Important points To Remember

- Affordable coverage

- Instant quotes

- No medical exam

- Online comparison

- Flexible terms

- Family protection

- Financial security

Finding the right life insurance does not have to be very confusing or time-consuming. With term life insurance quotes online you can compare the prices, the coverage options and the benefits in just a few minutes without any pressure or long paperwork. No matter what you want if you are protecting your family, covering the debts or planning for the future, getting the right term life insurance quote is the first and the most important step to take.

In the detailed guide, we will explain about the term life insurance, how online term life insurance courses work and how to find the best life insurance quotes, including the options with no medical exam.

Simple Understanding Of Term Life Insurance

Understanding the term life insurance is very important. The term life insurance provides coverage for a specific time that is usually 10, 20 or 30 years. If the insured person passes away during this term, then the policy pays a death benefit to the beneficiaries. If the term ends and the policyholder is still alive, then the coverage simply expires, and you have to buy a new policy or renew the older one.

Because it’s straightforward and temporary, the term life insurance is often the most affordable type of life insurance that is available. This is why there are so many people who search for the life insurance quote instead of permanent policies.

Why People Choose Term Life Insurance Quotes Online

The Internet has made buying life insurance much easier. Instead of meeting agents or filling out long forms, You can now get free term life insurance quotes instantly.

Here we are addressing some of the benefits of getting the quotes online

- Fast and convenient

- Easy comparison of multiple insurance companies

- Transparent pricing

- No pressure from sales agent

- Instant policy estimates

With term life insurance quote online you can see the real prices that are based on your age, health and the coverage needs in just a few clicks.

How Term Life Insurance Quotes Work

After getting a better understanding now you must be thinking about how term life insurance quotes work. Life insurance quote is an estimate of how much you will have to pay for the coverage. Quotes are based on several factors like your age, gender, healthy history, smoking habits, coverage amount and the policy length.

When you request an online term, life insurance quote, the insurance companies used this information to calculate and estimate the pricing.

Instant Term Life Insurance Quotes: What Does “Instant” Mean?

An instant term life insurance quote gives you a price immediately after entering the basic details. These are the estimates, you just have to remember that these are not final approval, but they are very accurate.

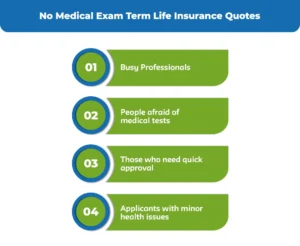

No Medical Exam Term Life Insurance Quotes

This is one of the most searched options today that is term life insurance quote no medical exam is available or not. All these policies skip the traditional medical exam and totally rely on health questions and the data checked.

Here are some of the people who can consider no exam quotes

- Busy Professionals

- People afraid of medical tests

- Those who need quick approval

- Applicants with minor health issues

Online Term Life Insurance Quotes vs Traditional Quotes

| Online Quotes | Traditional Quotes |

| fast and instant | slow process |

| easy comparison | limited options |

| often cheaper | higher overhead costs |

| available 24/7 | appointment based |

How to Compare Term Life Insurance Quotes Properly

Getting multiple quotes is a very smart option, but knowing how to compare them is even smarter. Here are some of the key things to compare whenever you are buying a term life insurance.

- Coverage amount

- Policy term length

- Monthly premiums

- Company reputation

- Riders and benefit

- Renewal options

Who Needs Term Life Insurance?

The term life insurance is best for the parents with the young children, homeowners with mortgages, business owners, single income families, and anyone with financial dependence. If someone relies on your income, then getting a term life insurance policy quotes should be the priority.

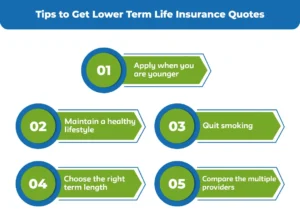

Tips to Get Lower Term Life Insurance Quotes

Here are some of the tips to get a lower term life insurance quote. For that you have to

- Apply when you are younger

- Maintain a healthy lifestyle

- Quit smoking

- Choose the right term length

- Compare the multiple providers

How Much Coverage Do You Need?

A common rule is 10 to 15 times your annual income value. It depends on your outstanding debts, your living expenses, education cost, and the future goals.

How Much Does Life Isurance Cost?

Using the online term life insurance quotes, you can adjust the coverage amount and instantly see how premiums change.

What Makes a Term Life Insurance Quote the Best

The best life term insurance quotes are not always the cheapest. The best quote balances the price, coverage and the reliability.

A good policy should offer you the affordable premiums, the strong, financial backing, simple claim process and also flexible policy options. You always have to choose value over price alone.

Final Words

Getting the right term life insurance quote online is easier than ever. No matter you want the instant, you want no medical term life insurance quote to compare the term life insurance courses. The most important thing is to understand what you need and review your options very carefully. With the right approach, you can secure affordable protection that will give you and your loved ones peace of mind.

Lets get instant call affordable term life insurance quotes online from M-life Insurance. No hassle, no pressure. Compare the plans and secure the coverage your loved ones deserved in a minute.

FAQS

For a healthy adult, it usually costs $20-$40 per month. The price depends on age, health, smoking, and insurance company.

You get limited coverage often $5000-$15,000 mainly for the final expenses. It’s not full-time life insurance and offers much lower benefits.

A reasonable cost is $15-$50 per month for most people. Younger and healthier people usually pay less for the higher coverage.

It usually costs $8 to $50 per month for a healthy adult. The older age or the health issues can also increase the price.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.