Matters like Final need planning is crucial because you need to shield your loved ones from a potential financial problem. The sooner you decide, the simpler it will be for you and your loved ones to understand your final desires.

Early preparation would bring you a certain level of comfort and enable your family to carry out your wishes. Let them fulfil your requests following the specific plan you have already discussed with them.

Discussing matters like final planning is not a common factor in many communities. However, it is just as important to plan for other end-of-life issues, such as how to divide your assets.

Hence, go one step further in selecting the right items to leave behind.

Also, make life easier for your loved ones.

What is end-of-life planning?

End-of-life planning is all about financial planning that focuses on an individual’s or family’s long-term needs. It considers the individual’s current and future financial situation, including income, expenses, investments, and debt.

It allows you to ensure that you and your family are financially secure for the future. The planning may include retirement, estate planning, and other events during their lifetime.

Moreover, planning involves the financial satisfaction that you and your family have enough resources to cover their final expenses and any other financial obligations they may have.

End-of-life or final planning can also involve setting up trusts to ensure that you have correctly allocated your assets to your dependents.

Why is end-of-life planning important?

End-of-life planning gives you an immense sense of security that you have fulfilled your final wishes. Moreover, you ensure that your family have enough to secure their financial future after you pass away.

Final needs planning cost includes deciding how you want to perform your memorial, what funeral arrangements you would like, and how you want to distribute your assets.

Additionally, it helps to avoid family disputes over your estate and ensure that your wishes are respected.

Final needs planning is integral to life and can help ensure that you have carried your potential properties according to your wishes.

How End-of-life planning is a gift to your loved ones?

End-of-life planning is a gift to your loved ones because it allows them to focus on their grief and healing rather than making difficult decisions during a time of emotional turmoil.

It allows you to make important decisions about your care and wishes in advance so that your loved ones don’t have to.

By planning, you can ensure that you have successfully fulfilled your wishes. And that satisfaction is enough to know that your loved ones will not face financial stress during the emotional period of your death.

End-of-life decisions are a gift to your loved ones because it allows them to focus on the positive memories they shared with you rather than worrying about making difficult decisions.

Types of final need planning, Advantages and Disadvantages:

There are three main types of final need planning:

Pre-Need Planning

- A. Pre-Need Planning: This type of final planning involves making arrangements for funeral, burial or cremation services in advance of death. Pre-need planning allows individuals to make decisions and financial arrangements for their final arrangements and alleviate the burden on their loved ones during grief.

- B. At-Need Planning involves making arrangements for funeral, burial or cremation services after a death. At-need planning requires the surviving family members or executors of the estate to make arrangements for the deceased’s final disposition.

- Post-Need Planning: This type is about handling affairs after the deceased’s final disposition. Post-need planning includes settling the deceased’s estate, paying final expenses, and distributing assets according to the deceased’s wishes or state laws.

Advantages and disadvantages of pre-need planning:

Advantages:

- Allows for Pre-Planning of Funeral Arrangements: Pre-need planning will enable you to make decisions about final arrangements, such as funeral coverage service details, burial or cremation preferences, and more.

- Helps Family Avoid Making Decisions During Difficult Times: Pre-need planning can alleviate the burden on family members during grief, as they won’t have to make decisions about the funeral arrangements themselves.

- Can Help Reduce Financial Burden: Pre-need planning allows individuals to make financial arrangements for their final arrangements in advance. Moreover, it helps you reduce the financial burden on your loved ones, as the cost of funeral expenses can be high.

Disadvantages:

- Can Be Expensive: Pre-need planning can involve high upfront costs, especially if the individual chooses to prepay for funeral arrangements. Furthermore, it can be a disadvantage for those on a tight budget.

- May Not Be Right for Everyone: Pre-need planning may only suit some. For example, someone who frequently moves may not want to pre-plan funeral arrangements, as they may not know where they will be at the time of their passing. Additionally, someone with a terminal illness or is elderly may not have enough time to utilize the benefits of pre-need planning fully.

2 At-Need Planning

Advantages and disadvantages of at-need planning:

Advantages:

- Provides Immediate Assistance to Family During Difficult Times: At-need planning can provide immediate assistance to the deceased’s family during grief. Funeral directors can help guide the family through the process and take care of the arrangements as quickly as possible.

- Allows Family to Make Decisions at Their Own Pace: At-need planning enables the deceased’s family to make the funeral arrangements at their own pace, without the pressure of having to make decisions in advance.

- Can Help Reduce Financial Burden: While funeral expenses can still be significant with at-need planning, you can take some cost-saving measures, such as choosing less expensive options for funeral services.

Disadvantages:

- Can Be Stressful for Family: At-need planning can be stressful for the deceased’s family, especially if they are unprepared to make funeral arrangements. The added stress during an already difficult time can be overwhelming.

- May Not Be Right for Everyone: At-need planning may only suit some, as some prefer to make arrangements in advance. Additionally, if the deceased did not leave instructions or preferences for their funeral arrangements, this can make at-need planning more difficult and stressful for the family.

