Life insurance is a very important financial tool that will protect your loved ones when you are no longer around them. But what if you could use that same policy to cover the high cost of long-term care in old age? That is the time of your life insurance with a long-term care rider comes in and saves your life.

This policy not only gives your family a death benefit when you pass away but also helps you to pay for the long-term care expenses such as nursing homes, assisted living or in-home service.

Let’s understand what life insurance with a long term care rider is? how it work, it’s benefits and costs if it’s worth buying or not

What Is A Rider In Life Insurance

Rider is an optional ad on feature that you can include in your life insurance policy for extra protection or benefits. You just think of it as a small upgrade to your base plan.

For example

- A term life rider offers the person temporary extra coverage

- A child rider life insurance will cover your children under the same policy

- Long-term care writer will help you to pay for the medical and personal care when you cannot perform daily activities due to age or illness

So whenever you are thinking, what is a rider on a life insurance policy? It is a very simple way to customize your plans according to your personal needs like adding health or any other protection.

What Is The Life Insurance With Long Term Care Rider

The LTC rider allows you to use part of your death benefit while you are still alive if you need long-term care. The insurance company will pay you monthly or lump sum benefits to help cover the extra costs like nursing home stays, assisted living facility expenses, home health aid or caregiver support, rehabilitation or therapy costs.

In most of the cases to qualify for the LTC benefits, a doctor must confirm that you cannot perform at least two of six basic daily activities such as bathing, dressing, eating or walking.

How Life Insurance With Long Term Care Rider Works

Let’s have a look at an example, so you will better understand how life insurance with LTC rider work

Suppose you have a $300,000 life insurance policy with a long-term care rider

If you need long-term care later in life, you can start using a portion of your death benefit. You can say $200,000 to pay for the medical or personal care.

When you pass away, your beneficiaries will get the remaining $100,000 as a death benefit.

If you never need long-term care, your family will get the full $300,000.

It’s a win-win solution like you get both protection and flexibility from your life insurance policy.

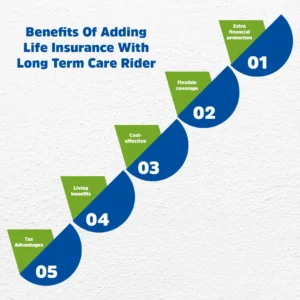

Benefits Of Adding Life Insurance With Long Term Care Rider

There are so many benefits of adding riders to life insurance lets have a look at the key benefits.

Extra financial protection

Riders will help you to prepare for the unexpected things in your life like illness, disability, or any accident

Flexible coverage

Riders can also let you to adjust your policy to match your personal or family needs

How Much Does Life Isurance Cost?

Cost-effective

If you are adding the riders, it means that you are buying it at cheaper rates as compared to by the separate insurance policies.

Living benefits

Some writers, like LTC or critical illness, also let you access money while you are still alive.

Tax Advantages

Long-term care benefits from writers are often tax-free, it depends on your area where you live.

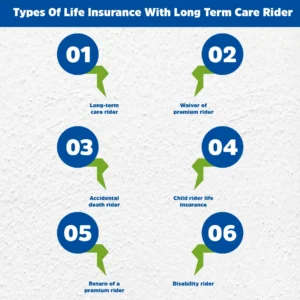

Types Of Life Insurance With Long Term Care Rider

There are so many kinds of riders you can add to your policy. These include;

Long-term care rider that will cover the cost of long-term medical or personal care

Waiver of premium rider, it waives future premium payments if you become disabled.

Accidental death rider that provides extra payout if death results from an accident

Child rider life insurance that will offer small coverage for your children

Return of a premium rider, it will refer premiums if you outlook the ter

Disability rider, that will provide income replacement if you become unable to work

Term Life Rider Vs Whole Life Rider

A term life insurance with long term care rider will provide you temporary coverage for a specific time that is 10, 20, or 30 years. It is more affordable but the plan ends when the term expires.

Talking about the whole life writer, this is the permanent plan and also lasts for your entire life. The plan also builds cash value which you can borrow or use money later in life when you need it.

If you want long-term security then the whole life policy within an LTC writer is a great option for you because it will make sure that you can get the both lifetime coverage and care benefits

Life Insurance With Long Term Care Rider – Pros And Cons

| Pros | Cons |

| Dual benefit — life coverage + long-term care. | Higher premiums than standard life insurance. |

| Protects retirement savings from being used for medical costs. | Reduces death benefit if LTC benefits are used. |

| Benefits are usually tax-free. | Medical approval required (some may not qualify). |

| Flexibility: you can use funds as needed. | Not all policies offer the same payout structure. |

Is Life Insurance With Long Term Care Rider Worth It?

Yes, for so many people life insurance with a long term care rider is worth it. If you are worried about the rising cost of long-term care and don’t want to buy a separate LTC insurance policy, this combination offers you the best of both worlds. According to data, long-term care costs can exceed $90,000 per year in nursing facilities. Being such a huge amount out of your pocket can quickly drain your savings.

With these riders, you can use your life insurance funds for care and still leave a portion behind for your family and loved ones. However, it is very important to compare the plans, check the cost and understand how much of the benefit can be used for LTC.

Life Insurance With Long Term Care Rider Cost Comparison

| Type of Life Insurance | Monthly Cost | LTC Rider added cost | Coverage duration |

| Term Life (20 years) | $50 – $100 | +$10 – $25 | Limited term |

| Whole life | $150 – $300 | +$40 – $70 | Lifetime |

| Universal Life | $200 – $400 | +$50 – $80 | Flexible term |

What Is The Best Life Insurance With Long Term Care Rider

The best policy depends on your age, health and your goals. However, there are some known insurance companies with strong LTC writer options that include.

- Lincoln financial life insurance

- nationwide life

- John hancock

- Prudential

- New york life

These companies look for the policies that offer flexible benefit payout options, cover booth facility and home care, have cleared terms for activation and cause and provide inflation protection so benefits can go overtime.

Final Thoughts

Life insurance with long term care is one of the most practical and flexible options for anyone who wants lifelong protection and financial peace of mind. It also makes sure that you will not have to sacrifice your savings for one benefit when you are gone.

You have to make sure that before purchasing your plan, always compare the policies, understand the cost and talk to the license insurance agent to find the best life insurance with LTC rider for your needs.

Planning for tomorrow starts today.

With M-Life Insurance, you don’t just protect your family, you protect yourself too.

FAQS

The best life insurance with an LTC writer depends on your age, wealth, and budget. Top companies who are providing these plans. Before choosing you have to compare the prices and how much coverage it will provide you for long-term care and home care.

Yes, it is worth it for the people who want protection in one, life insurance for family and long-term care coverage. It can help to pay for the expensive care cost in the future without using up your savings.

An LTC writer is an add-on to your life insurance policy. It will help you to use the part of your death benefit money while you are still alive.

The cost depends on your age, health and type of policy you choose. On average an LTC writer increases your life insurance premium by about 15% to 25%.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.