Are you looking for final expense insurance that provides immediate coverage without a waiting period? If so, you’re in the right place! Final expense insurance is a crucial consideration for those who want to ensure their loved ones are financially protected when they pass away.

Thank you for reading this post, don't forget to subscribe!In this guide, we’ll explore the world of final expense insurance with no waiting period, exploring what it is, how it works, and how to find the right policy for you. Read on to discover everything you need to know about final expense insurance that offers immediate coverage from day one.

What is Final Expense Insurance?

Final expense insurance, also known as burial or funeral insurance, is a type of life insurance designed to cover the costs associated with your funeral and other final expenses. It’s a way to ease the financial burden on your loved ones during a difficult time.

When you purchase a final expense insurance policy, you pay regular premiums to the insurance company. In return, the insurer agrees to pay out a death benefit to your beneficiaries upon your death. This money can be used to cover funeral expenses, medical bills, and other end-of-life costs.

How Does Final Expense Insurance Work?

How Does Final Expense Insurance Work?

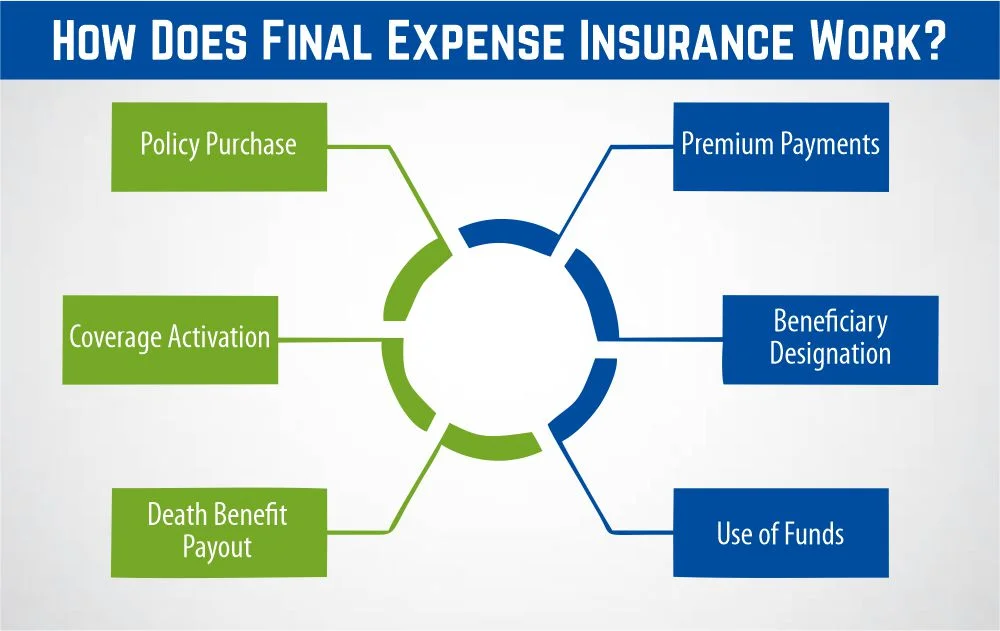

A question might arise, how does final expense insurance work? Well! Final expense insurance works in a very straightforward manner. Here is an overview for you:

1- Policy Purchase

You start by purchasing a final expense insurance policy from an insurance company. You choose the coverage amount and pay regular premiums.

2- Premium Payments

You pay premiums on a monthly or annual basis, depending on the terms of your policy. These premiums contribute to the overall death benefit that will be paid out upon your passing.

3- Coverage Activation

Once your policy is in effect, you are covered for the specified amount. If you pass away while the policy is active, your beneficiaries will receive the death benefit.

4- Beneficiary Designation

You designate one or more beneficiaries who will receive the death benefit when you pass away. This ensures that the funds are distributed according to your wishes.

5- Death Benefit Payout

Upon your death, your beneficiaries file a claim with the insurance company. After verifying the claim, the insurer pays out the death benefit to your designated beneficiaries.

6- Use of Funds

The beneficiaries can use the funds from the death benefit to cover their funeral expenses, medical bills, outstanding debts, or any other final expenses.

So, final expense insurance provides a simple and accessible way to ensure that your loved ones are financially protected and can cover the expenses associated with your passing.

What is a Waiting Period?

A waiting period, in the context of final expense insurance, is the period between when you purchase a policy and when the full death benefit becomes available. During this waiting period, if you were to pass away, the insurer may only pay out a portion of the death benefit or refund the premiums paid.

Waiting periods are common in certain types of life insurance, including final expense insurance, to protect the insurer against immediate claims for individuals who may be in poor health at the time of policy purchase.

Final Expense Insurance with No Waiting Period

Final expense insurance with no waiting period offers immediate coverage from the moment the policy is active. Unlike traditional final expense policies that may have a waiting period before the full death benefit is available, these policies provide instant protection. This means that if you were to pass away shortly after purchasing the policy, your beneficiaries would receive the full death benefit right away.

This insurance plan is especially beneficial for those who want to ensure their loved ones are not burdened with financial expenses after their passing. It provides peace of mind knowing that your beneficiaries will have immediate access to the funds they need to cover your funeral expenses and other final costs.

Types of Final Expense Insurance with No Waiting Period

What are the types of plans final expense insurance has with no waiting period? There are only a few types of final expense insurance policies that may offer immediate coverage without a waiting period:

1- Level Benefit Final Expense Insurance

This type of policy provides immediate coverage from the first day the policy is active. It offers a level death benefit, meaning the full amount of coverage is available to your beneficiaries upon your passing.

