Introduction

Healthcare costs are rising globally, making medical coverage a critical financial decision for individuals and families. Unexpected medical emergencies, specialist treatments, and long hospital stays can quickly become a financial burden without adequate insurance coverage. Private health insurance offers flexibility, faster access to care, and wider provider choices compared to public healthcare systems.

Thank you for reading this post, don't forget to subscribe!Whether you are self-employed, between jobs, running a small business, or simply looking for enhanced healthcare coverage, understanding private health insurance plans is essential. Unlike government-funded healthcare, private health insurance allows individuals to tailor coverage according to personal health needs and lifestyle preferences.

What Is Private Health Insurance?

Private health insurance is a medical coverage plan purchased by individuals or families directly from private health insurance companies rather than being provided by the government or an employer. These plans help cover healthcare expenses such as doctor visits, hospital stays, surgeries, prescription medications, diagnostic tests, and preventive care.

People often choose private medical health insurance for greater control over coverage options, shorter waiting times, and access to private hospitals and specialists. In many regions, private health insurance also complements public healthcare by covering services that may not be fully included under government programs. Private pay health insurance is especially popular among individuals who want quicker treatment, personalized care, and broader healthcare options.

Types of Private Health Insurance Plans

1. Individual Private Health Insurance

Private individual health insurance is designed for a single policyholder. It is commonly chosen by freelancers, self-employed professionals, remote workers, and individuals without employer-sponsored coverage. These plans allow individuals to customize coverage levels, deductibles, and benefits based on personal healthcare needs, making them a flexible option for independent professionals.

2. Private Family Health Insurance

Private family health insurance covers multiple family members under one policy. Family private health insurance plans often include coverage for spouses, children, and dependents, making them more cost-effective than purchasing separate policies. Family plans usually offer benefits such as pediatric care, maternity services, preventive checkups, and emergency coverage, providing comprehensive protection for households.

3. Affordable & Low-Cost Private Health Insurance

Affordable private health insurance focuses on essential coverage with lower monthly premiums. These plans typically have higher deductibles or limited benefits but still provide financial protection against major medical expenses. Low cost private health insurance is ideal for young adults, students, or individuals seeking basic coverage while managing tight budgets.

4. Comprehensive Private Health Care Insurance

Comprehensive private health care insurance offers extensive coverage, including specialist consultations, mental health services, maternity care, rehabilitation, and advanced medical treatments. These plans are ideal for individuals seeking long-term healthcare security and premium medical services.

Benefits of Private Health Insurance

Private health insurance offers several advantages over relying solely on public healthcare systems:

- Faster access to medical treatment and specialist care

- Greater choice of hospitals, doctors, and healthcare providers

- Shorter waiting times for surgeries and diagnostic procedures

- Flexible coverage tailored to personal health needs

- Higher comfort levels, including private hospital rooms

- Financial protection against unexpected medical expenses

For many individuals and families, private health insurance provides peace of mind, improved healthcare quality, and better long-term health outcomes.

How Much Does Private Health Insurance Cost?

The cost of private health insurance varies depending on multiple factors, including:

- Age and overall health condition

- Coverage level and included benefits

- Individual versus family plans

- Geographic location and healthcare costs

- Deductibles, co-payments, and policy limits

Average Cost of Private Health Insurance

On average, private health insurance prices range from affordable monthly premiums for basic plans to higher costs for comprehensive coverage. Many insurers provide a private health insurance cost calculator to help estimate monthly premiums based on personal details.

How much is private health insurance per month?

Monthly premiums can vary significantly, but choosing the right balance between coverage benefits and deductibles can help manage costs effectively.

Cheapest & Affordable Private Health Insurance Options

Finding the cheapest private health insurance does not always mean choosing the lowest premium. Low cost private health insurance plans often come with higher deductibles but still cover essential medical services.

To identify the best affordable option, it is recommended to compare private health insurance quotes from multiple providers. This allows individuals to assess coverage, pricing, and value rather than focusing solely on cost.

How to Buy Private Health Insurance

If you are wondering how to get private health insurance, the process is straightforward and accessible:

- Assess your healthcare needs and budget

- Research available private health insurance options

- Compare coverage benefits, exclusions, and deductibles

- Request quotes from private health insurance companies

- Purchase private health insurance directly from the provider

Many people ask, can I buy private health insurance at any time?

Yes, in most cases, private health insurance can be purchased year-round without open enrollment restrictions, making it a flexible option for individuals.

How Much Does Life Isurance Cost?

Best Private Health Insurance

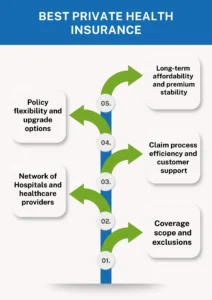

The best private health insurance plan depends on individual circumstances. When evaluating options for private health insurance, consider the following factors:

- Coverage scope and exclusions

- Network of hospitals and healthcare providers

- Claim process efficiency and customer support

- Policy flexibility and upgrade options

- Long-term affordability and premium stability

There is no single answer to what’s the best private insurance, as the ideal plan varies based on age, lifestyle, health history, and financial goals.

Private Health Insurance Companies & Market Overview

The private health insurance market includes a wide range of providers offering plans for individuals, families, and businesses. Some private health insurance companies specialize in affordable coverage, while others focus on premium healthcare services with extensive benefits. Before selecting a provider, it is important to research company reputation, financial stability, customer reviews, and claim settlement records to ensure reliable long-term coverage.

Private Health Insurance Costs vs Public Healthcare

While public healthcare systems provide essential services, they often involve longer waiting times and limited provider choices. Private health insurance offers faster access, personalized treatment, and broader healthcare options. For individuals who value convenience, speed, and flexibility, private health insurance costs are often justified by the enhanced quality of care and improved patient experience.

Conclusion

Private health insurance provides a flexible and dependable way to protect your health while ensuring timely access to quality medical care. With a wide range of private health insurance plans available, individuals and families can choose coverage that aligns with their healthcare needs, financial goals, and lifestyle preferences.

At M-Life Insurance, the focus is on helping individuals make informed decisions through clear guidance and carefully designed private health insurance options. By comparing plans, understanding costs, and choosing the right coverage, you can secure long-term health protection and financial peace of mind.

FAQS

Private health insurance is medical coverage purchased from private insurers to cover healthcare expenses beyond public healthcare systems.

Monthly costs vary depending on age, coverage level, and provider, ranging from affordable basic plans to comprehensive premium coverage.

The best private health insurance depends on individual healthcare needs, budget, and preferred coverage benefits.

Yes, most private health insurance plans can be purchased at any time without enrollment restrictions.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.