Key Points

- Group coverage saving

- Term and whole option

- Flexible policy choices

- Strong customer service

- Employer sponsored benefits

- Optional supplemental plans

Life insurance is a very important financial tool that will help you to secure the future of your family in case of anything that is unexpected happen to you. There are so many insurance companies out there but farmers group life insurance stands out as a trusted and directly recognised me in the insurance industry. No matter if you are a single person, employer or the employee, farmers offer a wide range of life insurance options that are specially designed for different needs and budgets.

In this article, we will explore the ins and outs of farmer group life insurance, we also discussed it with benefits, coverage types rates and how it compares to other insurance companies

What Is Farmers Group Life Insurance?

Farmers group life insurance referred to the life insurance policy that is offered by the farmer insurance. This will cover the multiple individuals under a single plan. Usually the employees of the company or the members of an organisation will take the benefit from these plans.

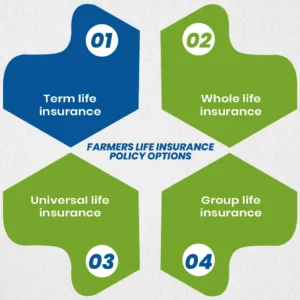

Farmers Life Insurance Policy Options

Primary insurance provides so many times of life insurance policies that will suit the different needs so let’s have a look and find which plan is best for your budget and needs

Term life insurance

Term life insurance by farmers group life insurance is the type of temporary life insurance plan that will provide you the coverage for the set number of years so you can choose the 10,20 or 30 years according to your needs and budget. This plan is best for the people who need temporary coverage such as being their home loans or their kids’ tuition fees.

Whole life insurance

Whole life insurance from farmers group life insurance is the type of permanent life insurance plan that will provide you lifetime coverage. This plan also includes cash where you can put in that will grow over time. Your premiums will stay the same and there is no surprising increase later in life.

Universal life insurance

Universal life insurance is the most flexible option with opinions and benefits. This plan also accumulates cash value that also grows over time and is suitable for those who are looking for the long-term financial planning tool.

Group life insurance

Reply insurance is best for the employers who want group life insurance coverage through farmers, offering basic and supplemental life insurance options to their employees. The coverage is usually more affordable because it’s spread across many participants.

Group Life vs. Individual Life Insurance

When you are deciding between group life insurance and individual life insurance, it is very important to know the pros and cons of each. So let’s have a look at this table that which group life or individual life is better fit for you.

| Feature | Group Life Insurance | Individual Life Insurance |

| Definition | Coverage provided by an employer or organization to its members. | A policy purchased directly by an individual from an insurance company. |

| Coverage Amount | Typically limited and based on a multiple of your salary. | Flexible — you can choose the coverage amount that fits your needs. |

| Eligibility | Automatically available if you’re part of the group or company. | Requires you to apply individually and qualify through underwriting. |

| Medical Exam | Usually not required or simplified underwriting. | Often requires a medical exam and detailed health assessment. |

| Cost | Generally low-cost or free (employer-subsidized). | Premiums depend on age, health, and coverage amount — can be higher. |

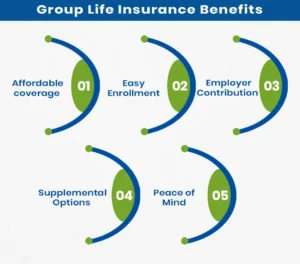

Group Life Insurance Benefits

Farmers group life insurance comes with so many benefits, we will discuss all those with you

Affordable coverage

Groups rates are generally low as compared to the single person insurance plans

Easy Enrollment

Employees can join without a medical exam

Employer Contribution

These plans are partially or sometimes fully funded by the employers

Supplemental Options

Employees can buy additional coverage

Peace of Mind

These plans gives peace of mind and also provides a basic safety net

Farmer Life Insurance Rates

The cost of farmers life insurance will depend on the several factors

- It depends on what type of policy you choose like the term, whole or universal

- Your coverage amount

- Age and health status of the insured person

- Length of the policy term only for term life insurance

Farmers group life insurance rates are more affordable because these plans share the risks into the group. Employers often get the pulp pricing and then pass savings to their employees.

How Much Does Life Isurance Cost?

For the most accurate and reasonable courses you have to contact the farmer life insurance customer service or you can visit their official website.

How Does Group Life Insurance Work

Let’s have a look at how the group life insurance plan works

- First, the employers enrolling a plan, a business signup with farmers to offer life insurance as a benefit

- Then employees automatically get enrolled or have the option to join during open enrolment periods

- Employers have to pay the full cost or share it with employees

- Once they are in road, the coverage will start and remain active as long as employment continues

- In the event of the insured death beneficiaries will receive the agreed payout amount

Farmer Life Insurance Customer Service

Farmers group life insurance is also known for a strong customer support system. No matter if you are an employer who is looking for a group policy or an employee with questions about your coverage, the farmer life insurance customer service name is always available. You can get access from your phone, online account, mobile app or any local agent.

Is Farmer Life Insurance Good Or Bad?

It depends on your budget and your needs that the farm life insurance is a good fit for you or not. Let’s have a look at the pros and cons so you can understand better how it will benefit you and why you cannot buy this.

Pros

- Strong reputation in financial backing

- Multiple policy types available

- Competitive group life rates

- Flexibility with supplemental options

Cons

- Group cover coverage can be insufficient as a stand alone policy

- Limited customisation options as compared to the standalone providers providers

- Portability issues when changing jobs

Final Thoughts

No matter if you are an employer who is offering benefits or the employee who is looking for the options farmer group life insurance is always there for you and it is worth considering. It comes with affordable pricing, flexible options and strong packing from farmers’ new world life insurance companies. It delivers peace of mind to thousands of policy holders.

You have to remember that whenever you are buying a plan, always compare the prices so you can get the better option that fit your needs and budget

If you’re looking for the term life, whole life or universal life insurance policies, you can talk to the customer representative agent at M-life insurance so you can get your quotes and buy the plan that is best for you.

FAQS

Farmers group life insurance is good for people who want trusted coverage and different plan options. It’s a well-known company, but the cost can be a bit higher than some others.

Yes, farmers group life insurance offers life insurance. You can choose from term life, whole life, or universal life plans depending on your needs.

Farmers Insurance is a company that provides many types of insurance, like car, home, life, and business insurance.

Geico is usually cheaper for car insurance, while Farmers gives more personal help and more types of coverage. The better one depends on what you need, low cost or more service.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.