Key points

- Term life explained

- Affordable family coverage

- Compare insurance quotes

- 20 or 25 years

- Short-term options available

- Tips to lower

When you think about getting life insurance, the first step is usually to get a quote for a term life insurance policy. A term life insurance policy gives you financial protection for a fix number of years. This plan is more affordable, easy and simple as compared to the other plans. That why it is a good choice for so many people and families. In this article, we will explain how to get term life insurance quotes, what affects the price, and how to choose the coverage that works best for you.

What Is a Term Life Policy Quote?

A term life policy quote is an estimate from an insurance company from where you are buying the plan. This quote shows how much you have to pay for the amount of coverage you have decided for a set number of years. Term life insurance only lasts for a specific time, and you have an option to select what is best for you like that is for 10, 20, or 30 years, this plan is not like the permanent life insurance. Getting a quote will help you to compare prices from different companies and choose a policy that fits your budget and needs.

When you request term life insurance policy quotes, the insurance company normally see the things to give you the estimate, these things include

- Your age and gender

- If you have any health history and current medical conditions

- Lifestyle choices, including smoking or risky hobbies

- Desired coverage amount

- Term length

Why Comparing Term Life Policy Quotes Matters

Every life insurance policy is different from each other, it means that all come with different benefits and quotes. It is very important to compare quotes when buying the plan from the different insurance companies so that you will get what you need and what you want, lets have a look at why comparing quotes is important:

- Cost Differences: Prices for the monthly premiums can be very different even for the same coverage.

- Coverage Options: Some companies give extra benefits or add-ons that make your policy better.

- Financial Stability: you just have to make sure that the company you are picking has a good reputation, so that your family will get the money when they need it.

- Customized Terms: You can choose a policy that fits your needs, like a 20-year or 25-year term life insurance plan. Choice is all yours that depends on your budget.

How to Get Accurate Term Life Insurance Policy Quotes

Getting accurate quotes for a term life insurance policy is easier today because of the online tools and insurance agents. Here’s how to do it:

- Gather Personal Information, like your age, health history, job, and lifestyle details must be ready.

- You have to decide coverage needs,figure out how much insurance you need based on your family, bills, and future plans.

- It’s very important to pick the policy length that fits your financial goals, like if you want it for 10, 15, 20, or 25 years.

- Make sure to look at quotes from different companies. Online tools make this quick and easy.

- Don’t just look at the price. See if there are extra benefits like accidental death coverage, premium waivers, or options to convert the policy later

Understanding Different Types of Term Life Insurance Quotes

When exploring term life policy quote, you may encounter different types of term policies:

Level Term Life Insurance

This type keeps your payment and coverage the same for the whole term. For example, if you get a 20-year policy, your monthly payment stays the same for 20 year term life policy quotes. It’s good if you want everything predictable.

Decreasing Term Life Insurance

With this type, your payment stays the same, but the coverage slowly goes down over time. People often use this to cover things like a mortgage that gets smaller as you pay it off.

Short-Term Life Insurance

This is for people who only need coverage for a short time, like 5–10 years. It’s good for temporary expenses or when your life is in a transition.

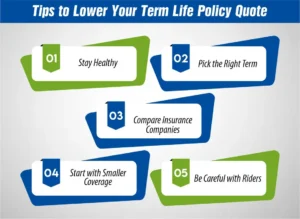

Tips to Lower Your Term Life Policy Quote

Everyone wants life insurance that is affordable but still gives good coverage. Here are some ways to lower your term life insurance quotes:

Stay Healthy

People who don’t smoke and live a healthy lifestyle usually pay less.

Pick the Right Term

Choose a term that matches your needs. Don’t pick too many years if you don’t need them.

Compare Insurance Companies

Check quotes from different insurers online to find the best price.

Start with Smaller Coverage

If money is tight, get the coverage you need now and increase it later.

Be Careful with Riders

Only add extra options (riders) if they really help you.

Selecting the Right Quotes for term life insurance policy

Choosing the right term life insurance isn’t just about the price. Here’s what to think about:

How Much Does Life Isurance Cost?

- Make sure the company is financially stable by looking at ratings from places like AM Best or Moody’s.

- See if you can change your term policy to permanent insurance later if needed.

- Make sure that there are fast claims because fast claims and helpful support are import

- Always look at the riders. Extra features (riders) can give more protection, like for disability or serious illness.

Popular Term Length Options and Their Quotes

20-Year Term Life Policy Quotes

A 20 year term life policy quote is suitable for individuals who want coverage through major life stages, such as raising children or paying off a mortgage. Premiums are generally affordable, and the fixed term provides peace of mind.

25-Year Term Life Insurance Policy Quote

For those with longer-term financial responsibilities, a 25 year term life insurance policy quote ensures coverage well into middle age. This term is ideal for younger parents or homeowners with long-term mortgage obligations.

Short-Term Life Insurance Policy Quote

If your coverage needs are temporary, a short term life insurance policy quote may be ideal. It allows flexibility and lower premiums for coverage periods under 10 years.

Final words

Getting a term life policy quote is the first step to protecting your family’s future. There are only few thing you have to remember and take care of, like you have to make sure that you compare the different types of insurance policies and compare the quotes that what suits you best. No matter if you want 20 years or 25 years or short term life insurance plan, choice is all yours and you can make the better decision according to your needs and budget.

A good term life insurance policy keeps your family safe financially and gives you peace of mind knowing they are protected.

Protect your family today with M-life Insurance. Get your free term life policy quote online in minutes and compare 20, 25-year, or short-term options to find the perfect coverage. Don’t wait, secure peace of mind now!

FAQs About Term Life Policy Quotes

How much does a $1,000,000 term life insurance policy cost?

The cost of this coverage plan is not fixed; it depends on your age, health, and term length. For a healthy 30-year-old, it can be around $30–$50 per month for a 20-year policy. Older ages or longer terms cost more.

What does Dave Ramsey say about term life?

Dave Ramsey says term life insurance is a good choice because it is cheap and covers your family only for the years they need money, like when raising kids or paying a house loan.

What is the famous quote about life insurance?

A well-known quote is: “Life insurance is the cornerstone of financial planning,” meaning it protects your family and financial future if something unexpected happens.

How much should a term life policy cost?

A good rule of thumb is to spend what fits your budget while getting enough coverage—usually 10–15 times your annual income. Younger and healthier people generally pay less, often $20–$50 per month for $500,000–$1,000,000 coverage.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.