Are you thinking about the future? Planning for the end of life can be tough, but it’s important to make sure everything is taken care of. This is where Purple Cross burial insurance comes in. It’s a thoughtful way to help families handle funeral expenses without stress. What makes Purple Cross unique? How does it help families during such a hard time? Let’s dive into what makes Purple Cross burial insurance a caring choice for many.

About Purple Cross:

Purple Cross is a company that offers specialized insurance solutions to cover the costs associated with end-of-life arrangements. Their plans are designed to provide financial security and peace of mind for families during difficult times. Here are key details about the company and its offerings:

Company Overview

Purple Cross has been assisting families since 1948, focusing on pre-funding funeral and cremation needs. They aim to simplify the process of funeral planning by offering final expense insurance, commonly known as burial or funeral insurance. This insurance covers funeral services, burial or cremation, memorial ceremonies, and any outstanding medical bills or debts.

Purple Cross Plans

Purple Cross offers four main plans for final arrangements, which include options for both traditional burial and cremation. Each plan is designed to help pre-plan funeral arrangements to reduce financial strain on families:

Traditional Funeral Plan – Includes services like a steel casket, funeral home services, and a funeral service at a preferred location.

Traditional Cremation Plan—This plan provides services such as preparation and a funeral service before or after cremation and includes an urn but not a casket.

Direct Cremation Plan—This plan focuses on simplicity without a service, covering only the cremation process and delivery of remains.

purple cross burial insurance – Covers a broader range of potential expenses beyond funeral costs, including unpaid bills and taxes.

Purple Cross Burial Insurance:

Purple Cross Burial Insurance:

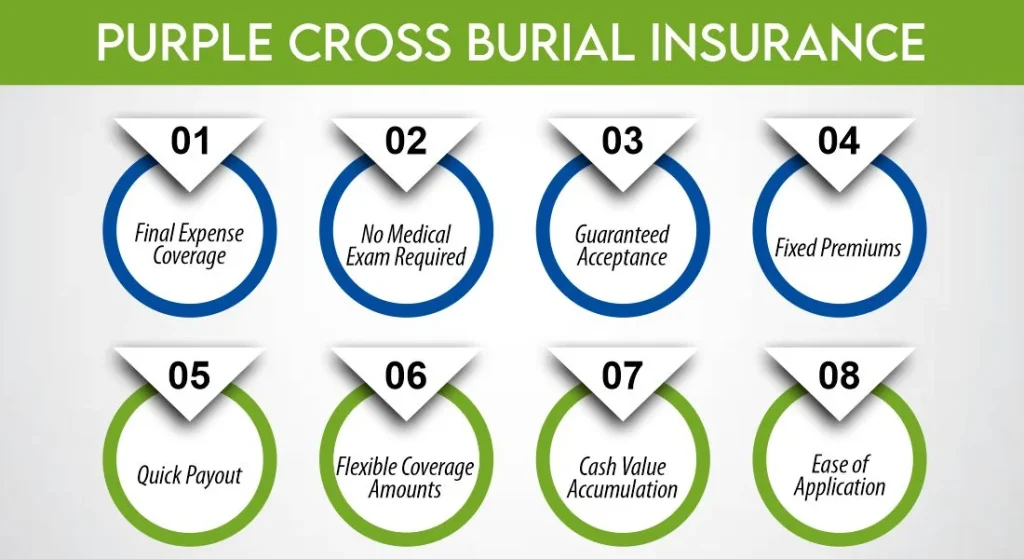

Purple Cross burial Insurance, like other burial insurance plans, is designed to help cover the costs associated with a funeral and burial. Here are some key features commonly associated with such plans:

Final Expense Coverage:

Purple Cross Burial Insurance provides coverage specifically tailored to cover funeral and burial expenses. This includes costs such as caskets, urns, embalming, cremation, burial plots, and memorial services.

No Medical Exam Required:

Many burial insurance plans, including Purple Cross, typically offer coverage without requiring a medical exam. This makes it easier for individuals with health issues or seniors to obtain coverage.

Guaranteed Acceptance:

Purple Cross Burial Insurance often comes with guaranteed acceptance, meaning that individuals cannot be turned down due to age or health status. This can provide peace of mind for those concerned about being denied coverage.

Fixed Premiums:

The premiums for Purple Cross Burial Insurance are usually fixed for the duration of the policy. This means that the monthly premiums will not increase as the insured individual ages or deteriorates in health.

Quick Payout:

Upon the death of the insured, Purple Cross typically pays out the benefit quickly, often within days of receiving the necessary documentation. This can help the beneficiaries cover immediate expenses associated with the funeral and burial.

Flexible Coverage Amounts:

Purple Cross may offer flexibility in choosing the coverage amount based on individual needs. Policyholders can select a benefit amount that aligns with their anticipated funeral and burial expenses.

Cash Value Accumulation:

Some burial insurance policies, including Purple Cross, may accumulate cash value over time. This means that a portion of the premiums paid by the policyholder goes into a cash account, which can be accessed or borrowed against if needed.

