As we grow older in our life, financial peace of mind becomes more important than ever. There are so many seniors who start thinking seriously about how to protect their loved ones and cover final expenses, and this is where AARP life insurance will come to save your future.

In this detailed guide, we will explain what AARP life insurance can offer you, how much it costs by age, and whether it is the right fit for your needs.

What Is AARP Life Insurance?

AARP ( American Association Of Retired Persons) partners with New York Life, this is one of the most trusted insurance companies in the United States, and it can offer exclusive life insurance plans for its members.

Membership is open to people aged 50 and above, and the insurance products are tailored specifically for seniors who are looking flexible and easy to qualify coverage options

AARP provides four main types of life insurance plans:

Types Of Life Insurance Plans

There are different types of AARP and life insurance plans gives you protection for your future.

Life Insurance AARP Rates By Age

Lets have a look at the estimate of this life insurance rates by age for non smokers, male applicants. Actual rates can vary by state, gender and health. So you have to make sure to confirm before buying

| Age | Term life monthly | Whole life monthly | Guaranteed acceptance monthly |

| 50 | $20–$25 | $40–$45 | $55–$60 |

| 60 | $35–$40 | $65–$75 | $80–$90 |

| 70 | $65–$75 | $110–$120 | $125–$135 |

A Closer Look At Each AARP Plan

Term Life Insurance

The AARP term life insurance plan gives you coverage for a set period of time and this plan is designed for short time protection, you have to keep in mind that the monthly premium can go up as you get older and the coverage will automatically end at the age of 80.

Whole Life Insurance

The AARP whole life insurance plan covers you for your entire life and also build cash value over time so that you can take this money whenever you want. The best thing is that monthly premiums will remain the same and you will stay protected for life.

Guaranteed Acceptance Life Insurance

AARP guaranteed acceptance life insurance plans specially designed for the seniors who are not getting any other policy. The plan comes with no medical exam and everyone can get the coverage no matter what their health is.

Young Start Life Insurance

The AARP Young start life insurance plan is made to have parents or grandparents who want to keep protection to their children or grandchildren. The plan provides affordable coverage for the kids from 0 to 17 years and this is the best gift that gives you kids peace of mind as they grow up.

AARP Life Insurance Program Options By Age

Over 60

If you are in your 60s you can choose between term life policy or the whole life policy. Both plans are easy to get and protect you and your loved ones from any financial

Over 70

And the people who are in their 70s, whole life and guaranteed acceptance plans are the best options for them. In this plan premiums are higher, but these plans will make sure the lifelong coverage.

Over 80

For seniors who are 80 or more than 80 only the guaranteed acceptance plan is available. It is perfect for covering funeral or final expenses, ensuring your family is not left with unexpected costs.

These prices are just estimated monthly cost for AARP or New York life whole life insurance plans. The actual aarp life insurance rates can be different depending on where you live, your health condition, and whether you smoke or not. So make sure to see the prices before buying. You can go to the site and aarp life insurance login page for the details and also you can call on aarp life insurance phone number.

Understanding The Cost Of AARP Life Insurance

The price of AARP life insurance changes based on the plan you choose

How Much Does Life Isurance Cost?

- Term life insurance starts at around $16-$25 per month for someone who is 50 years old

- Whole life insurance usually cost between $40 and $80 per month

- Guaranteed acceptance insurance begins at about $55 per month

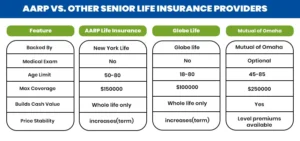

AARP vs. Other Senior Life Insurance Providers

Customer Reviews: What Seniors Say About AARP Life Insurance

Positive Feedback

Many customers say that AARP life insurance is very easy to apply for online. The customers are also happy with the easy and quickly application process and there is no need to take any medical exam to get approved by the company. People would also like that the plans are supported by aarp New York life insurance, which is a well-known trusted insurance company

Common Complaints

Some customers have mentioned a few things that they don’t like. They say that the rates go up as you get older, especially with life policies. Others feel that the coverage amount is limited and wish they could choose higher amounts. A few people also mentioned that customer service can be slow or hard to reach sometimes.

AARP Life Insurance – Pros And Cons

| Pros | Cons |

| Easy approval, no exam | Limited coverage amounts |

| Backed by new york life | Rates increase with age |

| Whole life plan builds cash value | Waiting period on guaranteed plans |

| Designed for seniors | Must be an AARP member |

Final Thoughts

AARP life insurance is a good choice for seniors who want easy and dependable coverage. It is backed by New York life, a trusted company . These plans give peace of mind and fit different dates and budgets. No matter if you are in your 50s or 80s getting insured is simple and stress free. Before you buy, check and compare the plans and prices.

You can also look at other options like globe life or mutual of Omaha through M-life Insurance.

Get your free quotes today with Mlife Insurance and secure your family’s future.

FAQs

How much does AARP life insurance cost?

There is no fixed cost of AARP life insurance. It depends on your age, health and gender and also what type of plan you choose. But talking about the average price it’s between $20 and hundred dollars. Younger people usually have to pay less and older people pay more for the same coverage.

Is AARP good life insurance for seniors?

SAARP life insurance is a good option for seniors. It is made specially for people over 50 and packed by New York life, trusted company. You can also get a plan without taking a medical exam, which make it simple and easy to qualify.

What is the best life insurance for seniors?

The best plan depends on what you need

- If you want a short term coverage, choose a term life plan

- If you want lifetime protection, go with a whole life plan

- If you have health problems, the guaranteed acceptance plan is a good option

How much does a $100,000 life insurance policy cost a month?

A $100,000 policy can cost anywhere from $25 to hundred dollars per month depending on your age health and plan type. Younger and healthy people used to get to her rates.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.