider consulting with a financial advisor to help you evaluate your options and make an informed decision.

How Much Life Insurance Do Self-Employed Need?

Determining how much life insurance you need as a self-employed individual depends on various factors, including your financial obligations, income replacement needs, and future goals. Here are some key considerations:

Income Replacement: Consider how much income your loved ones would need to maintain their standard of living if you were to pass away. Multiply your annual income by the number of years you want to replace income for, such as until your children are grown or your spouse reaches retirement age.

Debts and Obligations: Factor in any outstanding debts you have, such as mortgages, car loans, or business loans. Your life insurance policy should be sufficient to cover these debts to prevent your loved ones from inheriting them.

Future Expenses: Consider future expenses, such as college tuition for your children or retirement savings for your spouse. Your life insurance policy should provide enough coverage to meet these needs.

Final Expenses: Don’t forget to include funeral and burial expenses, which can be significant. Your life insurance policy should provide enough coverage to cover these costs.

Business Continuity: If you own a business, consider how much capital would be needed to ensure its continuity in your absence. Factor in any outstanding business debts, the cost of hiring and training a successor, and any other expenses related to the business.

Calculating the exact amount of life insurance for self-employed can be complex, and it’s advisable to consult with a financial advisor to ensure you have adequate coverage to meet your family’s needs.

How Much Does Life Isurance Cost?

How to Get Life Insurance for Self-Employed Individuals?

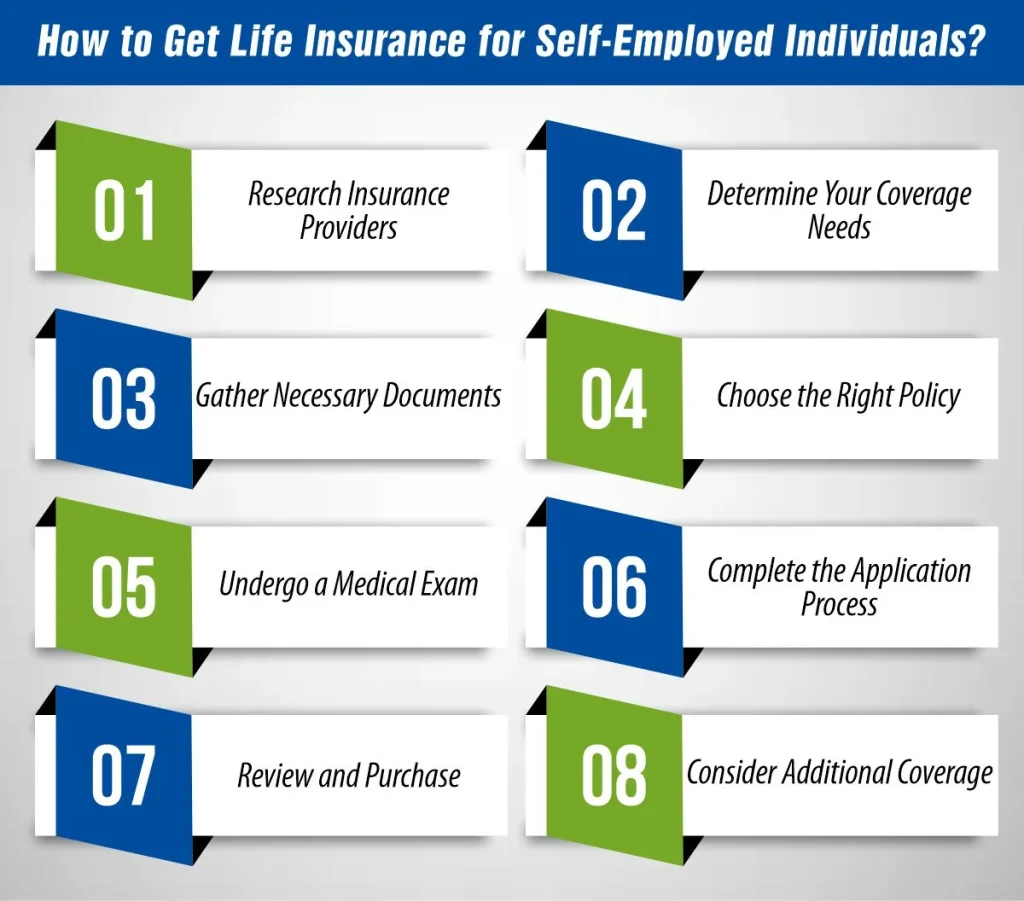

How to Get Life Insurance for Self-Employed Individuals?

Getting life insurance as a self-employed individual is similar to getting coverage as an employed person, but there are some key steps to keep in mind:

1- Research Insurance Providers

Start by researching insurance companies that offer coverage to self-employed individuals. Compare their policies, rates, and customer reviews to find a reputable provider that meets your needs.

2- Determine Your Coverage Needs

Calculate how much coverage you need based on your financial obligations, income, and future expenses. Consider consulting with a financial advisor to help you determine the right amount of coverage.

3- Gather Necessary Documents

Insurance companies will require proof of income, such as tax returns or profit and loss statements, to assess your eligibility for coverage. Gather these documents before applying for a policy.

