Last Updated on: August 5th, 2025

- Licensed Agent

- - @M-LifeInsurance

Having a thyroid problem is never an easy thing, and a lot of body parts are affected by this disease. I met a lot of people who have Graves’ disease, and they are always wondering about life insurance. They have a lot of questions if they can still get life coverage. The answer is yes, and in this simple guide, we’ll explain everything you need to know about life insurance and Graves’ disease. We will also cover how it works, if it’s seen as a serious illness by insurance companies, what happens when you apply, and how to find the best policy for you.

What Is Graves’ Disease?

Before getting into the details of Graves’ life insurance, let’s have a short look at what kind of disease this is. Graves’ disease is an autoimmune disorder that causes hyperthyroidism, or an overactive thyroid. Your immune system mistakenly attacks your thyroid gland, causing it to produce too much thyroid hormone. This can lead to a range of symptoms such as:

- Weight loss

- Rapid heartbeat or palpitations

- Anxiety and irritability

- Fatigue

- Heat sensitivity

- Bulging eyes

Graves’ Disease Life Insurance

Under most critical illness insurance policies, Graves’ disease is not considered a critical illness. So, life insurance does pay out for Graves’ disease, as long as your policy is active and you are honest on your policy application, the insurance company will give you money when you pass away, no matter what is the cause of death, and if you die because of the Graves’ disease and you told the truth about your condition when you applied, your family or the person you choose will get the full money.

The most important thing is that you have to be honest when applying. If you hide your Graves’ disease or any other health problem, the insurance company will not pay after your death.

How Does Graves’ Disease Life Insurance Work?

Graves’ disease life insurance works the same as a standard life insurance, but there is an additional thing that the company will ask you more health questions, or they will need more details before they approve your plan. It works like regular life insurance, just with a few extra steps.

1. Application Process

When you apply for life insurance with Graves’ disease, the insurance company will ask you a few extra health questions. They want to know when you were first diagnosed with this disease, what your current symptoms and what medication you are using. They also ask about the surgery, if you had any. All of this helps them to understand your health better so they can decide at what cost they have to give you the coverage.

2. Medical Underwriting

There are a lot of insurance companies that look at how serious and stable your Graves’ disease is. If your condition is stable with the ongoing treatment and you have not had any major health problems because of this, you have a chance to get the policy at a regular or close to regular price. But if your condition is serious and you have a lot of complications, then the insurance company will charge you higher monthly payments and they also limit the coverage of the policy.

3. Types of Life Insurance Available

People with Graves’ disease have options to choose from.

- Term Life Insurance: This life insurance gives you fixed coverage for a specific period (10, 20, or 30 years)

- Whole Life Insurance: This policy gives permanent coverage with a cash value.

- Guaranteed Issue Life Insurance: There is no medical exam, but a limited death benefit and a higher cost

- Simplified Issue Life Insurance: There is no exam, but a health questionnaire is required.

Cost Of Graves’ Disease Life Insurance

The price of life insurance for someone with Graves’ disease depends on the overall health and how risky it is to be insured. Here are some things that can affect the price:

- Your age and your gender

- The type of life insurance you choose (like term or whole life)

- How much coverage you want

- How serious your Graves’ disease is

- If you have any other health problems

All of these things help the insurance company decide how much you will need to pay each month.

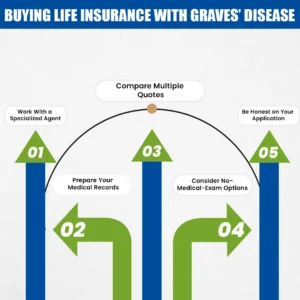

Buying Life Insurance with Graves’ Disease

When you have Graves’ disease, it’s hard and a little bit confusing when buying a life insurance policy. But it is possible if you follow the steps. Let’s have a detailed look for a better understanding.

1. Work With a Specialized Agent

At first, it is very important to pick an insurance agent who has experience helping and working with people who are suffering from this condition. They will better understand your condition and give you the best plans and help you to apply in a way that gives you the best chance of getting approved.

2. Prepare Your Medical Records

You have to make sure that you have all the details, treatment plan, and all other medical records ready in your hands. This will help you to give clear and correct information, and as a result, the insurance company will review your application faster.

3. Compare Multiple Quotes

There are so many insurance companies, and they all treat Graves’ disease differently. So, make sure to compare the prices while buying the policy.

4. Consider No-Medical-Exam Options

If you were recently diagnosed or have a more serious case of Graves’ disease, you will have trouble getting regular life insurance. In that case, you can check out guaranteed issue or simplified issue policies. These types cost more, but they can still give you coverage when other policies won’t.

5. Be Honest on Your Application

You have to be honest about your health condition when you are applying for life insurance. If you hide it, the insurance company will refuse to pay out the policy amount later to your family. Being truthful helps you to get the right coverage, and this will avoid problems in the future.

How Much Does Life Isurance Cost?

Final Thoughts

Having Graves’ disease does not mean that you can not get life insurance. You can get it, but you have to make a little effort to find the best plan for you. The most important thing that you have to work with an insurance company that understands the disease and is willing to be flexible with the coverage options. Make sure to be honest with your condition. This will give you and your family a secure future that you deserve.

Need help finding the best Graves’ disease life insurance?

Work with our specialists who know how to navigate the underwriting challenges and match you with the right insurer.

Let your condition work with you, not against you, and protect your loved ones for the future.

FAQs

1. How does Graves’ disease life insurance work?

It works like standard life insurance, but the underwriting process may involve additional review of your medical history, lab results, and treatment history.

2. Can you get life insurance after a Graves’ disease diagnosis?

Yes, you can get life insurance if you have Graves’ disease. You will have a chance to get the regular life insurance policy if your condition is under control. If your case is more serious, you can still get coverage through special plans called guaranteed issue or simplified issue policies.

3. Does life insurance pay out for deaths caused by Graves’ disease?

Absolutely. As long as you disclosed your condition honestly and your policy is in force, beneficiaries should receive the full payout.

4. Is Graves’ disease considered high-risk for insurers?

It depends. If well-controlled, insurers may not consider you high-risk. However, if there are serious symptoms or complications, you might receive a substandard rating or be declined by some providers.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.