Key Insights On Life Insurance For Diabetes

- Life insurance for diabetics is widely available today

- Both type 1 and type 2 diabetes can qualify for coverage

- Term life insurance offers affordable and high coverage amounts

- Whole life insurance provides lifetime protection, and cash value

- Children with diabetes can also be insured

- Good diabetes management improves the approval and rates

- Working with the right insurance company makes a big differences

Living with diabetes, does not mean that you cannot protect your family’s financial future. Life insurance for diabetics is more easy to get today than ever before. There are so many insurance companies offering affordable options for people with diabetes, including both type 1 and type 2 diabetes, as well as coverage for children.

In this guide, we will explain how life insurance works for diabetics, the best policy types that are available today and how diabetes affects the premiums. We will also discuss how to use the best life insurance for diabetics without stress or confusion.

What Makes Life Insurance Possible for Diabetics Today

Life insurance for diabetes, especially designed to provide financial protection to your loved 1s if something unexpected happens to you. While diabetes does increase health risks, insurance companies can no longer automatically deny the coverage.

Instead, companies can evaluate the type of diabetes, age of diagnosis, blood sugar control, medication, or insulin use, and overall health and lifestyle. With good management, there are so many people who can qualify for competitive rates.

Can People with Diabetes Really Get Life Insurance?

Yes, absolutely. Life insurance for people with diabetes is still available through most major insurance companies. Advances in medical treatment and better understanding of diabetes have made underwriters more flexible.

People who maintain stable blood sugar levels, can follow treatment plans and attend the regular medical checkups often receive approval at reasonable premiums. Even those with long-term diabetes can still find strong coverage options.

Coverage Choices for Type 1 Diabetes Explained Simply

Life insurance for type 1 diabetes is more expensive than type 2, but it is far from impossible.

Type 1 diabetes is typically diagnosed earlier in life, and it requires insulin use, because of this the insurance company looks closely at the consistency of insulin use, history of complications, hospitalizations, and A1 C trends over time. Applicants with a good role and no major complications often qualify for term life insurance for diabetics, at manageable rates.

Getting Life Insurance with Type 2 Diabetes: What to Expect

Life insurance for diabetics type 2 is often easier to obtain and more affordable. This is possible especially when the condition is under control. You can receive better rates if your diabetes is managed with diet or oral medication. If the diagnosis occurred later in life or no related complications exist. There are so many insurance companies who consider type 2 diabetes a manageable condition rather than a high-risk illness.

Which Policy Is the Best Life Insurance for Diabetics?

Choosing the right policy, depends on your age, budget and long-term goals. Here are some of the most common options that are available.

Why Term Life Insurance Works Well for Diabetics

Term life insurance for diabetics provides coverage for a specific time period. That is 10 years, 20 or sometimes 30 years.

This plan is very popular because of its lower premiums, and high coverage amount. This option is best for income replacement and family protection. Also this plan works well for diabetics with stable health who want affordable coverage.

Whole Life Insurance for Diabetics: Lifetime Security Benefits

Whole life insurance for diabetics offering life of protection, and it also includes a cash value component.

This plan works best and it includes the benefits like the coverage that never expires, it has experience and it also builds cash value over time.

It is a good choice for lockdown financial planning, estate planning, and those who want to get protection, regardless of health changes later.

Protecting Your Child’s Future: Insurance for Diabetic Children

There are so many parents who are worried about securing life insurance for children with diabetes, but the good news is that the option also exists.

There are some of the insurance companies who are offering guaranteed issue policies, whole life plans with smaller coverage amounts, and policies that lock in insurability early.

Buying insurance for a child with diabetes can also help to make sure that there are available future financial protection and also the coverage that grows over time.

How Much Does Life Isurance Cost?

How Blood Sugar Control Impacts Your Insurance Cost

Insurance companies calculate the risk using the medical data. Diabetes impacts the premiums that are based on control and complications.

Here are some of the factors that can improve the

- A1c under control

- Healthy BMI

- No smoking

- Active lifestyle

- No heart, kidney or nerve issues

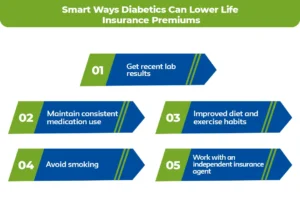

Smart Ways Diabetics Can Lower Life Insurance Premiums

If you are diabetic patient, preparation can make a big difference in your monthly premiums. Here are some of the things that you have to look for before applying.

- Get recent lab results

- Maintain consistent medication use

- Improved diet and exercise habits

- Avoid smoking

- Work with an independent insurance agent

Why Choosing the Right Insurance Company Matters

Not all the insurance companies treat diabetes the same way. There are some of the specialized companies in life insurance for people with diabetes and offering better underwriting guidelines.

An experienced agent can compare the multiple companies, it also matches you with diabetes friendly insurance companies. It also saves time and money and avoids any unnecessary rejections. Their approach will increase your chances to find the best insurance for diabetics.

Final Things Every Diabetic Should Know Before Applying

Diabetes should never stop you from protecting the people you love. No matter if you are looking for a type 1, a type 2 diabetes or you want to cover your child. With the right plan, proper guidance and the correct medical information you can secure the best life insurance that can fit your needs and budget. Always make sure to go for the options that are providing the best coverage to your family.

Protect Your Family With M-life Insurance Today!

Diabetes should not limit your future. MLife Insurance will help the diabetics to find affordable, reliable life insurance plans that are fast, simple and stress-free.

FAQS

Yes, most diabetics can get life insurance. If your diabetes is controlled and you are following the treatment and there are so many companies who approve your application.

Term life insurance is usually best because it is affordable. Whole life insurance is good if you want lifetime coverage and savings.

Yes, with a good diet, medicine and exercise. There are so many people with type 2 diabetes, live long, healthy lives.

You can claim life insurance, benefits, health coverage, and disability benefits, and it depends on your policy and country rules.

It depends on your age, health and diabetes control. Many diabetics pay only slightly more than non-diabetics if the condition is well managed.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.