Last Updated on: October 6th, 2025

- Licensed Agent

- - @M-LifeInsurance

Key Points

- Simple life insurance for seniors

- Covers funerals, medical bills and any unpaid loans

- No medical exam for most of the policies

- Quick approval and easy application

- Cost depends on age and health

- Compare prices for best value

Planning for the end of life can bring so much relaxation and peace and buying a life insurance policy can play a very important role in that preparation. For many seniors and older adults, final expense coverage is an important and a good step to make sure that their funeral cost and other end of life expenses are taken care of without burdening their family members. Open Care Life Insurance is a popular name in this space. This guide will break down what Open Care life insurance offers, its costs, coverage types, and whether it might be the right fit for you.

Basic Understanding of Open Care Life Insurance

Open care life insurance is not a regular life insurance company, instead this is the company that helps the seniors to find and get the affordable life insurance policies from the different known companies. They focus on the plans that are easy to get, often without needing the medical exam.

The main type of life insurance policy that is offered by open care is final expense insurance that is also called burial insurance or funeral insurance. This insurance helps to pay for the funeral costs, medical bills, and other small expenses, so your family does not have to pay for them unexpectedly.

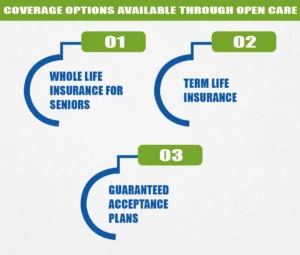

Coverage Options Available Through Open Care

Open care life insurance not only provides the final expense insurance, it also offers the other types of plans. So that these plans will help the seniors to get the plan that is best for them.

Whole Life Insurance for Seniors

A whole life insurance policy will last for your whole life. This policy will give you coverage from $2,500 to $50,000. For this plan your monthly premiums will stay the same, and money can help you pay for the small loans and funeral expenses.

Term Life Insurance

Term life insurance will give you the coverage for the set number of years like the choice is all yours if you want to buy the 10 years, 20 or 30 years. This plan is good for the seniors who want temporary protection without paying for the lifelong premiums.

Guaranteed Acceptance Plans

These plans are for people with health issues. This plan is best for the seniors because there is no medical exam needed for the policy. But the monthly premiums can be high and also some limit on the benefits in the start of the policy.

Who Can Benefit from Open Care Life Insurance?

Open care life insurance is mostly for the seniors aged 50 – 85. Their insurance plans are simple and easy to buy, and this plan is meant to cover the funeral expenses. Many seniors prefer because the plan has fast approval and also that most plans don’t require a medical exam, making it an easy way to get protection.

What Does Open Care Life Insurance Cost?

The total cost of the open care life insurance includes the monthly premiums and the cost depends on the person’s age and gender. No matter if you are smoking or not and how much coverage you choose for your plan.

Lets get a better understanding by taking an example.

- A 60-year-old non-smoker might pay $30–$50 per month for a $10,000 policy.

- A 70-year-old smoker could pay $70–$100 per month for the same coverage.

Sometimes there are some ads that show the low rate, but these rates apply to the very small insurance policies or the younger people. Most seniors will pay a bit more based on their age and health.

Comparing Open Care Life Insurance Rates

Open Care comes with the good rates and best plans for people under 65 who are in good health. There is open care senior life insurance that is for the elderly who are older or have health problems can find out that guaranteed acceptance plans cost more.

So it’s a good idea to make sure that you have compared the rates with the well-known and good insurance companies like Mutual of Omaha AIG or Colonial pen to make sure you are getting the best deals.

Final Expense Insurance Through Open Care

Final expense insurance is the most common type of coverage open care offers. It is meant to help to pay for funeral and burial costs, outstanding medical bills and small remaining unpaid loans.

Since funerals in the US usually cost $8000-$12,000, many senior shoe policies cost around $10,000-$15,000 to feel secure.

Benefits

- The main benefit is that this plan is easy and it is easy to apply

- The plan comes with little or no more medical exams.

- You get the fast approval

Possible drawbacks

- Premiums can be higher than other insurance companies.

- Some plans have a waiting period before full benefits so you have to wait in the starting.

Open Care life Insurance Reviews and Feedback

Open care does not have a single official rating system, and online reviews are mixed. Many seniors like how easy it is to find coverage without contacting different companies. There are some people who say that they can get lower rates by going directly to the insurance company itself so it is very important to read the policy details carefully to make sure it meets your needs.

How Much Does Life Isurance Cost?

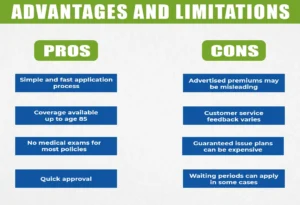

Advantages and Limitations

Open care life insurance comes with so many benefits but there are also some limitations that you have to know before buying the plan.

| Pros | Cons |

| Simple and fast application process | Advertised premiums may be misleading |

| Coverage available up to age 85 | Customer service feedback varies |

| No medical exams for most policies | Guaranteed issue plans can be expensive |

| Quick approval | Waiting periods can apply in some cases |

Is Open Care Life Insurance Right for You?

Open is right for you so you can consider it if you want simple and fast coverage without a lot of paperwork or fighting, or if you prefer no medical exam to get approved, this will make it easier and quicker to get a policy. You can also go for it if you need a small life insurance plan to help cover funeral expenses, medical bills, or other end of life expenses, so your family is not left with unexpected cost and stress.

Is open care life insurance trustworthy?

Yes, open care is a legitimate agency that connects the clients with license insurance companies. While it does not issue its own life insurance policies, it acts as a broker. Being legitimate does not always guarantee the best rates so you have to make sure that you compare the prices and get the better policies that are best fit for you and your family.

Final thoughts

Choosing life insurance is highly personal, especially for senior planning for end of life expenses. Open care comes with the straight forward options, but it’s one of many choices. You have to make sure that you review the cost, coverage, and feedback carefully to decide if it meets your requirement or not. For those who are looking for simple hasslefree life insurance policies, open care can be a very good option for you, but always compare the alternatives to find the best value.

Protect your family today with M-life insurance.

Don’t leave your love once when there are unexpected expenses. With M-ife insurance, seniors can find simple, affordable life insurance plans that are easy to apply and that come with no medical exams. Get your free quote now and see how easy it is to secure your peace and your family’s peace of mind.

FAQS

1. Is Open Care life insurance legitimate?

Yes, open care is a real and legitimate company but keep in mind that it does not sell insurance directly but it will help the people in the seniors to connect with real insurance from trusted companies

2. How much is a $10,000 life insurance policy?

There is no fixed cost as the cost of the life insurance for this coverage, but yes, it depends on your age, health and your smoking routine. For example, a healthy 60 year old man who does not smoke will pay less monthly premiums. But if you are talking about a 70 year old man who smokes, he has to pay more monthly premiums.

3. What is the cash value of a $25,000 whole life insurance policy?

The cash is the amount of money that builds up inside a whole life insurance policy over time. At first, it will be small, but it grows gradually as you pay your monthly premium. The exact amount depends on the policy and how long you have had it.

4. Can I withdraw money from my life insurance?

Yes, for some types of life insurance, like whole life insurance, you can borrow or withdraw a part of cash value as in these plans cash grows over time as you are paying your monthly premiums. However, doing soulmate can reduce the death benefit or cause fees so it’s very important to check before buying the plan.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.