Thinking about to Cancel Globe Life Family Heritage Insurance but need help figuring out where to start? Whether it’s a change in your financial situation or just a shift in needs, getting out of an insurance policy shouldn’t be a maze. We’ll guide you through the cancellation process step-by-step, making it as simple and hassle-free as possible. Ready to find out how you can untie the knot with your policy? Let’s dive right in!

Globe Life Family Heritage Insurance

Globe Life Family Heritage Insurance stands out in the crowded insurance landscape, primarily for its focus on life and supplemental health insurance. Established with a mission to protect American families, its insurance plans are tailored to meet diverse needs—from straightforward term life policies to more complex whole and universal life options. What really sets it apart is its unique “Return of Premium” feature on some policies, where if you don’t end up using the insurance, they actually return your premiums!

Importance of Understanding Insurance Cancellation Policies

Diving into the fine print of any insurance policy isn’t exactly a picnic at the beach, but it’s crucial. Why? Because knowing when and how you can cancel your policy can save you a lot of grief—and possibly a lot of money. Every policy has its own set of rules about cancellations. Some might offer partial refunds, while others could leave you high and dry. Understanding these policies before you sign up can help you avoid the shock of unexpected fees or lost benefits down the line.

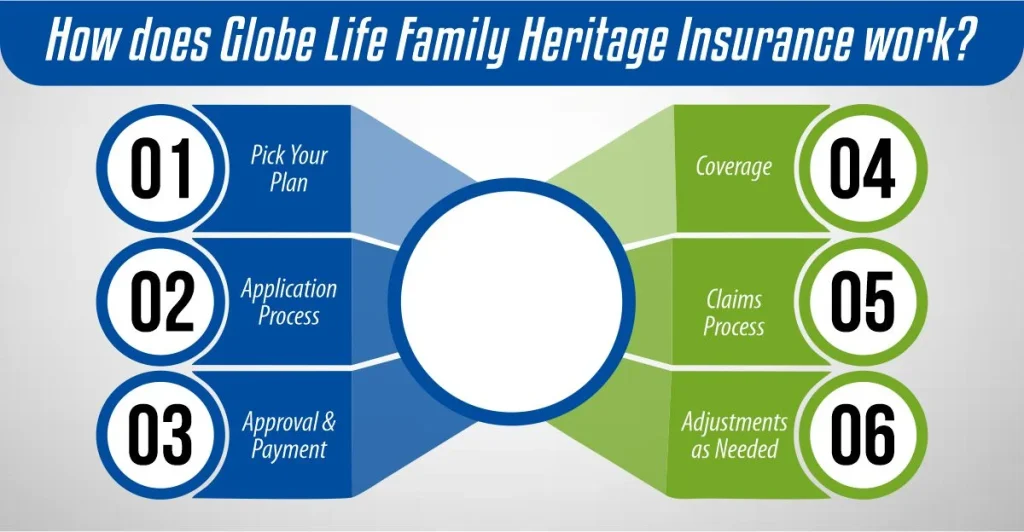

How does Globe Life Family Heritage Insurance work?

Let’s break down how Globe Life Family Heritage Insurance works in a simple, friendly way:

- Pick Your Plan: You start by choosing the type of insurance that fits your needs—whether it’s term life, whole life, or specific disease and accident protection. Think of it as picking your favorite ice cream flavor, but, you know, it is more important.

- Application Process: Next, you fill out an application. There is no need to climb any mountains or cross any deserts; it is just paperwork to let them know about you and your health.

- Approval & Payment: Once they give you the thumbs up, you start paying premiums, which is just a fancy word for the price you pay regularly to keep your insurance active. It’s like a subscription to a magazine but for peace of mind.

- Coverage: Kicks In After you’re all set up, your insurance is there to help cover expenses if certain things go wrong, like illnesses or accidents. Think of it as a safety net that catches you financially.

- Claims Process: If you ever need to use your insurance, you file a claim. It’s pretty straightforward: you let them know what happened, provide some documentation, and they help cover the costs according to your plan.

- Adjustments as Needed: Life changes, and sometimes your insurance needs to change, too. You can update or cancel your plan depending on what’s new in your life.

Types of Policies Offered by Globe Life Family Heritage

Term Life Insurance

Globe Life Family Heritage provides term life insurance, which is similar to a temporary lease. You receive coverage for a predetermined time—like 10, 20, or 30 years. It’s straightforward and generally more affordable than permanent life insurance. However, it doesn’t build up any cash value, meaning if the policy ends and you’re still alive, there’s no return of money. It’s ideal for those needing coverage for specific time-bound responsibilities, such as until your children finish education or a mortgage is fully paid.

Permanent Life Insurance:

On the flip side, permanent life insurance is more like buying a home. It offers lifelong coverage as long as you keep up with premium payments. Both whole and universal life insurance policies build cash value over time, which can be a financial boon. You can borrow against this cash value or even surrender the policy for the cash if you’re in a pinch. It’s a pricier option, but think of it as a long-term investment in your family’s financial security.

Unique Features:

A standout feature of Globe Life Family Heritage is the “Return of Premium,” which is available with some policies. Imagine paying for insurance over many years, and if you never need to claim, they return all the money you spent. It’s not just a safety net but could also mean a full refund, making it an attractive option for those who prioritize financial prudence.

When selecting a policy, consider what best suits your needs—whether it’s the reliable coverage of term life, the long-term benefits of permanent life, or the potential for a refund with the return of premium feature. Each type caters to different financial situations and goals, so it’s crucial to understand your options to make an informed decision. If you’re unsure, consulting with an insurance agent can provide guidance tailored to your specific financial situation.