Ease of Application:

Purple Cross Burial Insurance typically offers a simple application process. This can be especially beneficial for seniors or individuals who prefer minimal paperwork.

Coverage for All Ages:

Purple Cross may offer burial insurance plans that cater to individuals of all ages, from young adults to seniors. This ensures that everyone can obtain coverage regardless of their stage in life.

How Much Does Life Isurance Cost?

Support for Loved Ones:

Beyond financial coverage, Purple Cross may provide additional support services for loved ones, such as assistance with funeral arrangements or grief counseling.

It’s important for individuals considering burial insurance to carefully review the specific terms and conditions of the policy offered by Purple Cross or any other provider to ensure that it meets their needs and preferences.

How to get purple cross burial insurance.

To get Purple Cross burial insurance, which is designed to cover the costs associated with end-of-life expenses, you can follow these steps:

1. Choose a Plan:

Purple Cross offers several types of plans, including traditional funeral and cremation plans, direct cremation plans, and plans specifically aimed at covering final expenses. These plans are designed to meet various needs and budgets, and some can even grow in value tax-free over the insured’s lifetime.

2. Contact Purple Cross:

You can reach out to Purple Cross directly to inquire about specific plans or to get more details on what each plan offers. They provide the option to request a callback, or you can call them directly at their number.

3. Discuss Payment Options:

Purple Cross offers different payment options, which can be tailored based on your specific financial situation. These might include time payment plans with full insurance coverage, ensuring that even if death occurs while payments are still being made, the full death benefit will be paid if all payments are current.

4. Considerations for Medicaid and SSI:

If you are concerned about Medicaid or SSI eligibility, Purple Cross plans can be structured to be exempt from these resources, especially when setting up irrevocable trusts. This can help protect the funds designated for funeral expenses from being counted as assets under Medicaid/SSI regulations.

5. Pre-Planning:

Pre-planning with Purple Cross can help provide financial and emotional security, as well as ensure that your funeral or cremation wishes are respected and executed according to your plans.

If you need further assistance or specific guidance, contacting Purple Cross directly will give you the most tailored information to help you make an informed decision.

What to consider before getting Purple Cross burial insurance:

Before getting Purple Cross burial insurance, consider these important factors:

- Type of Plan: Purple Cross offers various plans, including traditional funeral and cremation services, direct cremation, and final expense plans. Each has different features and covers different needs. It’s essential to understand what each plan offers and what is included in the cost.

- Costs and Budget: Assess the costs associated with the plan you are considering. Determine if the premiums fit within your budget and understand any additional costs that the insurance plan may not cover, such as third-party fees or specific service fees not included in the plan.

- Payment Options: Review the payment options available. Purple Cross provides flexible payment solutions that can accommodate various financial situations. For some plans, if the insured passes away before completing all payments, the full death benefit may still be payable if the costs are up to date.

- Impact on Medicaid and SSI: If you are eligible for Medicaid or SSI, it’s important to understand how purchasing a plan can affect your benefits. Purple Cross plans can be structured to not count as an asset, which can be crucial for maintaining eligibility for these programs.

- Policy Portability: Check if the policy is portable, meaning it remains in effect even if you move to another state or change your place of residence. This can be particularly important for ensuring coverage continuity without interruption.

- Customer Service and Support: Consider the level of customer service provided. This includes how claims are processed and the support available to make arrangements. Knowing you can rely on compassionate and efficient service during difficult times can be a significant comfort.

Conclusion:

Purple Cross burial insurance offers a compassionate and practical solution to managing end-of-life expenses, ensuring that individuals can provide for their final arrangements without imposing financial burdens on their loved ones. With flexible plans that cater to different needs and budgets, from traditional funerals to direct cremations, Purple Cross helps families honor their loved ones with dignity and respect.

The option to structure policies to be exempt from assets in Medicaid and SSI considerations further underscores Purple Cross’s commitment to providing accessible and thoughtful financial products. Choosing Purple Cross means choosing peace of mind, knowing that when the time comes, your and your family’s focus can remain on healing and remembrance rather than financial concerns.

FAQs

Is there any age limit for buying a Purple Cross insurance plan?

There isn’t a specific age limit mentioned for purchasing Purple Cross insurance plans, which suggests flexibility in eligibility. However, it’s best to contact Purple Cross directly or check their official resources for any age-related stipulations that might affect eligibility.

Can you get Purple Cross insurance for someone else, like a parent or grandparent?

Yes, you can purchase Purple Cross insurance plans for someone else. This is often done to ensure that end-of-life expenses are managed and to provide peace of mind for the whole family regarding final arrangements.

Is Purple Cross insurance the same as standard life insurance?

No, Purple Cross insurance is not the same as standard life insurance. It is specifically designed as burial or final expense insurance to cover costs associated with end-of-life arrangements such as funerals, cremations, and other related expenses rather than providing broader financial support like standard life insurance.

References:

https://www.purplecross.info/plans

https://www.burialseniorinsurance.com/purple-cross-burial-insurance/

https://www.niewoehnerfh.com/preplan/purple-cross-plan

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.

Purple Cross Burial Insurance:

Purple Cross Burial Insurance: