Last Updated on: September 23rd, 2025

- Licensed Agent

- - @M-LifeInsurance

Key Takeaways

- Life insurance for kids can be an important part of long-term financial planning.

- Whole life insurance policies for kids are the most popular for building cash value and ensuring lifelong coverage.

- Term life insurance for children offers affordable, temporary coverage.

- Universal life insurance provides flexibility with premiums and death benefits.

- Policies like Gerber Life Insurance for kids are trusted options.

- Special considerations exist for children with disabilities or autism.

- Starting early maximizes financial benefits, lower premiums, and guaranteed insurability.

Life insurance is not the first thing that you think as a parent for your kids, but this is the most important thing just like the education. A life insurance policy for kids will make sure to protect your kids future. It comes up with the affordable premiums and also some of the plans has the cash value growth that your child can use later in life.

In this article, we will explore the different types of life insurance for children, including whole life insurance for children, term life insurance for kids, and universal life insurance options. We will also discuss specialized coverage for children with disabilities or autism and highlight trusted providers like Gerber Life Insurance for kids.

Why Consider Life Insurance for Kids

Life insurance for children is not just about money if something bad happens. It can help in other ways too, lets have a look

1. Guaranteed Insurance

Buying a policy when your child is young means they can get life insurance later, even if they have health problems.

2. Cash Savings

Some policies, like whole life or universal life, can grow money over time that your child can use when they grow up.

3. Low Cost

Life insurance for children will mostly cost you less because young children are less likely to have serious health problems.

Types of Life Insurance for Kids

When exploring life insurance options for children, there are several types to consider:

1. Whole Life Insurance for Kids

Whole life insurance is a permanent life insurance policy that last for the entire time of the child’s life. It has a cash value component, it means that the part of the premiums build a savings-like account that grows over time.

Benefits of Best Whole Life Insurance for kids:

- It has guaranteed lifelong coverage

- The policy also builds cash value

- It has fixed premiums

- It can also be borrowed against in future when needed

2. Term Life Insurance for Kids

Term life insurance for children will provide coverage for a set time, like it can be 10, 20, and 30 years. The plan dont work like a whole life insurance policy as it can not build the cash value.

Benefits of Term Life Insurance:

- The plan will give you lower premiums

- It is simple and straightforward

- It also provides financial protection during childhood

3. Universal Life Insurance for Kids

Universal life insurance for children is another form of permanent life insurance that gives you the death benefit and also build a cash value over time. The policy is not like a whole life plan, this plan is flexible and you can adjust the coverage amount and the monthly premiums.

Key Features:

- The benefits include flexible premiums

- The plan also has adjustable death benefit

- It also builds cash value that grows over time

How to Choose the Best Life Insurance for Kids

Choosing the best life insurance for children depends on what you want and your budget. Here are some things to think about:

1. Coverage Amount

Most kids’ policies are between $10,000 and $50,000. So you have to pick an amount that fits your goals.

2. Policy Type

You can choose term, whole, or universal life insurance. Whole life is the best for long-term benefits.

How Much Does Life Isurance Cost?

3. Company Reputation

Whenever buying the plan for your kids you go with a well-known company that is financially strong and has the best rating. For example, Gerber Life Insurance is popular for kids.

4. Premiums

You also have to make sure that the cost fits your budget. Don’t just pick the cheapest, check the company’s reliability too.

5. Special Needs

If your child has a disability or condition like autism, look for policies that cover kids with special needs.

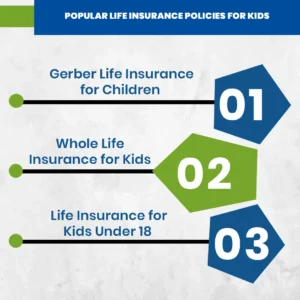

Popular Life Insurance Policies for Kids

There are several life insurance companies that are providing insurance policies for kids lets have a look for getting the best and popular insurance policies for kids

1. Gerber Life Insurance for Children

This is a well-known option. It offers whole life insurance, which means your child is covered for their whole life and the policy can also grow money over time.

