Key TakeAways

- Whole life insurance cost is higher than term life insurance

- The cost of whole life insurance depends on age

- Health conditions and lifestyle choices can also change the price

- Average whole life insurance cost per month ranges from hundreds to thousands

- Premiums are fixed and guaranteed for life

- Whole life insurance builds guaranteed cash value

- The average cost of whole life increases with higher death benefits

Anyone who is considering permanent life insurance, understanding the whole life insurance cost as one of the biggest concerns for them. The plan is totally different from term life insurance, this policy will last a lifetime and also cash value overtime, but that long-term security comes with higher premiums.

So you are thinking how much does whole life insurance cost and is it worth the price? In this guide, we will break down the cost of whole life insurance, we will also discuss average monthly premiums and pricing factors. Also how it compares to term life coverage, so you can decide if this is the best financial decision or not.

Whole Life Insurance Cost – The Real Price of Lifetime Coverage

Before diving into numbers, here are some points that will help you to understand what you are paying for. Whole life insurance is a permanent life insurance policy that covers you for your entire lifetime, it has fixed, it also builds cash value overtime and pays a guaranteed death benefit.

Because the insurance companies are guaranteeing the coverage for life not just for a few years like 10, 20 or 30. The whole life insurance policy cost significantly higher as compared to the term insurance.

How Much Does Whole Life Insurance Cost in Today’s Market?

For understanding the whole life insurance caused, it is important to know that there is no single price, but on average the whole life insurance can cost 5 to 15 times more than term life insurance for the same death benefit.

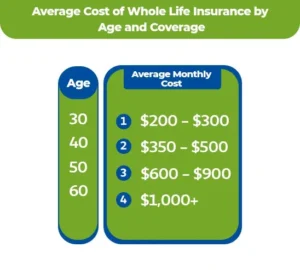

Average Cost of Whole Life Insurance by Age and Coverage

Here we are providing the rough estimate of a $250,000 whole life policy

What Is the Average Whole Life Insurance Cost Per Month?

There are so many people who are comparing whole life insurance costs with term life, and they are shocked by the difference.

- In term life insurance, a healthy 30 year-old can pay $25 per month for a $500,000 term policy

- In whole life insurance, the same coverage can cost $350-$500 per month.

The price difference exists because term life insurance expires after the term. While whole life insurance lasts forever and also builds cash value over time.

Breaking Down Whole Life Insurance Policy Cost Factors

There are several variables that can affect how much a whole life insurance policy costs.

- It can affect the price because the younger you are the cheaper your premiums will be.

- You have a medical condition, smoking, and family health history can significantly affect the pricing. Better health is equal to lower premiums.

- The coverage amount also affects the price. If the death benefit is higher than the whole life insurance can cost you more.

- Gender also plays an important role like women generally pay less because they statistically live longer.

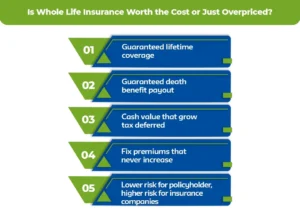

Is Whole Life Insurance Worth the Cost or Just Overpriced?

If you are thinking that why the cost whole life insurance is so high and here is the reasons that can explain better

- Guaranteed lifetime coverage

- Guaranteed death benefit payout

- Cash value that grow tax deferred

- Fix premiums that never increase

- Lower risk for policyholder, higher risk for insurance companies

Average Whole Life Insurance Cost: What Most People Actually Pay

Here is a simple breakdown for a 40 year old. Let’s have a look at the coverage amount and average cost.

| Coverage Amount | Average Monthly Cost |

| $100,000 | $150 – $250 |

| $250,000 | $350 – $500 |

| $500,000 | $700 – $1,000 |

| $1,000,000 | $1,300+ |

How to Reduce Whole Life Insurance Costs Without Losing Coverage

If you want to buy whole life insurance, but you are worrying about the price, here are some of the ways to reduce the cost.

You have to buy at the younger age, make sure to choose a smaller test benefit and improve health before applying. Make sure to compare the multiple insurance companies and consider limited pay policies.

Final Verdict – How Much Whole Life Insurance Really Costs Over Time

So how much does whole life insurance cost? Am I getting all the information? It’s clear that it depends on age, health, coverage amount, and your financial goals. But one thing is very clear that it is a long commitment. While the cost of whole life insurance is higher as compared to the term life insurance, it offers you the benefits that no temporary policy can match like lifetime protection, stable premiums, and cash value growth. If you are looking for guaranteed coverage and you want long-term financial planning, then whole life insurance can be worth the investment. If you want affordability then term life insurance can be a smarter choice for you.

Ready to See Your Whole Life Insurance Cost?

Let’s get a personalized whole life insurance quote in minutes. Let’s compare the top insurance companies, lock in fixed premiums, and find a policy that fits your long term goals.

How Much Does Life Isurance Cost?

FAQS

A $1 million whole life insurance policy usually costs $1200-$2500 per month. The exact price is depending on your age, your health and your smoking habits. If you are younger and healthy, then it will be cheaper. If you are older, then the cost can go up a lot.

A $500,000 whole life insurance policy can cost $600 to $1200 per month. This is much more expensive as compared to the term life insurance because whole life insurance covers you for life, builds cash value and it also has fixed premiums.

A $100,000 whole life insurance policy can still cost $100 to $300 per month. Younger and healthy people can pay around $100 while the older people can pay closer to $300 or more per month.

The $10,000 whole life insurance policy can cost you about $20-$50 per month. Most of the time these small policies can be used for financial expenses and funeral expenses. They are easier to qualify for and usually do not require any medical exam.

The whole life insurance cost is the amount you have to pay every month or year to keep the policy active for your entire period. Whole life can cost more because the coverage will never expire, the premiums never increase and it builds cash over time.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.