Ever wondered if Vantis Life Insurance is the right fit for your needs? With so many options out there, choosing the perfect life insurance policy can be overwhelming. Vantis Life Insurance promises comprehensive coverage and flexible options. Let’s dive into a detailed review and see if Vantis Life Insurance stands up to your expectations.

What is Vantis Life Insurance?

Vantis Life Insurance Company originated in the year 1942 and today it is among the largest insurance agencies in the country. Vantis Life Insurance has been in business for more than 75 years specializing in insurance thus it is poised to provide its clients with different life insurance products and annuities.

Take a look at the following table for some quick information regarding Vantis Life Insurance company.

Key Vantis Life Insurance Info Vantis Life Insurance Data

| Year Founded | 1942 |

| Current Executives | Ray Caucci, CEO |

| Number of Employees | 51 to 200 employees |

| HQ Address | 200 Day Hill Rd, Windsor, CT 06095 |

| Phone Number | (866) 826-8471 |

| Company Website | www.vantislife.com |

Headquartered in Windsor, Connecticut, Vantis Life provides families with affordable life insurance products. The company is a part of Penn Mutual Life Insurance Company, which means Vantis Life is consequently financially strong and stable.

Which types of life insurance does Vantis Life sell?

At Vantis Life, the company provides more than one option in life insurance, with term life insurance quotes included. Specifically, Vantis Life Insurance Company offers:

- Velocity Whole Life Flex Complete: a whole life insurance policy that can benefit you and your family.

- Guaranteed Golden: It refers to that last expense policy in life insurance that pays out the agreed amount on the policyholder’s death.

Another common type of life insurance is term life insurance which is cheaper than permanent life insurance. Term insurance is life insurance protection for a specific timeframe or for a term usually ranging from 10 to 30 years. In fact, the whole life policy is different from this one because you do not buy the cash value or any other extra with it.

Term life provides coverage to your family and other loved ones with less expenditure. Term insurance is advantageous to customers who have obligations that require lower, fixed prices such as paying for debts and supporting a family.

However, some advantages come with this plan, even though it is relatively more costly than the others; this is true for whole life insurance. For instance, a whole life policy provides you with financial coverage for a lifetime and does not expire. Second, there is the portion with the whole life policy where you pay a part of your premium to build up cash value over time in case of incidents.

Final expense is a kind of permanent life insurance policy that is specifically for the individual’s final expenses like funerals, medication, and more.

Does Vantis Life have good whole life insurance?

