Convertible term life insurance offers flexibility for people who want affordable coverage today with the option to convert it into permanent coverage later. If your financial needs change over time, a convertible term life insurance policy can help you adjust without starting over.

In this guide, we’ll explain what convertible term life insurance is, how conversion works, the pros and cons, cash value considerations, and whether you should convert term life insurance to whole or permanent life insurance.

What Is Convertible Term Life Insurance?

Convertible term life insurance is a type of term policy that allows you to convert your term life insurance to whole life or another permanent life insurance policy without taking a new medical exam.

This means even if your health changes, you can still secure permanent coverage. Many people choose term life insurance that converts to whole life because it provides long-term flexibility at a lower initial cost.

What Is the Main Benefit of a Convertible Term Insurance Policy?

The main benefit of a convertible term insurance policy is guaranteed insurability. You can convert your policy regardless of changes in health, age, or lifestyle.

This feature is especially valuable if you develop a medical condition or want lifelong coverage later in life without requalification.

What Is a Convertible Feature of a Term Insurance Policy?

The convertible feature allows you to change your term policy into permanent life insurance within a specific conversion period.

Most policies specify:

- A deadline to convert (often before age 65)

- Which permanent policies you can convert to

- Whether partial or full conversion is allowed

Renewable and Convertible Term Life Insurance Explained

Renewable and convertible term life insurance allows you to renew your coverage at the end of the term and convert it to permanent insurance if needed.

What Is a 20-Year Renewable and Convertible Term?

A 20-year renewable and convertible term policy provides coverage for 20 years, with the option to renew or convert during that period. Premiums increase upon renewal, but conversion avoids medical underwriting.

Can You Convert Term Life Insurance to Whole Life?

Yes, you can convert term life insurance to whole life if your policy includes a conversion option. The conversion process does not require a medical exam, but premiums will be higher than term insurance because whole life provides lifetime coverage and cash value.

Converting a Term Life Insurance Policy to Permanent Life Insurance

Converting a term life insurance policy typically involves:

- Choosing the permanent policy type (whole life or universal life)

- Selecting how much coverage to convert

- Locking in premiums based on your age at conversion

Many policyholders convert part of their coverage to manage costs while keeping some term insurance active.

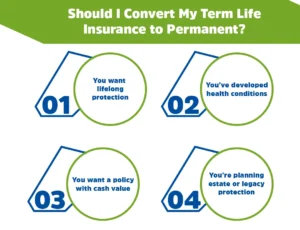

Should I Convert My Term Life Insurance to Permanent?

You should consider converting term life insurance to permanent coverage if:

- You want lifelong protection

- You’ve developed health conditions

- You want a policy with cash value

- You’re planning estate or legacy protection

If your coverage needs are temporary, keeping term insurance may still be the better option.

Convertible Term Life Insurance Pros and Cons

Pros

- No medical exam required for conversion

- Flexible transition to permanent coverage

- Protects against future health risks

- Long-term financial planning option

Cons

- Permanent insurance premiums are higher

- Conversion deadlines apply

- Limited permanent policy options depending on insurer

Does Convertible Term Life Insurance Have Cash Value?

Convertible term life insurance does not have cash value while it remains a term policy. However, once you convert to whole life or permanent insurance, the new policy can begin building cash value over time.

Convertible term life insurance cash value only applies after conversion, not during the term period.

How Much Does Life Isurance Cost?

Best Options for Converting Term to Whole Life

The best options for converting term to whole life depend on:

- Your age at conversion

- Budget and long-term goals

- Whether you want guaranteed premiums

- Cash value growth preferences

Whole life insurance offers predictable premiums and steady cash value growth, making it a popular conversion choice.

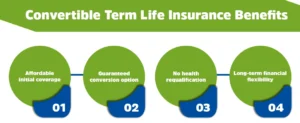

Convertible Term Life Insurance Benefits

Key convertible term life insurance benefits include:

- Affordable initial coverage

- Guaranteed conversion option

- No health requalification

- Long-term financial flexibility

This makes it a smart choice for individuals whose insurance needs may change over time.

Final Thoughts

Converting term life insurance to permanent life insurance is a strategic decision that depends on your financial goals, health, and long-term needs. A convertible term life insurance policy gives you the freedom to adapt without losing coverage.

At M-Life Insurance, we help you choose the right convertible term life insurance policy with confidence.

Contact us today to explore your conversion options and protect your future with expert guidance.

FAQS

No, term policies don’t build cash value, but converted permanent policies can.

Conversion makes sense if you need lifelong coverage or want cash value benefits.

Yes, that is the primary advantage of a convertible term life insurance policy.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.