When you purchase a life insurance policy, you’re securing financial protection for your loved ones in the event of your passing. However, circumstances can change, and you may find yourself needing to cancel your Primerica life insurance policy.

Are you one of those who are looking for how to cancel your Primerica life insurance? Well! This blog post is for you. Whether you’ve found a more suitable policy elsewhere, your financial situation has changed, or you simply no longer require coverage, it’s important to understand the process of cancelling your policy correctly to avoid any potential issues.

In this blog post, we’ll guide you through the steps on how to cancel your Primerica life insurance policy smoothly and efficiently. Read the blog post to know more.

Understanding Your Primerica Life Insurance Policy

Before you decide to cancel your life insurance agreement, Primerica, you must pay special attention to your policy wording. By knowing the policy terms and conditions, you will be in a better position to decide on policy tenure with no surprises during the cancellation process.

Your policy is not beyond being just a document; it’s a life vest for your loved ones. Here’s a breakdown of what you need to know:

Policy Details

This policy that you indicate will include key information such as the amount of coverage, payment terms for premiums, and any extra benefits available.

Terms and Conditions

Make sure to spend a moment looking at all those small characters. Under this situation, find out cancellation circumstances as well as any consequences or fees you may receive.

Coverage Needs

Find out if you meet the objectives that your family members require inside your financial coverage. Life may bring along certain events that can lead to amendment of your coverage.

Customer Service

A customer who needs help would get such help from Primerica’s customer service staff. Do not get overwhelmed by the policy, kindly reach out with any questions or concerns you might have.

By learning the intricacies of your Primerica Life Insurance plan, you will be in a position to make the wisest decisions you can about your financial future.

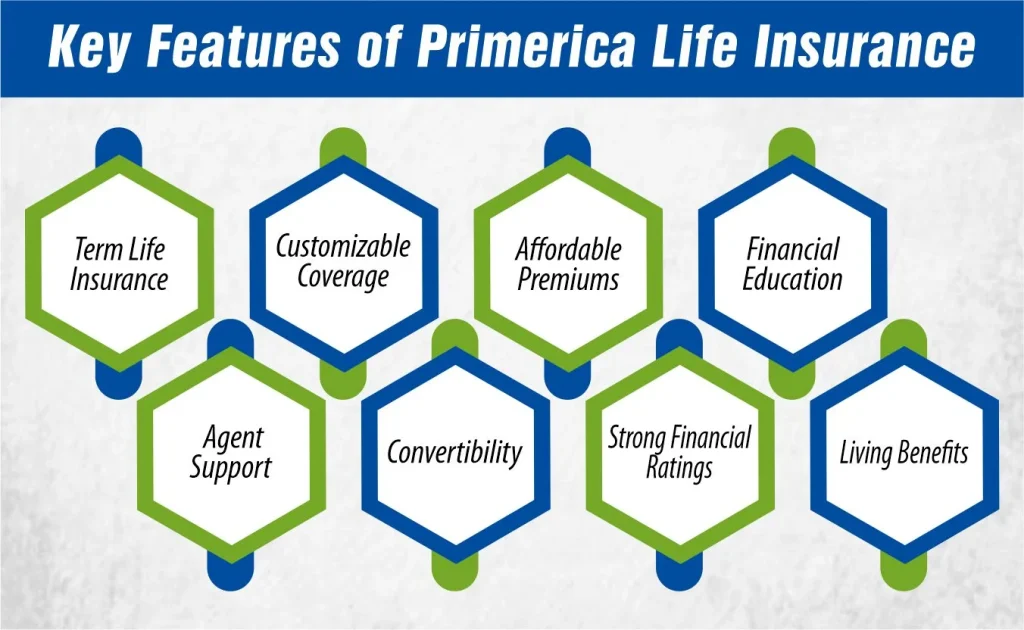

Key Features of Primerica Life Insurance

Key Features of Primerica Life Insurance

Primerica life insurance is full of interesting features and benefits, which makes it a popular choice for many people. Here are some of the key features:

1- Term Life Insurance

Primerica generally provides term life insurance, a kind of life insurance which provides coverage against death for a certain period. Its periods vary often and can be; 10, 20, and 30 years. Permanent term life insurance is in general less expensive than permanent life insurance contracts.

2- Customizable Coverage

Primerica has the advantage that it allows policyholders to customize their policy themselves depending on personal needs and available budget. Flexibility is the reason you would alter the plan according to your family’s needs creating an adequate safety net.

3- Affordable Premiums

Primerica allows life insurance at attractive premiums therefore individuals and families from different levels can have it even with small-size family budgets.

4- Financial Education

Primerica gives importance to financial literacy and offers educational materials to help policyholders get structured with the financial planning and claims handling process.

5- Agent Support

Primerica has agents today that not only serve you but also take the time to teach you about the different insurance options out there. These agents can even assist you in getting the policy that will suit your needs, or if you need to make changes to your existing coverage, they can help with that too.

6- Convertibility

The conversion option is even available for some Primerica Level term insurance policies in case your needs change, and that adds some flexibility.

7- Strong Financial Ratings

Primerica is a company with a solid financial strength, which enhances its reliability as revealed by independent rating agencies.

How Much Does Life Isurance Cost?

8- Living Benefits

Some higher insurance plans pay you part of death insurance benefits if you have a terminal disease or a critical illness.

By now you are clear about the features and benefits of Primerica Life insurance. The company always ensures that life insurance is affordable, customisable, and with exceptional financial ratings being focused on financial literacy and customer service satisfaction.

Reasons for Cancelling Your Primerica Life Insurance Policy

The cancelation of your Primerica life insurance policy is a decision that needs to be made carefully because it is massive. But what can be the reason for the cancelation of your policy?

