Key Points To Take

- Whole life insurance quotes offer lifetime coverage with fixed premiums

- Online quotes make comparison fast and easy

- Instant quotes provide real-time pricing estimates

- Cash value is a major advantage of whole life policies

- Seniors can also access specialized whole life insurance quotes

- Using a quote calculator will help to find a affordable options

- The best policy balances the cost, benefits, and long-term goals

When planning long-term financial security, whole life insurance quotes play a very important role in helping you to protect your family, build cash value, and log in lifetime coverage. Unlike the temporary policies, whole life insurance provides permanent protection with fixed premiums, and also it provides the guaranteed benefits.

In this guide, we will explain so that you better understand whole life insurance quotes online, how to get an instant quote and how to find the best coverage for your needs.

Understanding Whole Life Insurance Estimates Before You Buy

All life insurance quotes are the price estimates that are provided by the insurance companies that show how much you will pay for our whole life policy. These quotes are based on your age, health, coverage amount, and payment structure.

The plan does not work like term life insurance. It includes lifetime coverage, monthly, or annual premiums, guaranteed that benefit and also cash value growth over time. Getting quotes for whole life insurance allows you to compare the policies and choose one that suits your needs and financial goals.

How Whole Life Insurance Quotes Are Calculated Behind the Scenes

When you request a whole life insurance quote, the insurance company calculates your premium using risk factors and policy details. The quote remains pallet as long as the information you have provided stays accurate.

Here are some of the factors that affect your quote:

- Age, the younger applicants get lower rates

- Your health history can also raise the cost

- Gender also make a difference like women often receive lower premiums

- Coverage amount like the higher coverage means the higher premiums

- premium payment plans like monthly vs annual can also make the difference

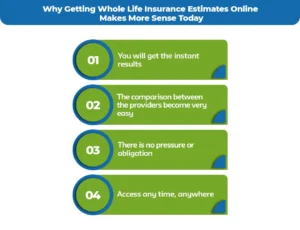

Why Getting Whole Life Insurance Estimates Online Makes More Sense Today

Today, getting whole life insurance quotes online is quick and easy. You can compare multiple insurance companies without speaking to an agent or filing out lengthy paperwork.

here are some of the benefits of online whole life insurance quotes

- You will get the instant results

- The comparison between the providers become very easy

- There is no pressure or obligation

- Access any time, anywhere

With online whole life insurance quote, you can review the policy features, premiums, and the benefit side-by-side before making any decision

Instant Whole Life Insurance Quotes: What You’ll See in Seconds

An instant whole life insurance quote gives you a real time estimate that is based on basic details, such as age, gender, and coverage needs. While final approval can require additional information, instant quotes provide a solid starting point.

Instant quote includes estimated monthly premiums, coverage amount, policy type and payment duration.

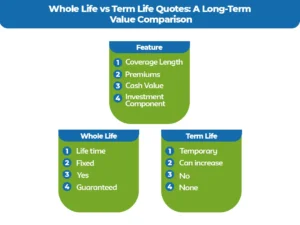

Whole Life vs Term Life Quotes: A Long-Term Value Comparison

Whenever you are comparing with life insurance quotes, whole life vs term, life, the price difference often stands out. Whole life costs more, but offers more benefits as well.

| Feature | Whole Life | Term Life |

| Coverage Length | Life time | Temporary |

| Premiums | Fixed | Can increase |

| Cash Value | Yes | No |

| Investment Component | Guaranteed | None |

How to Spot the Best Whole Life Insurance Quotes Without Overpaying

Finding the best whole life insurance estimate is not always about you selecting the policy with low prices, it’s all about the value, reliability, and long-term benefits.

To get the best quote you just have to compare the multiple insurance companies, choose only the coverage that you need so that you can lock in rates early. Ask about the dividend paying policies and review the insurance companies financial strength before buying.

Senior Whole Life Insurance Quotes: Lifetime Coverage After 50 & 60

senior whole life insurance quotes are specially designed for older individuals who want lifelong protection, final expense, coverage, or estate planning solutions

Senior choose whole life for so many reasons like there is no expiration date, the premiums are predictable, cash value for emergencies and also the approval options are very easy

How Much Does Life Isurance Cost?

There are so many insurance companies who are offering life insurance whole life quote options with simplified underwriting for the seniors so that it will make the coverage more accessible.

What Whole Life Insurance Policy Quotes Reveal About Cash Value Growth

One of the biggest advantages shown in whole life insurance policy quotes is its cash value accumulation. A portion of each premium builds guaranteed cash value saving that grows over time without any tax.

There are so many benefits of cash value you can borrow against it, it comes with the supplement retirement income, and also covers emergencies. It also leaves an additional legacy for your family.

Using a Whole Life Insurance Quote Calculator to Plan Smarter

A whole life insurance quote calculator simplifies the process by giving quick estimates without any long paperwork. These tools will help you to adjust the coverage amount and see how premium.

You can use a calculator to save time. There’s also no obligation, and it helps with the budgeting and provides you with easy comparisons.

Are Whole Life Insurance Quotes Worth the Higher Premium?

While whole life insurance quotes, online prices are a bit higher as compared to the term life insurance policies, but the long-term benefits often outweigh the cost.

Whole life insurance is best for long-term financial planning, state protection, guaranteed inheritance, and lifetime dependence. It is also for the wealth transfer strategies.

Final Thoughts

Wrapping up everything, whole life insurance is a smart step towards whole lifelong financial protection. You just have to remember to always compare the life insurance quotes for whole life policy online, make sure to use the instant quote tools and understand the policy benefits so that you can confidently protect your loved ones by building long term value.

Secure Whole Lifetime Coverage With Mlife Insurance Today

Get personalized whole life insurance quotes in minutes. Lock in fixed premiums, guaranteed benefits, and lifelong peace of mind with M-life insurance. Get your free whole life insurance quote now!

FAQS

A $1,000,000 whole life insurance policy usually costs $800-$2000 per month. The exact price depends on your age, health, and when you buy the policy.

Life insurance costs more than term life insurance because it lasts your entire life and also builds cash value over time. Most of the people pay $100-$500 per month for the smaller coverage amounts.

The whole life insurance policy is the one that fits your budget, offers lifetime coverage and comes from a financially strong company with good customer service.

Life insurance quotes at the price estimate that show how much you have to pay for the policy. They also help you to compare the options before choosing the right insurance plan.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.