Securing your family’s financial future is a priority for everyone, but traditional life insurance policies can sometimes be difficult to obtain, especially if you have health issues. This is where AIG Guaranteed Issue life insurance comes in, offering a simple and accessible solution.

With no medical exam or health questionnaire required, this policy provides guaranteed acceptance for individuals between the ages of 50 and 85, making it an attractive option for many. In this comprehensive guide, we’ll explore the key features of AIG Guaranteed life insurance, its benefits, and eligibility criteria.

What is AIG Guaranteed Issue Life Insurance?

AIG Guaranteed life insurance is a type of permanent life insurance policy that offers coverage without the need for a medical exam or health questionnaire. This makes it an attractive option for individuals who may have difficulty obtaining traditional life insurance due to health issues or other reasons.

With this insurance policy, you are guaranteed acceptance as long as you meet the age requirements, which typically range from 50 to 85 years old (age may vary by state). This policy provides coverage for your entire life, as long as you continue to pay your premiums. The premiums for this policy are fixed and will not increase over time, making it easier to budget for your insurance costs.

In the event of your death, your beneficiaries will receive a tax-free lump sum payment, which can be used to cover expenses such as funeral costs, outstanding debts, and ongoing living expenses. This can provide peace of mind knowing that your loved ones will be protected financially no matter what.

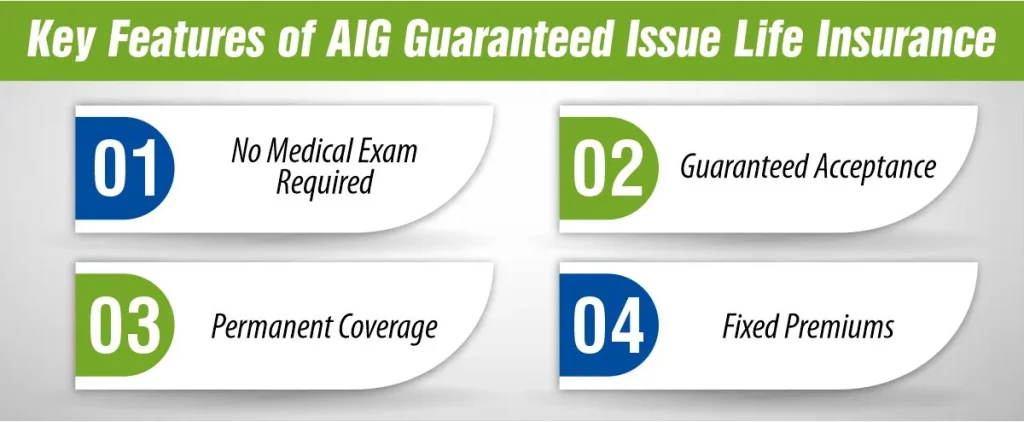

Key Features of AIG Guaranteed Issue Life Insurance

- No Medical Exam Required: One of the main features of this policy is that it does not require a medical exam or health questionnaire. This makes it easier for individuals with pre-existing health conditions to obtain coverage.

- Guaranteed Acceptance: As long as you meet the age requirements, you are guaranteed acceptance for this policy. There are no health questions to answer, making it an accessible option for many individuals.

- Permanent Coverage: AIG Guaranteed life insurance provides coverage for your entire life, as long as you continue to pay your premiums. This can provide peace of mind knowing that your loved ones will be protected no matter what.

- Fixed Premiums: The premiums for this policy are fixed and will not increase over time. This can make it easier to budget for your insurance costs.

How Does AIG Guaranteed Issue Life Insurance Work?

AIG Guaranteed life insurance works by providing you with a permanent life insurance policy that offers coverage without the need for a medical exam or health questionnaire. Here’s how it works:

1- Application Process

To apply for AIG Guaranteed life insurance, you simply need to fill out an application form. Since no medical exam or health questionnaire is required, the application process is simple.

2- Acceptance

As long as you meet the age requirements (typically between 50 and 85 years old) and are a U.S. citizen or permanent resident, you are guaranteed acceptance of this policy.

3- Premiums

The premiums for AIG Guaranteed life insurance are fixed and will not increase over time. You can choose to pay your premiums monthly, quarterly, semi-annually, or annually, depending on your preference.

4- Coverage

Once your application is approved and you start paying your premiums, you are covered for your entire life. In the event of your death, your beneficiaries will receive a tax-free lump sum payment, which can be used to cover expenses such as funeral costs, outstanding debts, and ongoing living expenses.

5- Policy Benefits

In addition to providing coverage for final expenses and income replacement, AIG Guaranteed life insurance can also be used as part of your estate planning strategy, providing a tax-free inheritance for your beneficiaries.