2. Whole Life Insurance for Kids

These policies last a lifetime. They give permanent coverage and can also build cash value that your child can use later.

3. Life Insurance for Kids Under 18

Many companies let you buy policies for babies and children under 18. This helps with early financial planning and makes sure your child has coverage from a young age.

Special Considerations

Life Insurance for Kids with Disabilities or Special Needs

Families with children who are special, like having a autism and other disabilities, they can also get the plans, as these plans are specially made for their needs. There are so many insurance companies who are providing plans to these kids, helping their family to manage the long term planning.

Life Insurance for Kids in Canada

Canadian parents also have access to child life insurance policies. Options include permanent life insurance, term insurance, and cash value life insurance for children. Local regulations may vary, but the benefits remain similar: guaranteed coverage and potential savings growth.

Benefits of Life Insurance for Kids

Life insurance for children helps secure their future, build savings, and provide financial protection, giving families peace of mind.

1. Financial Security

Life insurance for kids gives parents peace of mind. If something unexpected happens, the insurance company will pay the money and it will help to cover the expenses and protect the family from financial stress. It acts like a safety net, also making sure that your child’s future is not completely affected by unexpected events, providing support when it is needed most.

2. Cash Value Accumulation

Some life insurance policies for children are permanent, meaning they last a lifetime. These policies not only provide coverage but also save money over time. The cash value grows slowly and can be used in the future for things like college, emergencies, or other needs, giving your child a financial head start in life.

3. Guaranteed Insurability

Buying life insurance for a child will make sure that they can get insurance in the future, even if they will have some health problems. This means no matter what health challenges come later in life, they will not be denied coverage. It gives parents peace of mind, knowing their child will always have life insurance available.

4. Affordable Premiums

Life insurance for children is usually very cheap as compared to the adult insurance policies. Since kids are healthy and young, the prices for their plans is low. This will allow the parents to lock in the plan without spending a lot of money, this will make the things easier now for the future and protection of their kids.

5. Tax Advantages

Many life insurance policies for kids offer tax benefits. The cash value that grows over time is usually tax deferred and it means that you don’t have to pay for the taxes while its growing. This is the best choice to save the money for the future while still keeping your child protected.

Final Thoughts

Life insurance for the kids is not just a buying a policy it is a lifetime strategy to make sure that your kids are safe and secure if something unexpected happen. You just have to make sure that what fits your budget and what is best for your kids, look at the prices compare the different insurance companies and then buy the best plan, no matter what you are buying term, whole or universal insurance plans, just make sure to buy the best plan that will fit your budget and needs.

Get a Free Quote from Mlife Insurance Today and find the best life insurance policy designed for your child’s needs.

FAQS

What type of life insurance is best for kids?

All the types are best, but you just need to know what are your goals and then decide which policy will work best for you. If you are planning buy the whole life policy if you want lifelong coverage, other than that universal life is best if you want flexibility and term life is a good option if you are looking for the temporary coverage.

Can a child have a life insurance policy?

Yes. Children under 18 can have a life insurance policy. Parents or guardians usually purchase the policy, and coverage can start from infancy. Early buying the policy will make sure that you have to pay less premiums and save a lot of your kids’ future.

Does life insurance cover kids?

Yes. Life insurance policies specifically designed for children provide coverage in case of death. Policies like whole life insurance for kids or Gerber Life Insurance for kids also offer cash value accumulation, which can benefit the child later in life.

Is whole life insurance worth it for a kid?

Yes. Whole life insurance guarantees coverage, builds cash value, and can serve as a financial foundation for your child’s future.

Can children with disabilities or autism get life insurance?

Yes. there are so many life insurance companies who are offering and giving policies to the special kids having any disability or autism. The purpose is to make sure that they will get the better future.

How much does life insurance for kids cost?

Policies for kids are generally affordable due to lower risk. Premiums vary based on policy type, coverage amount, and insurer, but even whole life insurance for children can start with modest monthly payments.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.