Protect your loved ones from financial burden during a difficult time with Funeral Coverage insurance. Peace of mind for all.

The purpose of funeral coverage insurance is to give you the satisfaction of departing your loved ones in a peaceful environment.

If you don’t, your passing could increase their risk of dealing with unforeseen financial difficulty.

Preparing in advance while buying insurance saves you more than just money. And, preparing ahead and buying funeral coverage insurance saves you money and enables your loved ones to make the necessary preparations for your passing.

“We take care of your financial budget, get our insurance quote and ensure the quality we provide!”

How does funeral coverage insurance work?

Funeral coverage insurance is specific in terms of providing you with coverage for your funeral services and related expenses.

It works as you pay a set premium to the insurer, and in exchange, the insurer agrees to pay out a predetermined amount to cover funeral-related expenses.

Moreover, these expenses can include the cost of the funeral service itself, the price of a burial Insurance plot and the cost of a casket, among other things.

Depending on the policy, some policies may also provide coverage for cremation services, as well as any other related costs.

The policy may also provide benefits to the policyholder’s survivors, such as death or living benefits.

As a policyholder, to receive the death benefit, you must name a beneficiary who will receive the funds upon your death.

What does the funeral cover include?

Funeral cover includes a lump sum payment to cover funeral expenses when you pass away. However, the exact coverage will vary depending on the policy and insurer, but here are some everyday costs that funeral cover may include:

- Burial or cremation fees: Funeral cover may include the cost of burial or cremation, including prices for the cemetery plot, grave digging, and cremation.

- Coffin or urn: Funeral cover may cover the cost of a casket or urn for the deceased.

- Transport: Funeral cover may cover transporting the deceased to the funeral home, cemetery, or crematorium.

- Catering expenses: Funeral cover may include catering for the funeral or wake, such as food and drinks.

- Death certificate: Funeral cover includes the cost of obtaining a death certificate.

- Additional expenses: Some funeral cover policies may include additional costs, such as floral arrangements, newspaper notices, or musician fees.

Why is funeral cover necessary?

Funeral cover is essential because it helps you by providing a financial safety net for surviving family members to cover the costs of a funeral.

The policy costs can be expensive and can be a financial burden for families who are already dealing with the emotional toll of a loved one’s death.

However, having the cover will help alleviate some of this financial strain. And, it allows your families to focus on their grief during such a difficult period.

Moreover, the cover ensures that your loved ones have carried your funeral according to your primary wishes. And they could do it affordably that they could have managed.

What is the best funeral coverage insurance with no waiting period?

Guaranteed Issue Whole Life Insurance is the best funeral coverage insurance with no waiting period. This type of insurance provides a death benefit to your beneficiaries with no medical exam or health questions that the insurer asks.

Coverage is guaranteed regardless of your health status, and the insurer pays the death benefit immediately upon your passing.

Moreover, Premiums for this type of insurance are usually higher than other types of Burial life insurance. However, it offers the benefit of having immediate coverage can be invaluable.