Benefits and Drawbacks of AIG Guaranteed Issue Life Insurance

- Benefits of AIG Guaranteed Life Insurance

Guaranteed Acceptance: A major benefit of AIG Guaranteed life insurance is its guaranteed acceptance policy. Regardless of your health condition or medical history, you are guaranteed acceptance as long as you meet the age requirements.

No Medical Exam Required: Since no medical exam or health questionnaire is required, the application process is simplified and streamlined. This makes it easier for individuals with health issues to obtain coverage.

Coverage for Final Expenses: AIG Guaranteed life insurance provides coverage for final expenses such as funeral costs, medical bills, and outstanding debts. This can relieve your loved ones of the financial burden during a difficult time.

Income Replacement: The death benefit provided by this policy can help replace any lost income, ensuring that your loved ones can maintain their standard of living even after you’re gone.

Estate Planning: AIG Guaranteed life insurance can be used as part of your estate planning strategy, providing a tax-free inheritance for your beneficiaries.

- Drawbacks of AIG Guaranteed Life Insurance

Higher Premiums: Since AIG Guaranteed life insurance offers guaranteed acceptance and no medical exam, the premiums tend to be higher compared to traditional life insurance policies.

Lower Coverage Limits: The coverage limits for AIG Guaranteed life insurance are typically lower compared to other types of life insurance policies. This may not be sufficient for individuals with higher coverage needs.

How Much Does Life Isurance Cost?

Waiting Period: Some AIG Guaranteed policies have a waiting period before the full death benefit is paid out. During this period, the benefit may be limited to a return of premiums plus interest.

Not Suitable for Everyone: While AIG Guaranteed life insurance offers guaranteed acceptance, it may not be the best option for everyone. Individuals who are in good health may be able to find more affordable coverage with a traditional life insurance policy.

Before deciding on AIG Guaranteed life insurance, it’s important to weigh the benefits against the drawbacks and consider your individual needs.

Who is Eligible for AIG Guaranteed Issue Life Insurance?

To be eligible for AIG Guaranteed life insurance, you must meet the following criteria:

-- Age

Typically, you must be between the ages of 50 and 85 to qualify for this policy. However, age requirements may vary by state.

-- Residency

You must be a U.S. citizen or permanent resident to be eligible for AIG Guaranteed life insurance.

-- Premium Payment

You must be able to pay the required premiums to maintain your coverage.

-- No Health Questions

A key feature of AIG Guaranteed life insurance is that there are no health questions to answer. This means that individuals with pre-existing health conditions can still qualify for coverage.

Is AIG Guaranteed Issue Life Insurance Right for You?

AIG Guaranteed life insurance can be a valuable option for individuals who are unable to obtain traditional life insurance due to health issues or other reasons. However, it’s important to consider your individual needs and circumstances before making a decision. If you’re unsure whether this policy is right for you, it may be helpful to speak with a licensed insurance agent who can provide personalized advice based on your situation.

Conclusion

AIG Guaranteed Issue life insurance is a valuable option for individuals who are looking for a simple and accessible way to secure their financial future. With its guaranteed acceptance, fixed premiums, and permanent coverage, this policy can provide peace of mind knowing that your loved ones will be protected no matter what. If you’re interested in learning more about AIG Guaranteed life insurance or are ready to apply, contact a licensed insurance agent today to get started.

FAQs

1- What is the maximum coverage amount available with AIG Guaranteed life insurance?

The coverage limits vary depending on the insurance company and policy, but typically range from $5,000 to $25,000.

2- Are there any restrictions on how the death benefit can be used?

No, the death benefit can be used by your beneficiaries for any purpose they see fit, such as paying off debts, covering living expenses, or funding education expenses.

3- Can I add riders to my AIG Guaranteed life insurance policy?

Some insurance companies may offer riders that can be added to your policy for an additional cost, such as an accidental death benefit rider or a waiver of premium rider.

4- Is there a waiting period before my coverage begins?

Some AIG Guaranteed Issue policies have a waiting period before the full death benefit is paid out. During this period, the benefit may be limited to a return of premiums plus interest.

5- Can I convert my AIG Guaranteed policy to a different type of life insurance in the future?

Some insurance companies may offer the option to convert your AIG Guaranteed policy to a different type of life insurance policy, such as a whole life or universal life policy, at a later date.

6- Can I purchase AIG Guaranteed life insurance for someone else?

No, you can only purchase AIG Guaranteed life insurance for yourself. However, you can name someone else as the beneficiary of your policy.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.