Key Points

- Lifetime Coverage Guarantee

- Builds Cash Value

- Fixed Premium Rates

- Tax-Free Benefits

- Supports Estate Planning

Life is full of surprises, there are days that have some good things, some are not so good. No one knows what will happen tomorrow, and what it brings, but being prepared can make all the difference. That is where the whole life insurance comes to save you. These plans are not just about protection after you have gone but also they build lifelong financial safety, saving for the future and supporting your loved ones when they need it the most.

In the simple guide, we will break down everything for you like what is whole life insurance policy mean and how it work also we will discuss the main benefits how much it will cost you so by the end of this article you will clearly understand that why so many people are choosing the whole life plan to secure their future and create a lasting Peace of mind

What Is a Whole Life Plan Insurance?

Whole life insurance is a type of permanent life insurance that protects you for your entire life. This plan is not like term life insurance that comes for a few years. As long as you keep paying your monthly premiums your policy will stay active and will never expire.

Let’s explain you in simple words, a whole life plan means lifetime coverage and also the saving for your life. It includes two main parts.

Life coverage

The first part is that the plant provides you life coverage if you pass away your family will get money that is called death benefit

Cash value

The amount of money from your monthly premiums that you have paid goes to the account and builds up the cash value, this cash value works as the savings in your account and you can borrow or withdraw it later in life when you need it.

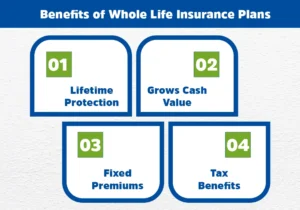

Benefits of Whole Life Insurance Plans

Whole life insurance comes with so many benefits and gives you a stress free future. It provides you something more than just basic coverage. Let’s have a look at how it can make a real difference in your life.

Lifetime Protection

The plan is not term life insurance that ends after 10,20 or 30 years, whole life insurance stays active for your entire life. As long as you are paying your monthly premiums your loved ones will always stay protected.

Grows Cash Value

The part of the money you pay for your monthly premiums will slowly build up as savings inside your policy. The savings are called cash value and you can borrow or withdraw it later for any emergency education or retirement.

Fixed Premiums

Your premiums will stay the same forever. The good thing is it never increases as your age increases. So it is very easy to plan your long-term budget.

Tax Benefits

The money your policy earns is tax effort. It means that you don’t have to pay any tax on it until you take it out. Plus the death benefit your family will receive is usually tax free.

Help With Financial And Estate Planning

The whole life insurance plan can be a part of your financial estate plan. It helps you build the money, live inheritance and also make sure your loved ones are cared for after you are gone.

Best Whole Life Insurance Plans In 2025

When you are choosing to plan a whole life insurance, you have to look for the flexibility and benefits and also make sure that this plan will match your needs and goals. Updated insurance providers can offer you these things like.

- Guarantee death benefit

- Dividend payout

- Custom payment option

- Accelerated benefits for critical illness

Always make sure to compare the whole life insurance plans from the trusted insurance company before deciding to buy. Each insurance provider offers you slightly different benefits so make sure to take time to consider the options ,coverage amounts and added features.

Affordable Whole Life Plans

Whenever you are thinking about whole life insurance, you might think whole life insurance is expensive, but in reality there are so many companies now we are offering the affordable whole life insurance plans that balance coverage and cost

Here are a few tips that can lower your premium let’s have a look

- By early because the younger applicants can get the cheaper rates

- Choose the right coverage amount for your needs

- Ask for the family or bundle discount

- Maintain good health to qualify for better rates.

How Much Does Life Isurance Cost?

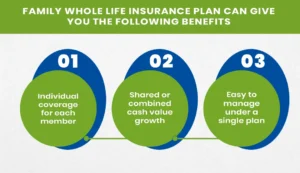

Family Whole Life Insurance Plans

A family whole life insurance plan will cover multiple members under one policy. This plan will make sure that your loved ones or your spouses, children, or parents all are protected in one whole plan.

Family whole life insurance plan can give you the following benefits

- Individual coverage for each member

- Shared or combined cash value growth

- Easy to manage under a single plan

Children’s Whole Life Insurance Planning

A whole life insurance plan will help the parents to secure their child’s future in the early age so that their children will never get any financial stress in the future

The children whole life insurance give you the benefits that includes the guaranteed life long coverage, locked in into premium rates, cash value growth for education or emergencies

Senior Whole Life Insurance Plan

Senior life insurance plan specially designed with the older people that are used in between 50 years to 85 years. This plan will help to cover the final expenses, medical bills or estate planning needs

This is very easy to qualify, and also you don’t have to give any medical exam to qualify . Seniors choose this smaller coverage amount to cover the end of life expenses that are affordable for them.

Whole Life Insurance For Retirement Planning

whole life insurance is not just about that benefit, it is also a smart tool for retirement planning. This is how the whole life for retirement planning works, let’s have a look

- The cash value acts like a saving account so that you can borrow from it during retirement

- It also provides guaranteed returns with low risk rate

- It also supplement your income when other investments fluctuate

Whole Life Insurance for Estate Planning

When it comes to state planning a whole life insurance policy will make sure that you receive a tax free inheritance you can use it to pay the taxes, leave money for heirs and also fund charitable gifts

Compare Whole Life Insurance Plans

Then you compare the whole life insurance plan you have to focus on a few things make sure to see the premium costs, cash value growth rate, dividend options, flexibility in payments and also financial reputation of the insurance company

Conclusion

As we have discussed the whole life insurance plan is more than just a policy, it is a lifetime investment in your family’s future. No matter if you are building wealth, planning for retirement, or securing your children’s future. The whole life plan offers you so many benefits so that your family will never get any stress. Whole life insurance comes with so many affordable options so that the family can choose according to the budget. Always make sure to compare the prices from the different insurance companies before buying the plan because when life changes, your protection should never end.

Get a free quote today for the whole life insurance from M-Life and protect your loved ones and family.

FAQS

A $500,000 whole life policy will usually cost you between $200 to $500 per month, it depends on your age, health, and gender. Younger people generally pay much lower premiums overall.

The main catch is that whole life insurance costs more than term insurance. However, it lasts your entire life and builds cash value that you can borrow or use later.

It’s expensive, and the cash value grows slowly in early years. If you cancel early, you might lose some money, so it’s better for long-term financial planning.

A whole life plan gives coverage for your entire lifetime. You pay fixed premiums, and the policy builds cash value that can be used for emergencies, loans, or retirement savings.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.