In the world of insurance, there are often questions about what is covered and what is not. One common query that arises is whether life insurance extends to cover cosmetic procedures like a tummy tuck.

Welcome to our comprehensive guide on whether life insurance covers tummy tucks! If you are wondering about the financial implications of undergoing a tummy tuck procedure and how it relates to your life insurance policy, you’re in the right place. In this article, we’ll break down everything you need to know in a clear and easy-to-understand manner.

First, we’ll provide an overview of what a tummy tuck entails and why someone might consider undergoing this cosmetic surgery. Then, we’ll address the burning question: does insurance cover tummy tuck? We’ll delve into the specifics and explore any possible scenarios where insurance might come into play.

Whether you’re considering a tummy tuck for yourself or simply curious about how insurance factors into the equation, we’ve got you covered. Let’s get started and uncover the truth about tummy tucks and insurance coverage.

What is a Tummy Tuck?

A tummy tuck, medically known as abdominoplasty, is the medical terminology that refers to the surgical technique undertaken with the only purpose of improving the appearance of the abdomen. It goes as far as getting rid of the excess skin and fat in the midsection and suturing the muscles in the abdominal wall to make the abdomen tight, strong and well-maintained. As a result, one can achieve this through a smooth, toned upper abdomen region.

People usually think of tummy tuck for the sake of getting back in the shape of their abdominal area with neglected loose or sagging skin, stretched abdominal muscles or increased difficulty the reason for the fat in this area that is resistant to diet and exercise. Some reasons why tummy tucks are done are because of major weight loss, pregnancy or just natural aging which could make body features like the abdomen area change in ways that non-surgical methods can’t reverse.

Does Insurance Cover Tummy Tucks?

An insurance company may not support tummy tucking unless it is medically required, though it may agree to cover the procedure if it is for cosmetic reasons. The medical policies that are offered in health insurance plans carry in terms of being medically necessary for the treatment of the disease or the accident. Given the fact that a tummy tuck is mostly a request for aesthetic value, therefore, it is uninsured.

However, there are some situations where insurance may cover a tummy tuck:

Medical Necessity: If a tummy tuck is deemed medically necessary to treat an abdominal condition leading to a hernia or severe muscle separation, the patient becomes eligible for coverage. Your surgeon must be prepared to give documentation attesting the need for the surgery’s sustainability.

Post-Bariatric Surgery: Just as a few policies extend their cover for tummy tucks to patients, who have lost weight significantly, say, after a bariatric surgery due to excess skin creating issues with the function of the skin or causing skin irritations.

Insurance Riders: Certain insurers provide an optional mandate to add cosmetic surgeries as riders to the existing health policy for a premium. These motorists, on the contrary, may only cover certain beautification procedures such as tummy tucks, but under a specified manner which case to case.

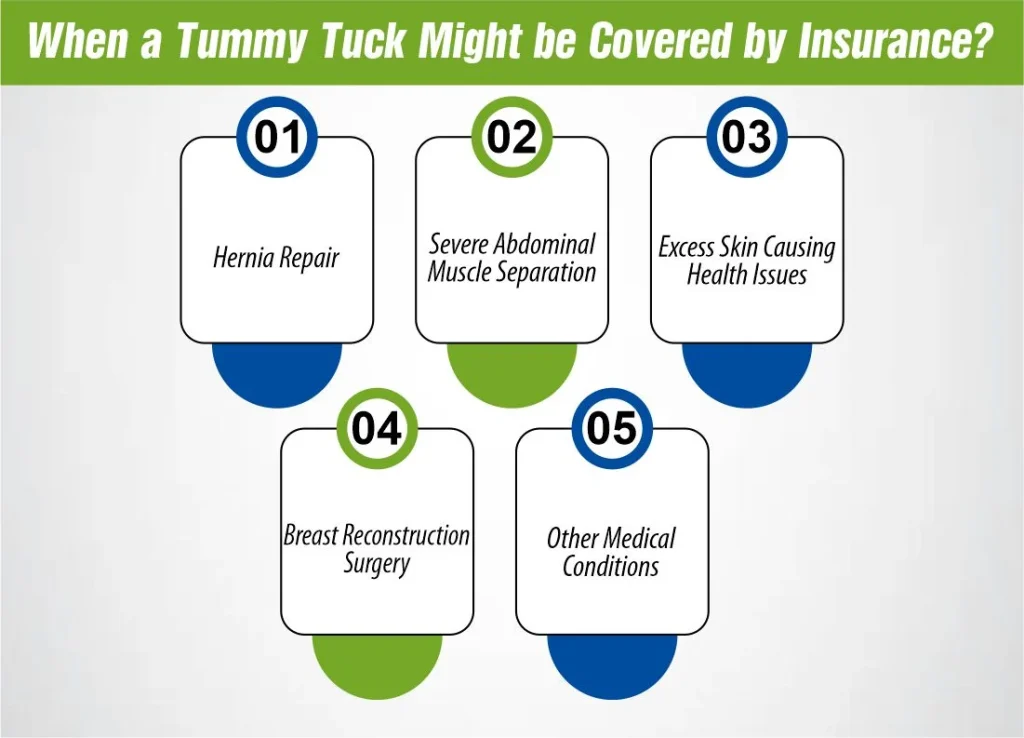

When a Tummy Tuck Might be Covered by Insurance?

When a Tummy Tuck Might be Covered by Insurance?

Insurance may be carried over to the abdominal lift in the case when this operation is medically required. Here are some situations where insurance might cover a tummy tuck:

Hernia Repair:

For example, you may need a tummy tuck surgery to deal with a hernia inside the abdominal region that gets mandatorily fixed through a hernia repair surgery. In this case, the medically necessary hernia repair will be treated as the primary purpose of the tummy tuck operation and for this reason, the treatment may be covered by insurance.

