Last Updated on: September 8th, 2025

- Licensed Agent

- - @M-LifeInsurance

We make plans for the things in our life like saving money, buying life insurance and setting up things for retirement. But there are so many people who forget to plan for a funeral, which is quite stressful and costly for families. A prepaid final plan is a way to arrange and pay for the funeral ahead of time. By doing this, you reduce the stress from your loved ones and can even save money by locking all the things in today’s price. In this guide, we’ll explain how these funeral plans work, their benefits, and the choices available in places like Oceanside, Bonita, Pitstone, and Texas.

What is a Prepaid Funeral Plan?

A prepaid final plan means you have to pay for your funeral before you pass away. You can choose the type of plan that is best for you. The plan can be simple, traditional or personal. You also get the options to pay all at once or you can pay in monthly premiums. You can do whatever is best for you.

The money you paid is safe in the trust fund or the insurance policy and when the times comes the funeral provider will carry out your wishes. This way the expenses are already covered and your family will not have to worry about the money problems during the difficult times.

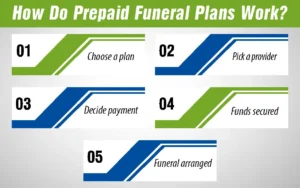

How Do Prepaid Funeral Plans Work?

Most of the time people ask: “How do prepaid funeral plans work?” lets have a simple step-by-step understanding:

1. Choose a plan

First you have to pick the type of funeral service you want.

2. Pick a provider

Then pick the provider, and work with a funeral home or company that offers the best prepaid plans.

3. Decide payment

Then you have to pay everything at once or in monthly payments.

4. Funds secured

Your money is kept safe in a trust or insurance policy.

5. Funeral arranged

When the time comes, the provider follows your plan.

Buying these plans will give you peace of mind, knowing that everything is already prepared and your family will not have to worry.

Benefits of Funeral Prepaid Plans

There are some main reasons why people choose funeral plans prepaid. Let’s discuss the benefits of buying this plan;

How Much Does Life Isurance Cost?

Financial Relief for Loved Ones

Funerals cost a lot of money. With a prepaid plan, your family doesn’t have to pay thousands of dollars suddenly.

Lock in Today’s Prices

Funeral costs keep going up. A prepaid plan lets you pay at today’s prices, so you save money in the future.

Personal Choice

You get to decide what kind of funeral you want, simple, traditional, or something more personal.

Peace of Mind

You and your family can feel calm knowing everything is already planned and paid for.

Types of Prepaid Funeral Plans

When looking for the best prepaid funeral plans, you’ll usually see a few main options. Each plan can be adjusted to fit your budget and your personal wishes:

Basic Plan

This is the most simple and low-cost option. It usually covers cremation or a very small service without a big ceremony. It’s good for people who want something modest.

Standard Plan

This plan includes a funeral service where family and friends can gather. It often covers the main costs like the service, staff, and arrangements.

Comprehensive Plan

This is the most complete option. It covers almost everything, such as transportation, viewing, flowers, casket, and other details. It’s meant for those who want a full traditional service.

No matter which plan you choose, you can get an option to customize it, so you can be able to add or remove the services. Then the plan will match your wishes and how much you want to spend.

Cheapest Funeral Plans

There are so many people who are looking for the cheapest prepaid end life plans to save money. A simple cremation plan is usually the most affordable. But while price matters, it’s also important to check what the plan includes. Sometimes the cheapest plan may miss important services, so it’s best to compare plans before deciding.

Prepaid Funeral Plan in Bonita

If you live in Bonita, these prepaid plans work the same way as anywhere else. They let you arrange and pay for your funeral in advance. You can choose a simple cremation or a full traditional service. A prepaid funeral plan in Bonita gives you both flexibility and peace of mind, knowing everything is already handled.

Prepaid Funeral Plan Pitstone

In the UK, many people ask about prepaid funeral plans in Pitstone. Local funeral homes in Pitstone offer different choices, such as eco-friendly funerals, cremations, and traditional services. By arranging a plan in advance, you make sure your family won’t face money worries or stress when the time comes.

Prepaid Funeral Plans Texas

In the United States, many families in Texas choose prepaid plans. Since funeral prices keep going up, planning early can save money. In Texas, insurance companies often give flexible payment options, so families can prepare without extra stress.

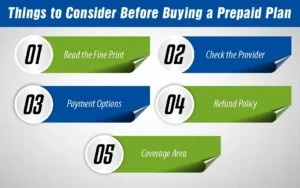

Things to Consider Before Buying a Prepaid Plan

When choosing among the best prepaid final plans, keep these tips in mind:

- Read the Fine Print – Make sure you know what is and isn’t covered.

- Check the Provider – Choose a trusted, licensed funeral home or company.

- Payment Options – Decide if you want to pay upfront or monthly.

- Refund Policy – Ask if you can cancel or transfer the plan if needed.

- Coverage Area – Ensure the plan works in your city or state.

Pros And Cons

| Pros | Cons |

| Saves your family from sudden funeral expenses | Some plans need a large upfront payment |

| You plans is lock in today’s prices, avoiding future inflation | Hard to switch if you move or change your mind |

| Gives peace of mind knowing everything is planned | Some services may not be included, leading to extra costs |

| Lets you choose the type of funeral you want | Risk if the provider closes or goes out of business |

| The plan offers you flexible payment options (lump sum or monthly) | May not always be the cheapest option compared to saving money separately |

Are Prepaid Plans Worth It?

Yes, prepaid plans can be helpful for many families. They save money by fixing today’s prices, reduce stress for loved ones, and let you choose the kind of service you want.

But it’s still important to check and compare different providers so you can pick the plan that fits your needs and budget.

Final Thoughts

A prepaid plan is more important than just a financial choice. This plan is a caring gift for your family and loved ones. By planning ahead, you can save them from the stress and extra cost during the hard time. No matter if you want a cheap plan or the best plan, Mlife Insurance is here for you to guide you with the best options. So make sure to get the free consultation and buy your funeral plan from the top insurance providers. You just have to make sure to pick a plan that is according to your budget and needs.

FAQS

What does a prepaid funeral plan include?

A prepaid plan usually covers the main expenses of a funeral. This plan include the funeral service, staff fees, a coffin or casket, cremation or burial, and sometimes extra services like flowers or transport. The plan include the things that is depend on the plan you choose.

What is a funeral plan called?

A funeral plan is also called a prepaid final plan or a prepaid funeral arrangement. This plan means you arrange and pay for your funeral in your life so your family doesn’t have to handle the end of life expenses later.

What is the best way to prepay for a funeral?

The best way is to buy a prepaid funeral plan is buying it from a trusted funeral home or insurance company. This way, your money is kept safe in a trust fund or life insurance policy, and your wishes are guaranteed. Always compare the policies and the insurance companies before choosing.

What is the cheapest way to plan a funeral?

The cheapest option is usually a direct cremation, which is a simple cremation without a ceremony. It covers the basic services at a much lower cost than a traditional funeral.

What are prepaid funeral plans near me?

Prepaid funeral plans let you arrange and pay for your funeral when you are still alive. Local funeral homes and online providers usually offer these plans.

Where can I buy a prepaid funeral plan in Oceanside?

You can get one from local funeral homes or nationwide companies that serve the Oceanside area.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.