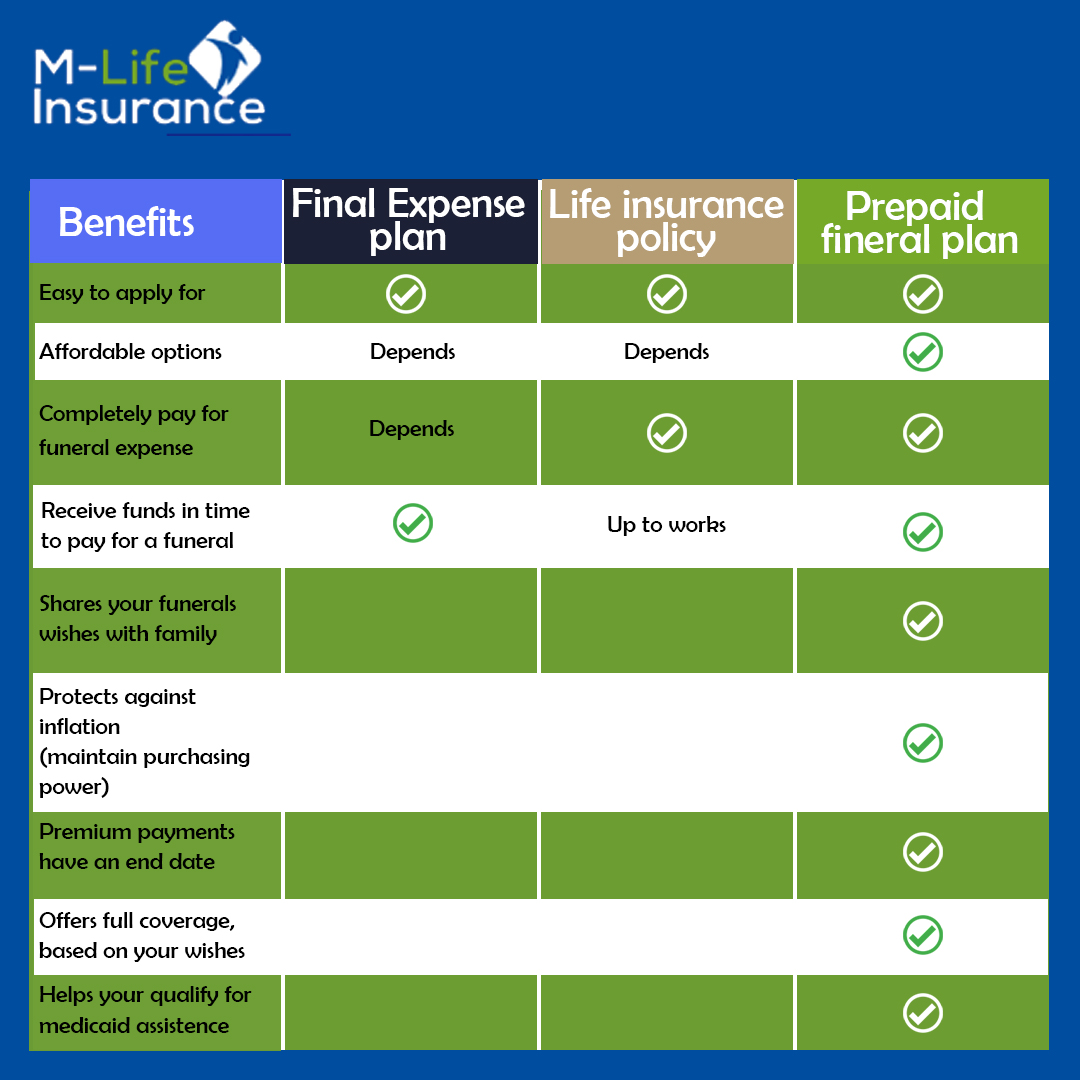

3 Funeral Insurance Options You Should Know About

Here are three options for funeral insurance:

- Final expense plan: This type of insurance helps you to cover the costs of a funeral, such as a casket, burial plot, and other expenses. Final need plans are more minor policies that range from $5,000 to $25,000 and provide financial assistance to loved ones during a death.

- Life insurance policy: While life insurance does not explicitly cover funeral expenses, it has the potential to cover those costs. Life insurance policies pay out a lump sum to the beneficiaries after the policyholder’s death. Moreover, they can use the amount for anything, including funeral expenses.

- Prepaid funeral plan: You can pay your funeral expenses in advance with a prepaid funeral plan. This plan allows you to make arrangements for your funeral and pay for it ahead of time. Moreover, it can help alleviate the financial burden on your loved ones. Prepaid funeral plans can vary in cost and coverage, so it’s essential to research before choosing one.

FAQs;

FAQs;

How much funeral cover can I have?

The amount of funeral coverage you can have will vary depending on the provider. However, it usually occurs between $5,000 and $25,000. Generally, your maximum amount depends on your age and health status.

Some providers may provide higher limits, so it is essential to compare different policies to find the best coverage for your needs. Additionally, if you are looking for a group policy, the amount of coverage may be determined by the group size.

How can I get affordable funeral coverage insurance for my parents?

You can get affordable funeral coverage insurance with no waiting period for your parents.

A funeral plan is a pre-arranged set of services, such as a funeral director, a casket, and other services, that you can pay for in advance.

The plan includes a funeral director’s costs, a casket, and other services, such as flowers and obituary printing.

