Key Takeaways

- Lock low premiums

- Guaranteed lifelong coverage

- Build tax deferred cash

- Insurability for life

- Consider alternatives too

Imagine giving your child a financial gift that goes with them overtime, sometimes that not only protects them but also builds value for their future. That’s what whole life insurance for kids needs to do. More and more parents are exploring this option as a smart way to combine security with savings

In the simple guide you will learn what are the whole life insurance policies for children, and also how it works and how you can buy the plan and compare the prices from the different insurance companies. By the end of this article you will clearly understand if this plan fit your needs and your family’s goals or not.

What Is a Children’s Whole Life Policy?

A whole life insurance policy for kids is also called child life insurance is a plan that provides lifetime coverage for a child. This plan works just like adult whole life insurance, if the child passes away it pays that amount of money to the family. Over time it also builds cash value that grows over time and you can use it or borrow it later in life.

Usually a part parent or guardian owns the policy until the child becomes an adult that is around the age of 18 to 21. After that, the ownership can be transferred to the child.

The big advantage is that the premiums stay the same forever, even if the child’s health changes.

In simple terms, this policy protects your child for life and helps build savings along the way.

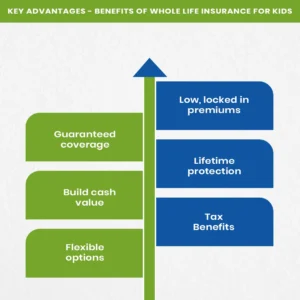

Key Advantages – Benefits of Whole Life Insurance for Kids

Here are some simple clear benefits of life insurance for their families often like, let’s have a look at the benefits for the pattern in the understanding

Low, locked in premiums

The cost is lower when a child is young and healthy, and it never increases as they grow.

Guaranteed coverage

The child stays insured for life, even if they later face health problems or choose a risky job

Lifetime protection

And let them insurance, discover never ends as long as you keep paying your monthly premiums

Build cash value

The policy slowly grow a saving amount that can be used or borrowed in the future

Tax Benefits

The cash value cruise without being text, and the payout after death is usually tax-free

Flexible options

Some plans let you add more coverage later in life, even if the child’s health changes

Common Critiques & Drawbacks

Of course there are also some downsides to whole life insurance for kids. Here are a few common concerns.

Low Returns compared to other investments

The money your policy earns that is cash value this money usually grows slower than if you invested the same amount as mutual funds or the stock market.

Less flexibility with your money

The money you pay as premium is tied up in the policy, if you take money out too early, you might lose part of the death benefit or face extra charges

Premium payments must continue

If you stop paying monthly premium policy and you could lose both your coverage and any savings that are built up

How Much Does Life Isurance Cost?

Limited coverage amount

These policies usually offer a smaller payout, which might not be enough when your child grows up and has bigger financial needs

Insurance is not a main investment tool

Some experts say it’s not smart to treat life insurance as an investment, since it’s mainly meant for protection, not earning money

Is Whole Life Insurance For Kids Worth It?

Yes, buying whole life insurance for a child can make sense in some situations. For example, it is a good idea if you want to log in lifetime stories while your child is young and the premiums are still low. It can also help if you think your child might have health problems in the future that could make getting insurance harder or more expensive later.

Some parents also like it because it encourages saving money regularly, since you have to pay the premiums, this will help you to build cash with you slowly over time. And if you prefer a safe and steady option instead of risking investments, then this policy can be a good addition to your child’s long-term financial plan.

and yes it cannot be a good fit if;

- Your primary goal is college funding or high growth, you can get better returns in stocks, mutual funds, or 529 plans

- You cannot afford to commit to long-term premiums reliably

- You already have alternative mechanisms or savings methods in place

- You view life insurance strictly as risk protection and don’t need coverage in the child’s life

In so many cases, families use a hybrid approach, maintaining a small children’s whole life plan for lifelong guarantee and insurability, while using separate investments or savings for aggressive growth.

Cost And Examples – How Much Does It Cost?

Knowing the cost of whole life insurance is very important so that you can make the better decision for your kids. Let’s have a look at the cost of the whole life plans in easy and simple words

Typical Cost

Most of the whole life insurance policies for the children can range from $10 to $30 per month for the coverage between $5000 and $25,000. The exact price depends on the child’s age, the insurance company and the state where you live. The provided price is just the estimate one but you have to make sure to talk to the insurance company for the exact prices for your plan

Whole life insurance For Kids options

Some plans for the whole life like Gerber Grow Up plan that starts as low as $3.70 per month for $5000 in coverage.

529 Plan Or Whole Life Insurance For Kids

It all depends on the parents that what they want for their kids, lets have a look at both and then you can decide what is best

529 Plans

The plans comes with the following things;

- Tax advantaged growth specially for education

- High potential returns via equities

- Flexibility to change beneficiaries

- No insurance component

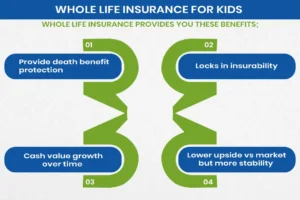

Whole Life Insurance For Kids

Whole life insurance provides you these benefits;

- Provide death benefit protection

- Locks in insurability

- Cash value growth over time

- Lower upside vs market but more stability

Final Thoughts and Recommendations

Whole life insurance for kids is not the plan that is for everyone but this is the smart and the good way to add the long term security to your financial plans and you have to look for some good reputable company to get these plans and also compare the prices from the different insurance companies, the most important thing is that you have to make sure that the plan has the best premiums and you can easily afford it and also it is good for your kids as well as your family financial future

Lets give your child a strong financial start with M-Life Insurance and protect their future today.

FAQS

It depends on your goals. If you want to lock in low rates, guaranteed future coverage, and build a small savings for your kids this plan can be worth it. But if your main goal is to grow money faster, other investment like mutual funds can help you better

The best policy is one that will fit your budget and offers you good coverage with trusted companies. Popular options often include Gerber life., Mutual of Omaha, and New York life, but it’s smart to compare the prices before choosing any plan

It is a type of life insurance policy that is bought for your kids. It gives lifelong coverage and builds cash value over time. A parent or guardian usually owns the policy and the child becomes an adult.

That much coverage for a whole child is very expensive, it can cost hundred of dollars per month or even more than that, depending on the child’s age and the insurance company most of the family choose smaller and affordable policies instead

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.