Last Updated on: June 2nd, 2025

- Licensed Agent

- - @M-LifeInsurance

When it comes to the security and financial stability of your family and loved ones after your death, it is very important that you have to choose the right life insurance. There are a lot of insurance companies that are giving the best policies with a lot of types. The most common types are individual life insurance and group life insurance. Both of the insurance policies offer unique benefits and drawbacks, but the question is how you will get to know which one is best for your situation.

Let’s break down and compare which is the best for you according to your needs and preferences, group life insurance or individual life insurance. We will look at the pros and cons, how much each typically costs, and what benefits they offer.

No matter if you are an employer thinking about offering life insurance to your team, or someone looking for personal, long-term coverage, knowing the difference between these two options can help you make a smart decision.

Group Life Insurance

Group life insurance is a type of life insurance policy that covers a group of people under a single policy, it is usually provided by a company to their workers as part of a benefits package. It offers a basic level of coverage, typically at little or no cost to the employee.

Key Features of Group Life Insurance

One Policy for Many People

A single insurance policy covers an entire group, most of the time employees at the same company.

Lower Costs

Because the risk is spread across many people, monthly payments are usually much cheaper.

No Health Exams

Most group plans don’t require medical tests or detailed health questions to qualify.

Job-Linked Coverage

The insurance is connected to your job. If you leave your job, the coverage will end.

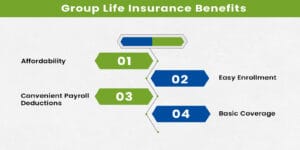

Group Life Insurance Benefits

Group life insurance comes with several perks, especially for employees who might not otherwise be able to afford individual coverage.

1. Affordability

Group life insurance is affordable because, most of the time, your company pays the premium or most of it. In some cases, it’s completely free for you.

2. Easy Enrollment

Signing up is usually easy. Many employees are automatically enrolled, and even those with health issues can often qualify.

3. Convenient Payroll Deductions

If you do have to contribute, your share is taken right out of your paycheck. There are no extra bills to worry about.

4. Basic Coverage

The death benefit is usually based on your salary, for example, one or two times your yearly earnings.

Drawbacks of Group Life Insurance

Group life insurance is easy and very affordable to get, but there are notable limitations, as it’s not perfect. Here are a few drawbacks you have to keep in mind when having group life insurance:

- Limited Coverage Amount: The amount of life insurance you get is usually limited. If you have a family, a home loan to pay, or other big financial responsibilities, it will not be enough to fully protect your family after you.

- Lack of Portability: Since group coverage is tied to your job, you will likely lose it if you change jobs, get laid off, or retire.

- Little to No Customization: Group plans are one-size-fits-all. You usually can’t customize your policy or add extra features that you might want or need to add.

Individual Life Insurance?

Individual life insurance is a policy you buy on your own, not through your job, not through any firm or workplace. You have to decide how much coverage amount you want, who will get the money when you pass away and how long the policy lasts. Best of all, the coverage stays with you no matter where you work or if you change jobs.

Types of Individual Life Insurance

- Term Life Insurance

Term life insurance will cover you for a set number of years, like 10, 20, or 30 years. This is usually the most affordable option and is great if you only need coverage for a certain time period. - Whole Life Insurance

Whole life insurance will cover your entire life and also builds cash value over time, like a small savings account you can use later for your family. - Universal Life Insurance

Universal life insurance offers a flexible option that lets you change your payments and coverage amount. It also builds cash value, like whole life insurance.

Advantages of Individual Life Insurance

Fits Your Needs

You can choose a policy that matches your personal goals, like paying off a home loan, saving for your kids’ education, or covering other debts.

Stays with You

Your coverage is not tied to your job. You keep the policy even if you change jobs, retire, or stop working.

More Coverage if Needed

You can buy a larger policy than what most group plans offer. It would be great if your family depends on your income.

You Choose Who Gets the Money

You decide exactly who will receive the life insurance payout when you pass away.

How Much Does Life Isurance Cost?

Cons of Individual Life Insurance

- Higher Cost: Individual policies are usually more expensive than group plans, especially if you’re older or have health issues..

- Medical Underwriting: You might need to take a medical exam or share your health history to qualify for coverage.

- Time-Consuming Application: Applying for individual insurance can take longer and involve more paperwork compared to the quick process of joining a group plan.

Group Life Insurance vs Individual Life Insurance: Cost Comparison

One of the most common questions is: Is group insurance cheaper than individual?

Group Life Insurance Cost:

- Usually free or very low-cost for employees.

- Your employer pays most or all of the premium

- Usually free or very low-cost for employees.

- Very little paperwork or extra fees

Individual Life Insurance Cost:

- The price depends on your age, health, policy length, and coverage amount

- Can cost hundreds of dollars per year

- You pay the entire premium yourself

If you’re young and healthy, individual term life insurance can still be affordable. But overall, group life insurance is typically the more budget-friendly option especially when you’re just getting started.

Group Life Insurance vs Individual Life Insurance: Pros and Cons

| Feature | Group Life Insurance | Individual Life Insurance |

| Cost | Generally cheaper | More expensive |

| Portability | Tied to employment | Fully portable |

| Customization | Limited options | Highly customizable |

| Coverage Amount | Typically low | Flexible and higher limits |

| Eligibility | Easy, no medical exam | Often requires medical underwriting |

| Beneficiary Control | May be limited | Full control |

Group Life Insurance vs Individual Life Insurance: Which Is Best?

There’s no one-size-fits-all answer. It depends on your personal choices and situations:

Choose Group Life Insurance If:

- If you’re looking for affordable, basic coverage.

- If you have health issues that make individual policies costly or inaccessible.

- If you’re relying on employer-sponsored benefits during your working years.

Choose Individual Life Insurance If:

- You want long-term or permanent coverage.

- You have financial dependents and complex financial needs.

- You prefer control over the policy’s terms and beneficiaries.

Combining Group and Individual Life Insurance

Many financial experts recommend using group life insurance as a supplement—not a substitute for individual coverage. Here’s why:

- Group life insurance offers a solid foundation.

- Individual coverage ensures long-term protection.

- Together, they provide a safety net through various life stages.

FAQs

What is the difference between group life and individual life insurance?

Group life insurance is provided through an employer and covers multiple people under a single policy. Individual life insurance is purchased personally and offers customizable, portable coverage. Group policies are generally cheaper, but individual policies offer more flexibility and control.

Is group insurance cheaper than individual insurance?

Yes, group insurance is usually cheaper because the cost is shared by the employer and covers many people. However, it often provides limited coverage and isn’t portable.

Can I have both group and individual life insurance?

Absolutely. Many people use group life as a base layer and purchase an individual policy to meet their full financial protection needs.

What happens to my group life insurance if I leave my job?

In most cases, your group coverage ends when your employment ends. Some plans may offer conversion options, but they’re typically more expensive.

Which type of life insurance should self-employed individuals choose?

Self-employed individuals typically opt for individual life insurance, since they don’t have access to employer-sponsored group policies.

Final Thoughts: Making the Right Choice

When choosing between group life insurance and individual life insurance, think about your money needs, health, and future plans. Group insurance is usually cheaper and easy to get but doesn’t offer much flexibility. Individual insurance gives you stronger, customized protection but can cost more.

The smartest choice for many people is to use both get group insurance for basic coverage and add an individual policy to protect your family for the long run.

Protect your loved ones today—start comparing life insurance options that fit your needs.

Get the right coverage with M-Life insurance now for peace of mind and financial security.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.