Key takeaways to Cancel Globe Life Family Heritage Insurance

Here’s a table of key takeaways formatted concisely and conversationally, for canceling Globe Life Family Heritage Insurance:

| Situation | Key Takeaway |

| Immediate Buyer’s Remorse | Just bought it and already regret it? It’s okay to change your mind! |

| Unwanted Term Life Insurance | If that term life insurance isn’t fitting your life anymore, maybe it’s time to let it go. |

| Over 65 with Permanent Life Insurance | Over 65 and reassessing your needs? It might be time to reevaluate that permanent life policy. |

| Can’t Afford Premiums but Still Need Coverage | Need life insurance but the budget’s tight? Look for more affordable options before dropping coverage. |

| Terminally or Chronically Ill | Facing serious health issues? Special rules might apply, making cancellation the right move. |

The process to Cancel Globe Life Family Heritage Insurance:

Need to Cancel Globe Life Family Heritage Insurance? No problem. Here’s how to do it smoothly: First, grab your policy details. Knowing the fine print will help you avoid surprises. Reach out to customer service through a phone call or email; they’ll guide you on the specific steps for your policy. You might need to fill out a cancellation form or submit a written request, so be prepared for a bit of paperwork. Once you’ve sent in your cancellation, keep an eye on your email or mail for a confirmation from Globe Life. If you’ve paid any premiums in advance, be sure to ask about how you can get a refund. Following these steps will help ensure a hassle-free cancellation process.

Steps to Initiate Cancellation

Deciding to cancel your insurance policy isn’t taken lightly. If you’ve made the decision, the first step is to review your policy documentation. This contains specific details about how and when you can cancel, helping you understand any timelines or conditions that apply. After this, you’ll want to prepare a written notice of cancellation; some companies might require this in a specific format, so double-check your policy for any such details.

Required Documentation and Information

Gathering the right documents before reaching out to cancel your policy ensures a smoother process. Typically, you’ll need your policy number, personal identification, and possibly recent premium receipts. Also, drafting a concise letter stating your intent to cancel, the effective date, and your contact information is advisable. This helps ensure the confirmation process is clear and concise.

Contacting Customer Service or Insurance Agents

Now, it’s time to make the call or send an email. Contacting customer service or your insurance agent directly can facilitate the cancellation process. Have your policy details at hand to make this step as straightforward as possible. Customer service representatives are there to help but remember, they might offer you alternatives to cancellation, like adjusting your policy to better fit your current needs. Whether you decide to proceed with the cancellation or consider their options, clear communication is key.

When canceling any insurance policy, remember that timing is crucial. Most policies have a specific window during which you can cancel without penalties. Missing this window might mean facing extra fees or even continuing the coverage for another term. Always approach cancellation with a clear plan and all necessary information ready—this ensures you’re not caught off guard by any part of the process.

Can I Get My Money Back if I Cancel Globe Life Family Heritage Insurance?

Sure thing! If you want to Cancel Globe Life Family Heritage Insurance, you might get your money back, but it depends on your policy. Have you looked at the details yet? Some policies give refunds if you cancel within a certain time, but others might have fees. Did you know insurance stuff can be tricky? Before you do anything, take a peek at your policy documents. You don’t want any surprises! And if you need help canceling, ask Globe Life Family Heritage Insurance. They know their stuff!

Can you get your money back after canceling your Globe Life Family Heritage Insurance? Here’s a straightforward rundown:

- Review Your Policy: First up, check your policy details. Most insurance policies have specific terms about refunds. It’s like checking the return policy before you try to take something back to the store.

- Free-Look Period: Many insurance policies come with a “free-look period.” This is a time (usually about 10 to 30 days after you receive your policy) when you can cancel the policy and get a full refund, no questions asked. Think of it as a trial period.

- Surrender Charges: If you’re past the free-look period and you have a type of insurance that builds cash value, like whole life or universal life, you might still get some money back. However, be aware of surrender charges. These are fees deducted from your cash value for canceling early.

- Term Life Insurance: If you have term life insurance, typically, there’s no cash value to refund. You might not get back the premiums you’ve paid, but you can stop future payments once you cancel.

- Contact Customer Service: The best step is to give their customer service a call. They can give you the specifics based on your policy. It’s like asking a server exactly what’s in a dish before you order it.

So, in short, check your policy, consider the timing, and touch base with customer service. That way, you’ll know exactly what to expect when you cancel your policy.

Alternatives to canceling your Globe Life Family Heritage Insurance

Considering alternatives to Cancel Globe Life Family Heritage Insurance? Smart move! Let’s dive into some options:

How Much Does Life Isurance Cost?

- Switch to paid-up status: Have you ever thought about letting your policy pay for itself? Switching to paid-up status means you use what you’ve already put in to keep your coverage rolling without spending more cash.

- Lower your death benefit: Want to reduce your coverage while still keeping it? Lowering your death benefit might be the ticket. It’s like adjusting the volume on your insurance to match your needs.

- Pay with dividends: Did you know your policy could earn bonus bucks? Instead of letting them sit unused, why not put them to work? Paying with dividends can help keep your premiums in check or even unlock extra benefits.

- Use the cash value: Your policy might have a hidden treasure! By tapping into the cash value, you can access funds for whatever life throws your way. It’s like having a secret savings spot within your insurance.

Each option has its benefits, so before you say goodbye to your insurance, why not explore these alternatives? They could be just what you need to tailor your coverage to fit like a glove.

Conclusion

All set to Cancel Globe Life Family Heritage Insurance? Just remember: check your policy, reach out to customer service, and submit any required paperwork. It’s as straightforward as that. If you’ve got any questions along the way, their team is just a call or click away to help smooth out the process. No headaches, no endless loops—just a clear path to moving on. Ready to take the next step? Your peace of mind awaits on the other side of that cancellation form.

References:

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.