Key HighLights

- Covers loan balance

- Protects your family

- Lender is beneficiary

- Decreasing term policy

- Optional loan add-on

- Peace of mind coverage

Life insurance special designed to protect your loved ones from the financial burden after the person’s death. There are so many types of credit insurance that stand out as a special policy that will protect the lenders by paying off a borrowed debt if the borrower dies before the loan is paid. In this guide we will explore the meaning of credit insurance, what is its purpose, cost and benefit and how you can buy this coverage in simple terms we will explain everything you need to know.

Credit Life Insurance Meaning

Credit insurance type of life insurance that pays off the outstanding balance of loan if the borrower dies before the date is fully paid. In simple words it will make sure that your family does not have to worry about repaying your loans after your death.

It is usually offered by banks, credit unions or financing companies where you take out a mortgage, car loan or personal loan. The lender is the beneficiary, meaning that the insurance pays the loan directly to the lender, not the family.

Credit Life Insurance Definition

According to insurance term credit insurance “decreasing term life insurance policy instead to cover up orders that declines overtime as the loan balance is reduced”.

This means that as you pay off your loan, the insurance coverage decreases because the remaining that get smaller each month.

How Credit Life Insurance Works

Here are some of the step-by-step information that how the credit live insurance works

- You take a loan for example, a mortgage, auto loan or personal loan

- You opt for a credit insurance that as the lender offer it as an add-on policy

- You pay the premiums, the cost can be included in your loan payment or paid separately

- If you die before repaying your loan, then the insurance company pays the remaining loan balance to the lender

In this case your family does not receive any payout instead they will get the peace of mind of not inheriting your unpaid debts.

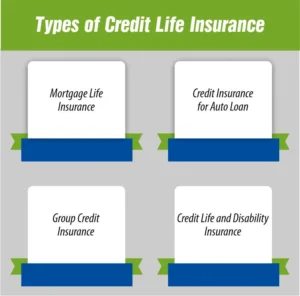

Types of Credit Life Insurance

There are so many credit life insurance types we will discuss each details so you will get a better understanding.

1. Mortgage Life Insurance

This will pay off your mortgage if you pass away before finishing your house payment, it will make sure that your family will keep the home without worrying about loan instalments

2. Credit Insurance for Auto Loan

This policy will cover your car loan balance if you die before completing the payments then it will protect your cosigners or family from losing the vehicle or paying off the remaining amount

3. Group Credit Insurance

This plan is offered by credit unions or banks, this policy covers a group of powers under one plan. It is often cheaper since the risk is shared among multiple people.

4. Credit Life and Disability Insurance

In addition to the death coverage this version also covers the disability. If you become disabled and can’t work then the insurance company can make loan payments on your behalf.

What Type of Life Insurance Are Credit Policies Issued As?

Credit life insurance is typically issued as decreasing term life insurance. This means that the coverage amount declines along with your loan balance. By the time your loan is fully paid off and the coverage ends automatically.

Credit Life Insurance On A Mortgage

Can you buy a house through a mortgage, lenders of an offer mortgage credit insurance. If you die before repaying, then the insurance company will pay off your remaining mortgage balance. This will make sure that your spouse or children can keep the home without facing foreclosure.

While it provides peace of mind, you should compare it with regular term life insurance which may offer a broader protection at a lower cost.

Who Is The Beneficiary Under A Credit Life Insurance Policy?

The lender or financial institution is the beneficiary under a credit insurance policy. So it means that upon your death the payout goes directly to the lender to settle down your loans and that is not given to your family members.

However, your family indirectly benefits from this because they were relieved from loan obligations after your death.

How Much Does Life Isurance Cost?

Credit Union Life Insurance

There are so many credit unions who provide credit union life insurance as a benefit for their members. It works the same way as standard credit insurance that is covering the loan balance such as car, home or personal loans, bit of an at lower premium rates or as the part of a membership benefit package.

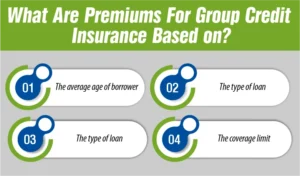

What Are Premiums For Group Credit Insurance Based on?

Premiums for the group credit insurance are usually based on the total loan balance of all insured members, along with these things

- The average age of borrower

- The type of loan

- The loan term length

- The coverage limit

Credit Insurance Cost

The cost of trade life insurance depend on the several factors like

- Loan amount like higher loans mean higher premiums

- Loan term like longer duration can also increase the cost

- Borrowers age like if the old person borrow, then they have to pay more

- Type of loan like mortgage, auto or credit card loan

Credit Life Insurance Calculator

Credit life insurance care helps to estimate your coverage amount in premium cost. Pending your loan balance, long-term and interest you can see how much protection you need and what it will cost you. There are so many banks and insurance companies who offer online Calculators to make this process easy for you.

Advantages Of Credit Insurance

There are so many advantages of having credit life insurance as it gives you peace of mind that your debts are cleared after your death. It also protects your family and your loved ones will not be burdened by loan.

Final Thoughts

Credit insurance can be a smart choice for borrowers who want to protect their loved ones from debt after their death. It is especially helpful if you do not have any other life insurance plan. However, it is always wise to compare the prices and benefits with the regular term life insurance policies. Term life can offer more coverage and flexibility for lower prices.

Before you decide, review the policy details, premiums and covers and ask your lender or insurance provider to give you full information.

Secure your Future today with M-life Insurance. And don’t let your loved ones bear the burden of your unpaid loans.

FAQS

Credit insurance policies are usually issued as decreasing term life insurance. This means that the insurance coverage goes down over time as you keep paying off your loan. And your loan is fully paid by the policy and automatically.

Credit insurance is the type of insurance that pays off your loan if you die before your loan is fully repaired. It will protect your family from having to pay your remaining debts. The insurance company pays the lender directly.

The correct statement is that credit insurance protect the lender, not your family. If the borrower dies, the insurance company pays the remaining loan balance to the lender. It will make sure that the loan is cleared and your family does not owe anything.

It pays off your loan if you die before completing payment, the lender is the policies beneficiary, the coverage amount decreases as your loan balance decreases, it is optional. You are not required by law to buy it.

Premiums for a group credit insurance are based on the total loan balance of all the injured boarders as well as the average age of the borrower, the type of term of loan and the coverage limit.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.