Last Updated on: June 5th, 2025

- Licensed Agent

- - @M-LifeInsurance

Love and commitment do not always mean getting married. These days, many couples choose to build a life together without getting married. Today, most couples live in the same home, sharing rent or home payments, manage money together, or even raise kids as a team. In all these situations, your lives are strongly connected, and you are planning a future side by side as well.

But what if something unexpected happens? If you’re not legally married, this will leave one partner with big money problems. That’s why life insurance is so important, it can help and support your partner in difficult financial problems if something happens to you.

Life insurance isn’t just for married couples. It can play an important role in helping unmarried partners to protect each other financially, cover shared loans, and plan for the future with peace of mind.

In this guide, we’ll look at why life insurance is important for unmarried couples, the different types of coverage you can get from the insurance companies, and helpful tips for choosing a right policy that fits your needs.No matter if you’re dating, engaged, or in a long-term relationship, this guide is here to help you make smart choices together for your future.

How Life Insurance Helps Unmarried Partners

Married couples automatically get some protections, like being able to get life insurance money or share a policy. But if you’re not married, you will not get these same benefits unless you set them up. That’s why life insurance is important for unmarried couples living together. This will help to keep each other safe if something goes wrong.

Here’s why life insurance is a smart idea for unmarried couples:

Income Replacement

If one partner dies, life insurance can help the other pay bills and living expenses.

Debt Protection

If you both took out a loan together, like a home loan, car loan, or credit card, your partner may still have to pay it alone if you pass away. Life insurance can help cover those payments.

Estate Planning

Life insurance will make it easier for your partner to receive money or assets after you pass away, without going through long legal steps.

Funeral Expenses

It can help pay for funeral expenses, so your partner doesn’t have to handle those costs alone.

Getting Life Insurance as an Unmarried Couple

Yes, unmarried couples can get life insurance. You don’t have to be married to buy your policy or to name your partner as the person who will get the money if you pass away.

But most insurance companies will ask for proof that you depend on each other financially. This means you need to show that if one of you passed away, this would affect the other partner financially

Here are some of the things that will show the insurance company that you both depend on each other financially:

How Much Does Life Isurance Cost?

- You share a home loan or rent together

- You have joint bank accounts or credit cards

- You take care of children or other dependents together

- You own a business or have investments together

Life Insurance Policies for Unmarried Partners

Unmarried couples have different life insurance options to choose from. The important thing is to pick the right type of policy that works best for your relationship and money situation.

1. Individual Life Insurance Policies

Each person buys their policy and can name their partner to receive the money if they pass away.

This will give you some of the benefits, like;

- You have full control over your policy

- There is no need for marriage or legal papers.

- Easy to change if your relationship changes.

The downsides of individual life insurance policies include:

- It can be more expensive than joint policies.

- Each person has to manage their policy separately.

2. Joint Life Insurance Policies

This is the one policy that covers two people, and some companies offer this option to unmarried couples. This type of policy gives you benefits like:

- This usually costs less than having two separate policies.

- Paperwork and managing the policy are simpler.

The downsides of joint life insurance policies include:

- It can be harder to cancel if you break up with your partner.

- Not all insurance companies offer this option to unmarried couples.

3. Group Life Insurance Through Employers

If your company provides group life insurance, you may be able to name your partner as the person who gets the money, even if you’re not married. Some companies also let you buy extra life insurance to add more coverage.

How Much Life Insurance Should a Couple Have?

How much life insurance you need depends on your money needs. Here are some things to think about:

- Any debts you have, like a home loan, credit cards, or student loans

- How much money would your partner need if you stopped earning (usually 5 to 10 times your yearly pay)

- Costs for the funeral and other final expenses

- Plans, like children, college costs, or buying a home

Life Insurance Tips for Unmarried Couples

Choosing the right life insurance policy is more than just picking a plan. Here are some easy tips for unmarried couples to keep in mind:

- Make Your Partner the Beneficiary

If you don’t name your partner, they may not get any money from the policy. Always make sure your partner is listed as the person who will get the money after you.