3 Post-Need Planning

Advantages and disadvantages of post-need planning:

Advantages:

- Allows Family to Receive Immediate Assistance: Post-need planning enables the deceased’s family to receive immediate assistance in settling the affairs of the dead, such as making arrangements for the funeral coverage service and handling legal and financial matters.

- Can Help Reduce Financial Burden: You must pay all the needed funeral expenses with post-need planning; certain financial matters you should consider—for instance, paying outstanding bills and debts. Post-need planning can help reduce the financial burden on the family by ensuring that you properly handle these matters.

Disadvantages:

- May Not Be Right for Everyone: Post-need planning may not be suitable, especially if the deceased did not leave instructions or preferences for their funeral arrangements, legal matters, or financial affairs.

- Can Be Expensive: Depending on the complexity of the deceased’s affairs, post-need planning can be expensive. Legal fees, taxes, and other expenses can add up quickly, burdening the family.

What are the benefits of final need planning?

There are several benefits of final need planning, which include:

Allows for pre-planning of funeral arrangements: Final need planning allows individuals to make decisions about their final arrangements, such as funeral service details, burial or cremation preferences, and more. Moreover, they can improve immense satisfaction by knowing that they have already carried out their wishes in an honorable way.

Helps to reduce the burden on family members: It can alleviate the burden on family members during a time of grief, as they won’t have to make decisions about the funeral arrangements themselves. It can help ease the emotional and financial burden of making arrangements after a loved one passes away.

Provides financial security: Final planning allows individuals to make financial arrangements for their final arrangements in advance. It reduces the financial burden on their loved ones, as the cost of funeral expenses can be high. In addition, prepaying for funeral expenses can help protect against inflation and ensure that you lock the costs at today’s prices.

Provides peace of mind: Final needs planning program can provide peace of mind for the individual and their family members. Knowing that final arrangements have been made and paid for can help alleviate stress and anxiety during a difficult time.

Ensures that final wishes are respected: Final need planning ensures that an individual’s last wishes are respected and carried out as desired. It provides closure for family members and ensures that you have respectfully membered the deceased.

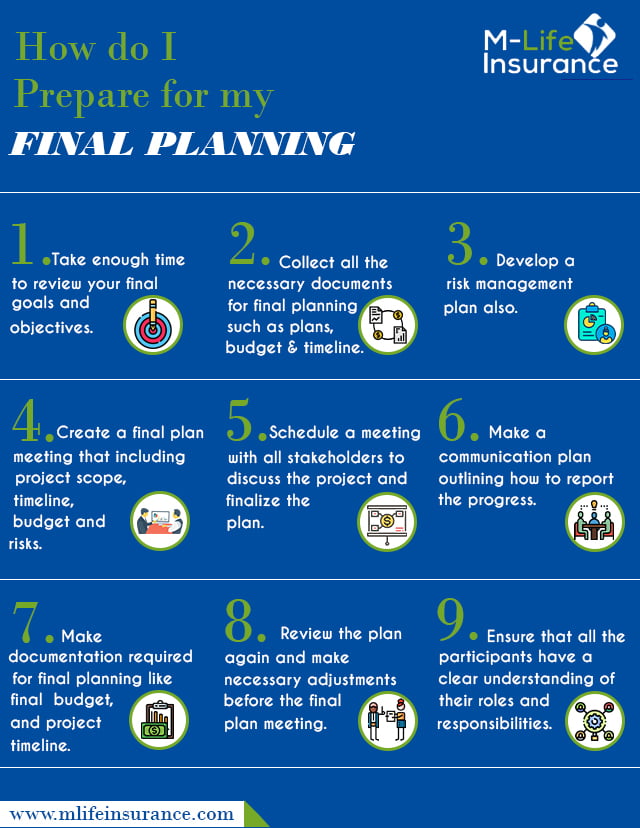

Figure 1- Preparing for Final Need Planning!

FAQs;

FAQs;

Q: What is end-of-life planning?

A: Final need planning is preparing for and managing end-of-life decisions. It involves making decisions about medical care, funeral arrangements, financial planning and other end-of-life issues.

Q: What should be included in a final needs planning program?

A: A final need plan should include a will, power of attorney, living will and advance health care directive. It should also include funeral arrangements, burial plans, and financial planning.

Q: Who should I talk to about creating a final needs planning cost?

A: You should talk to an estate planning attorney about final needs planning costs. He can help you create a plan that meets your needs. An attorney can also guide how to manage your assets best and provide for your family after you are gone.

Q: What is the importance of a final needs planning program?

A: Final need planning is essential because it helps ensure that you have fulfilled your wishes and that your family is taken care of when you are gone. It can also help relieve the burden of decision-making from your loved ones at a difficult time.

Conclusion

Final need planning is an essential step in the financial planning process. It helps ensure that you have provided your loved ones for after your death.

Think thoroughly about your options and create a plan that best fits your individual needs and goals. With proper planning, you can ensure that your family is financially safe and that you have fulfilled your final wishes.

M Life Insurance eagerly understands the issues their customers pose to them. Get our help by explaining your insurance quarries of final planning. We will address your problems in the best possible manner.

FAQs;

FAQs;