Severe Abdominal Muscle Separation:

Diastasis recti is a condition where your abdominal muscles functionally separate and it results in the appearance of a “mummy belly” or “pooch.” The condition is usually related with pregnancy or significant weight gain. If the alienation becomes so profound that it manifests as functional side effects, (for instance) intervertebral disc problems or weaknesses in the core muscles, then a tummy tuck procedure (which aims to restore the separated muscles) could be deemed medically essential and hence be covered by health insurance.

Excess Skin Causing Health Issues:

A notable loss of weight, whether through diet and exercise or bariatric surgery, is responsible for excess skin which can cause skin irritation, infections, or any other health issues. In the latter cases, when removal of the excessive skin is needed for medical reasons, insurance is likely to cover the abdominal tuck.

Breast Reconstruction Surgery:

Sometimes, a tummy tuck is used in breast reconstruction surgeries as a follow-up of a mastectomy. Insurance coverage of that service will depend on your cases and your plan.

Other Medical Conditions:

In specific cases, being a patient who suffers from another medical condition or a similar existing issue, may lead to considering a tummy tuck as the only solution to the medical issue. It is dependent on the given circumstances of the insured and the policy that you are insuring under.

However, even if you have a highly medically justified affair with a tummy tuck, the insurance will still not be paid automatically. You would need to satisfy the criteria as outlined by your insurance provider and then your surgeon must offer the needed medical documents that would justify the operation being medically necessary.

How Much Does A Tummy Tuck Cost?

The cost of a tummy tuck can vary widely depending on several factors, including:

1. Surgeon’s Fees: Surgeon’s fees are not absolute but depend on their skills, proficiency and hospital location. Unlike most newly empanelled plastic surgeons, board-certified surgeons usually bill more with their experience having trained utmost under the supervision of more experienced professionals.

2. Surgical Facility Fees: The location of the operation will raise the price of a tummy tuck as a surgical facility, either a hospital or outpatient surgery center, counts among the total bunch of factors affecting the cost of a tummy tuck.

3. Anesthesia Fees: The service of anesthesia as its own cost may be extra and can differ depending on the type of anesthesia used and the time spent in the procedure.

4. Extent of the Procedure: Surgical complexity of the tummy tuck is among the measures used to determine the cost of this procedure. A full stomach tuck, which covers the upper and low subdomains, generally becomes more expensive than a mini tuck, which specifically deals with the low stomach.

5. Additional Procedures: Besides that, if more processes are added alongside the tummy tuck as it is done in conjunction with liposuction or hernia repair, the meanwhile cost will dramatically increase.

6. Preoperative Tests and Consultations: Routine tests and face-to-face examinations may incur additional charges. Consult their doctor and the surgeon.

The average cost of an abdominoplasty operation in the United States is between $6,000 and $12,000. Even more expensive may be the surgery. This amount is the surgeon’s fee alone; also additional fees like provider anesthesia and facility fees are not included.

To do that you should get a tailor-made quote from your doctor which should include all the costs that will be incurred during the surgery before starting the procedure. In addition to that, some already credit-plastic surgery offices provide financing options for patients who find it difficult to make the sum within budget.

Insurance Coverage For A Tummy Tuck

The tummy tuck being considered for insurance coverage can be hard to deal with and it is mostly done when the procedure is thought to be medically justified. Here’s a summary of how insurance coverage for a tummy tuck typically works:

1- Cosmetic vs. Medical Necessity

An abdominoplasty performed purely for aesthetic purposes and the subsequent removal of excess skin resulting from the loss of weight would mostly be not medically necessary and thus not be covered by the insurance. Nevertheless, it is better to give birth in a hospital when the C-section is not medically necessary but is requested for birth purposes such as hernia or diastasis recti (abdominal muscle separation), insurance probably covers it.

How Much Does Life Isurance Cost?

2- Prior Authorization

Many insurance providers will demand authorization as a prerequisite for surgical procedures, including the abdominoplasty procedure. This entails that your doctor will have to submit the certified claim as to the necessity of the procedure to your insurance company for pre-approval before you are admitted for surgery.

3- Coverage Criteria

However, every insurance company has its own scaling for surgical coverage of a tummy tuck. Such criteria as the level of your condition, the possible result on your health and quality of life may be considered, as well as the options of conservative treatments and their previous efficacy are also important.

4- Out-of-Pocket Costs

Even if just a portion of the surgery costs will be cover by your health care coverage, even such expenses as deductibles, co-payments, or coinsurance may still have to be paid for by you.

5- Appeals Process

Do you have your tummy tuck insurance firm reject your claim? Get an appeal right. Your surgeon assists with the appeals process by presenting additional evidence or documentation which is supposed to be attached to your case for support.

By calling your insurance company directly, you will know what policies you have for tummy tucks and the ones that you may have that have some specific requirements and limits.

The Bottom Line

Getting insured for a tummy tuck is a complex process that has many pushes and pulls in terms of medical necessity and individual policy terms to decide its ring on the result. Though elective cosmetic procedures are not painted in a mature color, pre-existing medical conditions can lead to insurance considerations.

Knowing the criteria, approximate self-payment load and appeals path is essential for informed judgment. Please, always discuss all the issues with your insurance company and have your plastic surgeon carefully consider all the variants of applying them. Finally, an informed choice leaves you with not only the knowledge of what you want to use the funds for but the confidence to achieve this goal and financial awareness of the consequences.

References:

https://www.quora.com/Does-insurance-pay-for-any-tummy-tuck

https://www.marinaesthetics.com/does-insurance-cover-tummy-tuck/

https://creoclinic.com/blog/will-insurance-cover-abdominoplasty/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.