Last Updated on: October 2nd, 2025

- Licensed Agent

- - @M-LifeInsurance

Key Points

- Low-cost family protection

- Flexible term coverage

- Peace of mind

Financial planning is not always about only making plans to save money, it’s also about making sure that your loved ones are safe if something happens to you. Life insurance will help to protect your family, but many people think it will cost them too much. The good news? Term life insurance is usually the cheapest way to get strong protection.

Permanent life insurance has savings built in, but it also comes with higher monthly costs. Term life insurance is simple: you pay less, and your family gets coverage for a set period of time.

In this guide, we’ll explain how most affordable term life insurance works, who should think about getting it, and how to compare plans for your own situation, no matter if you’re a young parent, a homeowner, a senior, or even a smoker.

What Does Affordable Term Life Insurance Mean?

A term life policy covers you for a set period of time that is commonly 10, 20, or 30 years. If you pass away during that period, your chosen beneficiaries receive a death benefit payout.

When we talk about affordability, we mean policies that provide:

- Lower monthly premiums compared to permanent life insurance

- Flexible term lengths that match financial goals

- Coverage amounts that balance protection with cost

Why Term Life Insurance Costs Less

Affordable term life insurance is very simple. Its main purpose is to give financial protection. Unlike whole life or universal life insurance, it does not come with investment features or lifetime guarantees. Because it only provides coverage, the cost is usually much lower. There is no cash value or savings part included, the coverage ends once the term expires, and the design is straightforward with fewer extras. All of this makes term life insurance an affordable choice for many people.

Who Benefits Most from Budget-Friendly Term Life Insurance?

Different stages of life come with different responsibilities. Affordable term life insurance coverage can be an excellent fit for:

Parents Supporting Children

A policy will make sure that the children’s daily needs, education, and future plans are protected in a right way.

Homeowners with Mortgages

If something happens to you, your family won’t risk losing the home to unpaid mortgage debt.

Couples Relying on Shared Income

Affordable term life helps protect household finances and prevents surviving spouses from financial strain.

Seniors Seeking Cost-Effective Protection

Even in your 50s or 60s, term life insurance coverage can help with medical bills, final expenses, or leaving a modest inheritance, without sky-high premiums.

Factors That Affect Your Term Life Premiums

The cost of Affordable term life insurance depends on several factors. Age is important because younger people usually pay less. Health also matters when it comes to the rates of the plan, if you already have health problems, your price will be higher. The length of the term makes a difference too, since longer coverage, like 30 years instead of 10, costs more. Lifestyle choices can also raise costs, especially if you smoke, take part in risky sports, or work in a dangerous job.

Affordable term life insurance for Seniors

There are so many older adults who think they can not get life insurance once they reach a certain age, but that’s not true anymore. Today, insurance companies offer special term life insurance plans that are specially made for seniors in their 50s and 60s.

These plans can help with things like:

- Paying for funeral or burial costs

- Clearing any remaining debts

- Leaving some money behind to support loved ones

Coverage for Smokers & No-Exam Policies

Sometimes life insurance can feel very confusing, but knowing your choices makes it easier. Here are two important things to know:

Smokers

If you smoke, your monthly premiums will usually be higher, and sometimes even double as compared to non-smokers. Still, term life insurance is usually the most affordable choice. Shopping around and comparing Affordable term life insurance quote can help you save money.

How Much Does Life Isurance Cost?

No-Exam Term Life

Some people don’t want to take a medical exam. In that case, no-exam term life insurance is a good option. Instead of an exam, the company asks health questions and checks prescriptions. These plans may cost a little more, but they’re fast and simple to get.

Pros and Cons of Low-Cost Term Life Insurance

Advantages

- Most affordable form of life insurance

- Flexible term lengths (10–30 years)

- High death benefits for relatively low premiums

- Options available for seniors and smokers

- Fast application with no-exam alternatives

Drawbacks

- No savings or investment growth

- Coverage ends when the term expires

- Renewal rates increase significantly

- Health and age heavily influence premiums

- Not designed for lifelong protection

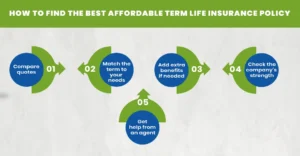

How to Find the Best Affordable Term Life Insurance Policy

When you are planning to buy the plan it’s not always about picking the cheapest plan, it’s all about finding one that gives you good protection at a fair cost. Here are some simple tips:

Compare quotes

Look at a few plans side by side before choosing.

Match the term to your needs

For example, enough years to cover your mortgage or until your kids finish school.

Add extra benefits if needed

Like coverage for disability or accidental death.

Check the company’s strength

Make sure the insurance company is trusted and stable.

Get help from an agent

It is very important to take the help from an independent agent to explain options and guide you to the best fit.

Final Thoughts

Affordable term life insurance is more than just saving money, it’s about giving you peace of mind. All you need is to make sure that before buying the plan must look at different plans and choose carefully, you can find a policy that protects your family’s future without spending too much money. No matter if you’re raising your kids, getting close to retirement, or just want low-cost coverage, there’s a plan that can fit your needs. Start by checking quotes today to find the right mix of protection and price.

Protect What Matters Most

Start your journey with M-life Insurance and secure your family’s future today.

FAQs

What is a reasonable amount to pay for term life insurance?

The affordable term life insurance depends on your age, health, and if you smoke. Younger and healthier people usually pay less. A fair price is one that fits your budget and still gives enough coverage for your family’s needs.

How much does a $1,000,000 term life insurance policy cost?

The price can be very different for each person. For a healthy 30-year-old, it could be around $20–$40 per month. For older adults, it can be much higher. The best way to know is to get a quote for your own age and health.

Who does Dave Ramsey recommend for term life insurance?

Dave Ramsey suggests buying 15–20 year term life insurance from trusted, independent insurance agents. He doesn’t recommend whole life insurance because it costs much more.

At what age should you stop term life insurance?

You should stop when you no longer need it, for example, after your mortgage is paid off, or when your kids are grown and no longer depend on you. For many people, that’s usually in their 60s.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.