4- Choose the Right Policy

Select a policy that aligns with your coverage needs and budget. Consider factors such as the length of coverage (term or permanent), the amount of coverage, and any additional riders or features you may need.

5- Undergo a Medical Exam

Depending on the type and amount of coverage you’re applying for, you may need to undergo a medical exam to assess your health. The insurance company will use this information to determine your premium rates.

6- Complete the Application Process

Fill out the insurance application form accurately and truthfully. Provide all requested documents and information to expedite the underwriting process.

7- Review and Purchase

Once you’ve been approved for coverage, review the policy terms and conditions carefully before purchasing to ensure it meets your needs. Make sure to pay your premiums on time to keep your coverage active.

8- Consider Additional Coverage

Depending on your needs, you may want to consider additional coverage, such as disability insurance or critical illness insurance, to provide further financial protection.

Getting life insurance as a self-employed individual requires careful consideration of your financial situation and future needs. By following these steps and consulting with a financial advisor, you can ensure that you have the right coverage to protect your loved ones and your business.

Cost of Life Insurance for Self-Employed

The cost of life insurance for self-employed individuals can vary based on factors such as age, health, coverage amount, and type of policy. Here’s a general overview of the estimated monthly premiums for a $500,000 term life insurance policy for a non-smoking male and female in good health:

| Age | Male | Female |

| 30 | $20 | $16 |

| 35 | $22 | $18 |

| 40 | $28 | $24 |

| 45 | $40 | $32 |

| 50 | $60 | $48 |

| 55 | $100 | $76 |

| 60 | $180 | $132 |

| 65 | $340 | $236 |

Please note that these are just estimated premiums and actual costs may vary based on individual circumstances and insurance companies. It’s advisable to request quotes from multiple insurers to compare rates and find the best coverage for your needs.

Considerations When Choosing Life Insurance for Self-Employed Individuals

When choosing life insurance for self-employed, there are several important considerations to keep in mind to ensure you get the right coverage for your needs:

-

Coverage Amount

Determine how much coverage you need based on your financial obligations, income, and future expenses. Consider factors such as outstanding debts, final expenses, and income replacement for your family.

-

Type of Policy

Choose between term life, whole life, universal life, or variable life insurance based on your budget and coverage needs. Term life insurance is typically more affordable, while permanent life insurance offers lifelong coverage and a cash value component.

-

Premiums

Consider how much you can afford to pay in premiums. Term life insurance generally has lower premiums compared to permanent life insurance, but premiums can increase as you age.

-

Health Considerations

Your health plays a significant role in determining your insurability and premium rates. Be prepared to undergo a medical exam and provide detailed information about your health history.

-

Riders and Add-Ons

Consider any additional riders or add-ons that may enhance your coverage, such as accelerated death benefit riders, which allow you to access a portion of your death benefit if you’re diagnosed with a terminal illness.

-

Company Reputation

Research insurance companies carefully and choose a reputable provider with a strong financial rating. Read reviews and check customer satisfaction ratings to ensure you’re selecting a reliable insurer.

-

Financial Goals

Consider how life insurance fits into your overall financial goals. If you’re using life insurance as an investment vehicle, permanent life insurance with a cash value component may be more suitable.

By carefully considering these factors and seeking guidance from a financial professional, you can choose a life insurance policy that provides financial security for you and your loved ones as a self-employed individual.

Conclusion

Life insurance for self-employed is a crucial financial tool as it provides financial protection and peace of mind for you and your loved ones. By understanding the different types of life insurance available and determining the right amount of coverage for your needs, you can ensure that your family and business are protected no matter what the future holds.

FAQs

1- Can self-employed individuals get life insurance?

Yes, self-employed individuals can get life insurance. In fact, it’s often a crucial financial tool for them to protect their loved ones and business interests.

2- What type of life insurance do you need if you’re self-employed?

The type of life insurance you need as a self-employed individual depends on your financial goals and needs. Term life insurance is a popular choice for its affordability and simplicity, while permanent life insurance offers lifelong coverage and a cash value component.

3- Are life insurance policies a good investment?

Life insurance can be a valuable investment, especially for self-employed individuals looking to protect their family and business interests. Permanent life insurance policies, such as whole life or universal life, offer a combination of insurance protection and a savings component that can grow over time.

4- Why is life insurance important if you’re self-employed?

Life insurance is important for self-employed individuals because it provides financial protection for their loved ones and businesses in the event of their death. It can help cover outstanding debts, funeral expenses, and provide income replacement for their family.

5- Is life insurance for self-employed tax deductible?

Life insurance premiums are generally not tax-deductible for self-employed individuals, unless the policy is used for business purposes, such as funding a buy-sell agreement or key person insurance. It’s recommended to consult with a tax advisor for specific advice related to your situation.

References:

https://www.moneygeek.com/insurance/life/life-insurance-for-self-employed/

https://www.legalandgeneral.com/insurance/life-insurance/guides/self-employed-life-insurance/

https://www.policygenius.com/life-insurance/life-insurance-for-self-employed/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.