Furthermore, funeral plans help you and your parents plan for the future. Also, it allows ensuring that your family’s financial future is safe even if you pass away.

Before making any decisions, it is essential to research the various funeral plans and providers to ensure that you get the best program for your parents.

How do funeral covers make money?

Funeral covers make money by charging a fee for providing insurance for funeral costs. They collect the price as a monthly premium from the policyholder. Moreover, they the amount later to pay out the policyholder’s funeral costs upon their death.

The policyholder pays a set amount each month in exchange for the coverage. Generally, the insurer saves the amount in the policyholder’s account.

Also, when they make a claim, they use the funds to pay for funeral costs. It allows the funeral cover provider to profit by charging a fee for the service.

Is the funeral cover worth it?

Whether funeral cover is worth it depends on your circumstances. If you have dependents and don’t have any other life insurance, funeral cover may be an excellent option to provide for your family’s financial needs in the event of your death.

And, it can also provide some peace of mind knowing that you have paid your later funeral cost. Therefore, your loved ones don’t have to worry about coming up with the money to cover these costs.

On the other hand, if you have additional life insurance or enough savings to cover your funeral costs, then funeral cover may not be necessary.

We always recommend that you weigh the cost of the policy against the potential benefit it provides to determine whether or not funeral cover is worth it.

How do I choose a funeral cover?

Choosing a funeral cover is essential as it provides financial support to your loved ones when you pass away. Here are some key factors to consider when selecting a funeral cover:

- Coverage amount: Determine how much coverage you need to cover your final expenses. Consider the type of funeral you want and factor in costs such as burial or cremation fees, coffin, transport, and catering expenses.

- Premiums: Funeral cover premiums can vary widely. Look for a policy that offers affordable tips that fit your budget. However, be cautious of policies that are too cheap as they may provide limited coverage or have hidden costs.

- Waiting periods: Many funeral cover policies have a waiting period before the cover becomes effective. Check the waiting period to ensure the policy provides cover when needed.

- Exclusions: Review the policy exclusions to ensure no surprises when you make a claim. Some policies may exclude specific causes of death or have age restrictions.

- The reputation of the insurer: Research the importance of the insurer before signing up for a funeral cover policy. Look for a reputable insurer with a proven track record of paying out claims promptly and efficiently.

- Policy flexibility: Look for a policy that allows you to adjust your coverage as your needs change. For example, you should increase your age range or add family members to your policy.

What are the benefits of funeral cover?

The funeral cover provides financial support to your loved ones when you pass away. Here are some of the benefits of having funeral cover:

- Covers funeral expenses: Funeral cover provides a lump sum payment to cover funeral expenses such as burial or cremation fees, coffin, transport, and catering expenses. It helps them to alleviate the financial burden on their loved ones during difficult times.

- Peace of mind: purchasing a funeral cover in advance provides immense peace of mind because you know that you and your family are secure from paying extra on your funeral costs.

- Easy to apply: Funeral cover policies are typically easy to use, and many insurers offer online or over-the-phone applications.

- No medical exams required: In many cases, funeral cover policies do not require medical exams, which means you can apply regardless of age or health status.

- Quick payout: Funeral cover policies typically pay out quickly, providing your loved ones with the necessary funds to cover funeral expenses.

- Customizable coverage: Funeral cover policies often allow you to choose the range you need. Therefore, you can customize the amount to suit your individual needs and budget.

Conclusion

Affordable Funeral coverage insurance is a valuable tool to ensure the safety net for your loved ones after you pass away. It provides your loved ones with the financial and emotional support they need to plan and pay for a funeral.

Buy funeral insurance to ensure your loved ones will not face an unplanned financial burden. It is the most suitable option for those looking to secure their family from funeral costs that may lead them out of their pockets.

M life Insurance is here, available 24 hours to support you in any way possible. Get our guidance and secure the future of your loved ones.

Provide them with a financial safety net, whether for funeral coverage or if they need to cover any other essential expenses.

Here is our expert author, Iqra, your go-to source for simplified insights into the world of life insurance. With years of industry experience, Iqra delivers concise and approachable content, ensuring you navigate the complexities with confidence.

FAQs;

FAQs;