Last Updated on: August 19th, 2025

- Licensed Agent

- - @M-LifeInsurance

There are a few names that are trusted as financial advisors. Suze Orman is one of those who comes up with the best financial advice. She is a well-known financial expert and famous for giving the best financial advice that helps people make better financial choices. There is one topic that she talks about a lot, which is life insurance. She shares her opinion on which type of life insurance is best for people and what they should choose.

If you’ve ever thought about, “What does Suze Orman think about life insurance?” or “Does Suze Orman recommend term life insurance?” This guide will explain her advice, the reasons behind it, and how her ideas compare to what other experts say.

Table of Contents

ToggleWhat Is Suze Orman’s Opinion on Life Insurance?

Suze Orman has been very clear for many years about the opinion that most people should buy term life insurance. There is no need to buy whole life, universal life, or variable life insurance policies.

The main reason for her opinion is very simple that you should pay for the insurance only when you need it, and there is no need to mix insurance with investment. She believes that insurance is just for protection, and investments are meant for growing your money, and when you combine both of them, it just costs you more and does not give the best results.

She says, “The only reason to have life insurance is to replace your income if you die.” In other words, you should keep life insurance only while your family or dependents still depend on your income.

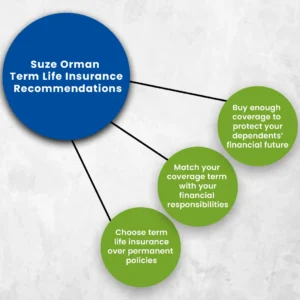

Suze Orman Term Life Insurance Recommendations

The recommendations of Suze Orman came in three major points. Let’s have a look

Choose term life insurance over permanent policies

- She believes that buying term life insurance is the best option because term life insurance provides coverage for a set number of years, like 10, 20, or 30 years. She believes this allows you to afford the higher coverage amount without overpaying because of the lower premiums every month.

Match your coverage term with your financial responsibilities

- If your youngest child is 2 years old and you want to support them until they finish college, a 20-year term policy could be a good choice.

Buy enough coverage to protect your dependents’ financial future

- She usually recommends getting coverage that is 20–25 times your yearly income so your family can keep their lifestyle and pay for big expenses.

Why Suze Orman Prefers Term Over Whole Life

Suze Orman is against whole life and other permanent life insurance policies because there are so many reasons few of which are discussed below:

They are expensive

Permanent life insurance policies are expensive because they have high monthly premiums and can cost 5-15 times more than term life insurance for the same amount of coverage.

They give low returns

The cash value in permanent life insurance usually grows more slowly than what you could make by investing in low-cost index funds or retirement accounts.

They can be misleading

She also says that many insurance salespersons sell whole life insurance as a forced savings, but they do not explain the high fees and penalties if you cancel the policy early.

Her simple rule is: “Buy term, and invest the difference.” This means you choose lower-cost term life insurance and put the money you save into investments, so your money grows over time and you may not need life insurance later.

How Much Does Life Isurance Cost?

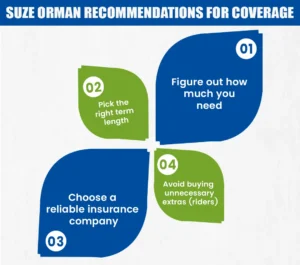

Suze Orman Recommendations for Coverage

If you want to follow Suze Orman’s advice on life insurance, here’s how she suggests that whato to decide when you are looking for your coverage:

Figure out how much you need

- Take your yearly income and multiply it by 20–25.

- Add big debts like your home loan, student loans, or other long-term bills.

- Include future costs, like your children’s college tuition.

Pick the right term length

- 10–15 years if your kids are older or your home loan will be paid off soon.

- 20–30 years if you have young children or bigger debts.

Choose a reliable insurance company

Go with companies that have strong financial ratings (A or better) from the agencies.

Avoid buying unnecessary extras (riders)

- Just add some add-ons, like a waiver of premium, can be very helpful if you become disabled.

- But don’t pay for extras you don’t really need.

Does Suze Orman Believe in Long-Term Care Insurance?

Suze Orman thinks long-term care insurance is a good idea, especially for people who are in their 50s or early 60s.

She recommends considering a policy if:

- You have valuable assets that you want to protect.

- You don’t want to burden your family members with caregiving or financial responsibilities.

- You can afford the premiums without cutting back on your retirement savings.

How Her Recommendations Compare to Other Experts

While many financial advisors agree with Orman’s stance on term life insurance, others point out that permanent policies can be useful for:

- Estate planning for high-net-worth individuals.

- Funding certain types of trusts.

- Covering lifelong dependents with disabilities.

Orman doesn’t deny these uses but emphasizes that most people don’t fall into these categories and are better served by buying term coverage.

Our Opinions on Suze Orman Recommendations

For most families, Suze Orman’s advice works well:

- Affordable: Term life insurance is cheaper, leaving more money for other investments.

- Simple: No tricky cash values or loans to worry about.

- Flexible: You can choose a term that fits your family’s needs.

However, we have added a few considerations:

- Health changes: If your health declines before your term ends, renewing or buying new coverage can be costly. Planning ahead is important.

- Discipline in investing: “Buy term and invest the difference” only works if you actually invest the difference. If you tend to spend extra cash, a permanent policy might provide forced savings.

Suze Orman on Avoiding Common Life Insurance Mistakes

She frequently warns against:

- Buying coverage through work only – Employer policies usually end when you leave the job, and coverage amounts are often too low.

- Letting salespeople talk you into more expensive policies – Permanent policies may benefit the salesperson more than you.

- Underinsuring – Too little coverage can leave your family struggling if you pass away unexpectedly.

Does Suze Orman’s Advice Fit Everyone?

Not always, her idea works for most people, but still, there are some exceptions.

- Very rich people use life insurance to pass on money and pay less tax.

- Parents with children who have special needs may need life insurance that lasts longer to keep their kids safe.

- People who are not good at saving and find it a hard thing to save money can use permanent life insurance to protect themselves and save money slowly over time.

Final Takeaway

Suze Orman says that life insurance should be affordable and simple, and it has to help you financially. She recommends that buying a term life insurance policy is a better option and there is no need to go for the whole life or universal life insurance, because these policies are expensive and sometimes also have some hidden fees. So it’s better to buy the policy that covers you for the set time when you need it the most.

Protect your family’s future today. Get your term life insurance with Mlife Insurance now!

FAQs

1. Does Suze Orman recommend term life insurance?

Yes. Suze Orman advises most people to buy term life insurance because term life insurance is easy and an affordable option that gives coverage for a set number of years your family depends on your income.

2. Why does Suze Orman advise against whole life insurance?

Suze Orman believes that whole life and other permanent policies are expensive, and it provide low investment returns, and also include hidden fees. Her rule is to “buy term and invest the difference.”

3. How much life insurance coverage does Suze Orman suggest?

Orman recommends coverage equal to 20–25 times your annual income, including major debts and future expenses like children’s college tuition, to protect your family’s financial future.

4. What is Suze Orman’s view on long-term care insurance?

She thinks that long-term care insurance is helpful, especially for people in their 50s or 60s. It helps you to protect your retirement money and stops your family from having to pay for your care.

5. Are Suze Orman’s life insurance recommendations suitable for everyone?

Not always. While term life works for most families, high-net-worth individuals, parents of children with special needs, or those who struggle to save may benefit from permanent policies.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.