- Update Your Policy When Things Change

If you move in together, buy a home, or have kids, update your life insurance to match your new situation.

- Keep Proof of Your Relationship

Since you’re not married, you have to keep the documents that show you share money and responsibilities. This can make it easier to get benefits later.

- Talk to a Legal Expert

Unmarried couples should have a will or trust. This helps make sure your partner can legally get your money and belongings if something happens to you.

- Avoid Common Mistakes

Don’t assume your partner is automatically covered by your life insurance when you pass away. Most of the insurance policies require you to name them as the person who will receive the money. It’s also important to review and update your policy after major life changes like moving in together, getting engaged, or having children. And while life insurance from your job is helpful, it’s often not enough to fully protect your partner, so consider getting additional coverage from the insurance company.

Can I Put My Girlfriend on My Life Insurance?

Yes, you can name your girlfriend as the beneficiary of your life insurance policy. In some cases, the insurance company may ask for proof that she is financially dependent on you, like shared loans, bills, or children. It’s also good to know that whoever you list as your beneficiary will receive the payout, even if your will says something different. You can change your beneficiary anytime, and while legal issues are rare, keeping clear records of your relationship and shared responsibilities can help avoid any problems later.

Is Joint Life Insurance Available for Unmarried Partners?

Yes, in some cases, unmarried couples can get a joint life insurance policy. Some insurance companies offer this if you can show that you share money responsibilities, like bills, a home loan, or other finances. However, not all companies allow it, so it’s a good idea to compare options or talk to an insurance agent who understands how things work for unmarried couples.

Legal and Tax Considerations

Life insurance money usually goes straight to the person you choose while buying an insurance policy, and doesn’t have to go through court. But if you’re not married and the amount is big, your partner might have to pay extra taxes, since married and unmarried couples do not pay the same tax breaks.

To help avoid tax problems, there are a few smart steps you can take. You can set up a special kind of trust just for your life insurance, which helps keep the money safe from taxes. It’s also important to carefully choose the right person as your beneficiary, so there’s no confusion later. And finally, talking to a tax expert or lawyer can give you the best advice for your situation and help you plan things the right way.

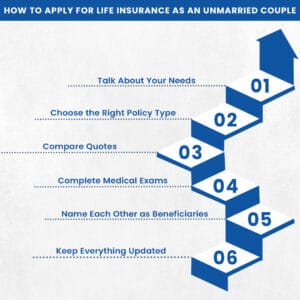

How to Apply for Life Insurance as an Unmarried Couple

- Talk About Your Needs

Discuss how much coverage each of you needs and why you want life insurance.

- Choose the Right Policy Type

You have to decide between individual or joint policies based on your needs and budget.

- Compare Quotes

You can use online tools or work with an insurance agent to find the best options.

- Complete Medical Exams

Some policies may need a health check, but others offer no-exam options.

- Name Each Other as Beneficiaries

List your partner with their full legal name to avoid confusion.

- Keep Everything Updated

Store policy papers safely and make sure your partner knows where to find them.

FAQs

Can unmarried couples get life insurance?

Yes, unmarried couples can get life insurance by proving financial dependency or insurable interest.

Can I put my girlfriend on my life insurance?

Yes, you can name your girlfriend as your beneficiary on a life insurance policy.

Can two unmarried people be on the same insurance policy?

Some insurers offer joint policies to unmarried couples if they can show financial ties.

How much life insurance should a couple have?

Typically, each partner should have 5–10x their annual income, plus enough to cover debts and final expenses.

Final Words

More and more couples are living together without getting married. Life insurance is very important for unmarried couples. It helps protect your shared money responsibilities and makes sure your partner is taken care of if something unexpected happens to you. No matter what you choose, separate policies, look into joint life insurance, or just want to keep your partner safe, the most important things are to talk openly, plan carefully, and pick an insurance company that understands your needs.

Protect your future together! Explore life insurance options for unmarried couples, talk openly, and choose the right policy. Start today to ensure your partner is financially secure, no matter what happens.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.