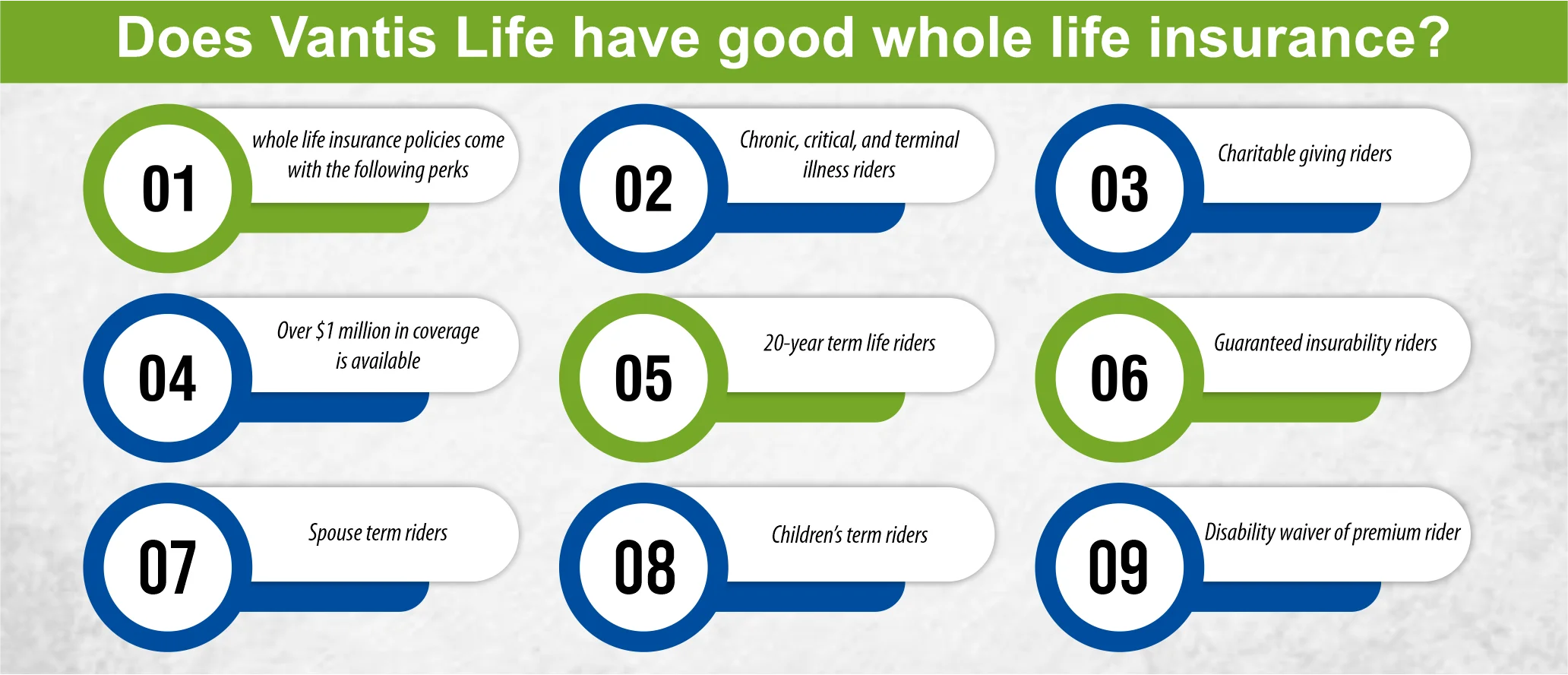

Vantis Life specializes in life insurance. Their Velocity Flex Complete whole life insurance policies come with the following perks:

- Chronic, critical, and terminal illness riders

- Charitable giving riders

- Over $1 million in coverage is available

- 20-year term life riders

- Guaranteed insurability riders

- Spouse term riders

- Children’s term riders

- Disability waiver of premium rider

Your independent insurance agent can help you find out more about Vantis Life’s whole life insurance policies as well as the other products offered.

Other Types of Insurance Products

In addition to the provided life insurance solutions, Vantis Life Insurance Co. offers a couple of annuity types. The additional Vantis Life annuities products include:

- TaxSaver Freedom ROP

- TaxSaver Freedom MVA

People usually go for annuities because they offer fixed income in the period of retirement. However, if you pass away too soon, you may not fully benefit from an annuity.

Once more, if you are uncertain about which particular policy to take, you should discuss this matter with an agent.

Good Life Insurance Policy for Mature Seniors and Adults

As we age, it can become increasingly difficult to find an affordable life insurance policy that meets your needs. However, Vantis Life has built a company with mature adults as one of its core customer bases.

For this reason, they offer a variety of solutions to meet some of the following needs:

- Burial or cremation costs

- Restoring value to existing insurance that has been eaten away by inflation

- Providing a gift for someone you love

- Helping to pay off debts and bills so as not to burden the family

- Paying off current mortgage

- Paying off any tax-related expenses

It should be noted that this guaranteed acceptance policy is not unique in helping seniors and mature adults with these needs, but it is a core solution to this career. Some other carriers are experts in other types of policies, such as term insurance or annuities. Or they are experts in working with other customer segments, like younger singles or families. Vantis Life is one of the carriers that focuses on the mature market.

How Much Does Life Isurance Cost?

Vantis Life Insurance Reviews

While comparing life insurance companies, it is essential to gather the opinions of customers and their ratings from reliable rating services. Moreover, financial ratings and customer feedback are informative in evaluating the importance a specific company pays to customer service and the overall financial health of the company.

The National Association of Insurance Commissioners (NAIC) on the other hand is a credible source when it comes to studying how customers feel about a certain company. On the NAIC Complaint Index, Vantis Life scores exceptionally well, with a 0.0 for 2020, meaning there were no customer complaints that year.

It is also important to look at a company’s financial capabilities because there is the possibility that a certain company is financially unsound meaning that it will not be able to cover you well. For instance, according to its rating by A. M. Best, Vantis Life has a superior financial strength score of A+. A high A. M. Best score indicates that a company has good financial health and, therefore, can pay out in the event of a claim.

Bottom line

Vantis Life Insurance Company is an established insurance agency that has been in the insurance sector for more than 75 years with proven records. The firm’s dedication to maintaining high standards of customer service and satisfaction ensures that the customers of Vantis Life will be able to easily purchase the product.

There are several options of coverage for the clients to select in Vantis Life; they include term policies, whole policies and annuities. Vantis currently has a good financial rating and customer satisfaction testimonials from prominent rating companies such as A.M. Best and NAIC.

When it comes to searching for the most suitable life insurance rates and companies, always try to get quotations from different firms.

FAQs

1- What is Vantis Life’s average claim response time frame?

Vantis Life provides no information for its customers regarding filing claims. The carrier provides several types of forms for customers to print out and mail; however, none of them are specified as claims forms.

2- What is Vantis Life’s customer service availability?

Vantis Life only offers phone and snail mail contact options in terms of customer service, which seems quite outdated by today’s standards. Their customer service phone line is available at restricted hours, Monday-Friday. The insurance company does have a social media presence on Facebook, LinkedIn, and Twitter, which makes it a bit more accessible to customers.

3- What is Vantis Life’s claims process?

Vantis Life’s official website provides many different forms for customers to print and mail to the carrier. None of the forms seem to be for claims, however. If a customer wants to file a claim, they will most likely have to call the carrier directly or go through their independent insurance agent.

4- Is Vantis Life a good insurance company?

Vantis Life has been around for several decades now and has been highly rated by both A.M. Best and the BBB. The carrier has also demonstrated impressive financial strength. Coverage is available across the country, and several forms of life insurance are offered for customers with varying needs. While some customer feedback is mixed, it appears that the vast majority of folks are satisfied with the carrier and its coverage. Overall, it does seem that Vantis Life can be considered a good insurance company.

References:

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.