Well! Here are some common reasons why individuals may consider cancelling their Primerica life insurance policy:

Financial Limitations

Even if the events of financial standing, such as employment and being less paid at work, can make the continuation of paying premiums for your life insurance impossible.

Policy No Longer Needed

You might discover that your current life insurance canopy is more than you need, particularly if the money you owe has decreased and financial responsibility appears from alternative sources such as bonds.

Better Coverage Options

It may be that you have come across another insurer which offers cover greater than yours but is nevertheless not bulging your pocket or might have a large number of additional benefits.

Health Improvements

Your life insurance coverage through Primerica may have gained ground since you first purchased, in which case you stand a chance of qualification for tags’ premium if you buy a new policy.

Change in Financial Goals

With your financial life goals having been redefined, you will probably support the array of insurance policies you were using to meet your needs, prioritizing that will on your new financial plan.

Policy Not Meeting Expectations

If your Proposition Life Insurance provided by Primerica does not suit you on service, coverage or other terms you may give it up for something better.

Life Changes

Large life occurrences for instance marriage, separation, the birth of a child or retirement could be a reminder that you need to rethink your insurance policy to establish more coverage after such adjustments.

Before you decide canceling your Primerica life insurance policy, you must be careful in taking your reasons into account and also consider all the existing options. It may be worthwhile seeking an appointment with a finance professional to discuss your current finances, and to decide the most appropriate course of action to suit you.

Steps to Cancel Your Primerica Life Insurance Policy

Are you further looking for the process of cancelation your Premerica Policy? The procedure of cancelling your Primerica life insurance policy differs from what you are used to and you need to break it into several steps for a smooth, comfortable process.

Here’s a guide to help you navigate the cancellation process:

1- Review Your Policy

Namely, thoroughly go through the standards, terms and conditions for your Primerica life insurance coverage in the policy, to fully understand what is related to cancellation. Be aware of such fees, penalties, or refund policies that can be found in the agreement.

2- Contact Primerica

Have Primerica’s customer service department fully a notice to ensure that your policy gets terminated. It is often feasible to have the phone numbers at hand through the detailed information on the policy documents or a company’s website.

3- Request a Cancellation Form

There is a possibility Primerica will ask you to fill in a written request form. The customer care agent will most likely have the form you need. It may also be available on their website, should they have one.

4- Fill Out the Form

Complete the cancellation form truthfully and well, providing all the information it requires. In such a case, you must provide your case number, personal information and the start date of cancellation. Documents and further required materials, if any, should be submitted to Primerica.

5- Submit the Form

Submit your cancelled policy form to the Primerica Company via the given channels. Distribution of the application form may be effected through the process of sending it to a particular destination by post or through electronic channels such as the Primerica website if it exists.

6- Confirm Cancellation

Once you have the form filled out, it is advisable to connect with Primerica once the form has been submitted and considered. For your records, before you leave, kindly request cancellation confirmation in writing.

7- Return Policy Documents

If the request comes in, mail all the physical policy papers and materials to Primerica. Make sure there are no mistakes in cancelling and that you also copy and keep all the letters and documents about the cancellation.

8- Review Your Finances

After you cancel your life insurance policy through Primerica, look again at your financial situation and confirm that the type and quantity of coverage you’ve acquired meets your current requirements. See an insurance agent to determine whether you need to intermediate other financial resources in case of a crisis.

This is how to do it; stick to the outlined instructions and comply with Primerica’s cancellation rules to finally close down your Primerica life insurance policy.

Important Considerations Before Canceling Your Policy

What important considerations you may have to consider before canceling your policy? Before cancelling your Primerica life insurance policy, it’s crucial to consider the following factors to ensure that you are making an informed decision:

Impact on Coverage: By terminating your life insurance, you will no longer have a cover! Think as if your family has another source of coverage, besides this retreating one, to protect your family members in the case of your death.

Financial Consequences: A principal policy term can cause the penalty of your Primerica life policy which has the accumulated cash value and the surrender charges. Examine your corporate policy papers to have a clear picture of any organization’s finances.

Future Insurability: If you stop having your Primerica life insurance and in the future you decide that you want to get another policy, you could find difficulty in finding another insurer, especially if your health is worse or perhaps you are already an old person.

Alternative Options: If you wish to keep your policy then find out about the other options like for example, reducing the coverage amount, paying the premium on time, or getting the rider or additional features that will suit you more.

Consultation: Before making a final choice, be sure to seek out the assistance of a financial counselor or an insurance professional for advice on your specific circumstances. They can influence your decision-making, working closely with you to ascertain the most appropriate approach to take regarding your unique conditions.

Review Policy Terms: Before the cancellation of your life insurance policy, Primerica, please read the terms and conditions so that you know the cancellation process, the fees or penalties if any, and any refunds or benefits that can be made available to you.

Taking these into account and consulting with an insurance expert if needed will make it possible for you to come to a well-informed decision on whether you should cancel your Primerica life insurance policies.

The Bottom Line

Hope you are clear about how to cancel your your Primerica life insurance policy. Canceling your Primerica life insurance policy is a straightforward process, but it’s important to follow the correct steps to ensure a smooth cancellation.

By looking over your policy documents, contacting Primerica, and following their cancellation processes, you will be in a position towards discontinuing the policy successfully and without problems. If you have any worries about the cancelation process, please contact Client Services directly at 1(800) 257-4725, Primerica’s customer team. They are there to provide you with assistance.

References:

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.

Key Features of Primerica Life Insurance

Key Features of Primerica Life Insurance