How Much Does Life Isurance Cost?

2- Graded Benefit Final Expense Insurance

While not technically offering immediate coverage, graded benefit policies provide a partial death benefit during the first few years of coverage. After the waiting period (usually 2-3 years), the full death benefit becomes available. This can be a good option for individuals who may not qualify for level benefit policies due to health issues.

3- Modified Benefit Final Expense Insurance

Similar to graded benefit policies, modified benefit policies also have a waiting period before the full death benefit is available. However, during the waiting period, if the insured passes away, the beneficiaries typically receive a return of premiums paid plus interest, rather than a partial death benefit. After the waiting period, the full death benefit becomes available.

4- Guaranteed Issue Final Expense Insurance

These policies offer coverage without any medical underwriting or health questions. While they often come with a waiting period, some insurers may offer guaranteed issue policies with immediate coverage options for certain age groups or health conditions.

When considering final expense insurance with no waiting period, it’s essential to understand the differences between these types of policies and choose the one that best fits your needs and circumstances. Consulting with a licensed insurance agent can help you explore your options and find the right policy for you.

Who Can Apply for Final Expense Insurance with No Waiting Period

Not everyone is eligible for final expense insurance with no waiting period until he lies under certain criteria. This plan is typically available to individuals who meet certain requirements set by the insurance company. Here’s who can typically apply for this type of coverage:

-

Age Requirement

Most insurers offering final expense insurance with no waiting period require applicants to be within a certain age range, often between 50 and 85 years old. Some insurers may have different age requirements, so it’s essential to check with the specific company.

-

Health Status

Applicants should generally be in relatively good health to qualify for final expense insurance with no waiting period. While minor health issues may not disqualify you, serious health conditions may impact your eligibility for immediate coverage.

-

Non-Smokers

Some insurers offer lower premiums or immediate coverage to non-smokers. If you are a non-smoker, you may qualify for final expense insurance with no waiting period at a lower cost.

-

No Terminal Illness

Applicants with a terminal illness may not qualify for immediate coverage. However, some insurers offer guaranteed issue policies that provide coverage without medical underwriting, albeit with a waiting period.

-

No Recent Hospitalizations

Insurance companies offering final expense insurance with no waiting period may require that you have not been hospitalized recently or had major surgeries. This requirement varies by insurer.

-

No Serious Health Issues

To qualify for final expense insurance with no waiting period, you typically need to be in relatively good health. While minor health issues may not disqualify you, serious health conditions may impact your eligibility for immediate coverage.

It’s important to note that eligibility criteria vary by insurer, so it’s best to compare quotes from multiple insurance companies to find the best coverage options for your needs.

Cost of Final Expense Insurance with No Waiting Period

The cost of final expense insurance with no waiting period can vary depending on factors such as your age, health, coverage amount, and the insurance company you choose. Here is a general overview of the estimated monthly premiums for final expense insurance with no waiting period:

| Age | Coverage Amount | Estimated Monthly Premiums |

| 50-55 | $5,000 | $20-$30 |

| 56-60 | $5,000 | $25-$35 |

| 61-65 | $5,000 | $30-$45 |

| 66-70 | $5,000 | $35-$55 |

| 71-75 | $5,000 | $40-$65 |

| 76-80 | $5,000 | $50-$80 |

| 81-85 | $5,000 | $60-$100 |

These are just estimates, and actual premiums may vary. It’s important to obtain quotes from multiple insurers to compare prices and coverage options. Additionally, factors such as your location and the insurance company’s underwriting guidelines can also affect the cost of final expense insurance.

How to Get Final Expense Insurance with No Waiting Period

Getting final expense insurance with no waiting period involves a few key steps:

- Research Insurers: Start by researching insurance companies that offer final expense insurance with no waiting period. Look for reputable companies with good customer reviews and ratings.

- Compare Quotes: Obtain quotes from multiple insurers to compare coverage options and premiums. Consider factors such as the coverage amount, premium amount, and any additional benefits offered.

- Apply for Coverage: Once you’ve chosen an insurer, complete an application for final expense insurance. You may need to provide information about your age, health status, and medical history.

- Underwriting Process: The insurer will review your application and may conduct a medical underwriting process, which could include a review of your medical records or a medical exam.

- Approval: If you meet the insurer’s eligibility criteria, you will be approved for final expense insurance with no waiting period. The insurer will provide you with details about your coverage, including the death benefit amount and premium payment schedule.

- Payment: Pay your premiums according to the schedule provided by the insurer to keep your final expense insurance policy active.

It’s important to carefully review the terms and conditions of your final expense insurance policy to understand the coverage provided and any limitations or exclusions that may apply.

The Bottom Line

As we are wrapping the article hope you are clear about final expense insurance with no waiting period. The policy provides immediate coverage for your funeral and other end-of-life expenses, offering peace of mind to you and your loved ones.

Remember to compare quotes from different insurers and consider your age, health status, and coverage needs when choosing a policy. With the right final expense insurance in place, you can ensure that your final wishes are carried out without placing a financial burden on your family.

References:

https://choicemutual.com/blog/burial-insurance-with-no-waiting-period/

https://senior-lifeservices.com/no-waiting-period-burial-insurance/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.