Are you searching for a financial strategy that offers stability, growth, and control? Look no further than infinite banking! A concept gaining popularity for its ability to empower individuals to take charge of their financial futures. At the heart of this strategy lies whole life insurance, a powerful tool when used correctly.

But with countless options available, how do you determine the best whole life insurance for infinite banking? Let’s explore.

When considering the best whole life insurance for infinite banking, several factors come into play. These include the policy’s cash value growth potential, fees, loan provisions, and the financial strength of the insurance company. Here are some top options to consider:

What is Infinite Banking?

Before moving towards our main concern “best whole life insurance for infinite banking” let’s first talk about what is infinite banking, and why is whole life insurance integral to its success. Infinite banking is a concept that empowers individuals to become their own bankers, enabling them to control and grow their wealth through a specially designed whole life insurance policy. At its core, infinite banking involves using whole life insurance to accumulate cash value over time, which can then be borrowed to finance various expenses. Whole life insurance is integral to the success of infinite banking for several reasons. Firstly, whole life insurance policies offer a guaranteed death benefit, providing a level of financial security for the policyholder’s beneficiaries. Additionally, these policies feature a cash value component that grows over time, allowing policyholders to access funds for loans or withdrawals. Furthermore, these policies typically offer fixed premiums, providing stability and predictability in terms of financial planning. This aspect is crucial for infinite banking, as it allows individuals to create a reliable source of funding for their financial needs. Overall, whole life insurance plays a vital role in infinite banking by providing a secure and flexible financial tool for wealth accumulation and management.How Does Infinite Banking Work?

Infinite banking works by leveraging a whole life insurance policy to create a pool of cash that you can borrow against. Here’s a step-by-step breakdown of how it typically works:1- Purchase a Whole Life Insurance Policy

You start by purchasing a whole life insurance policy from a reputable insurance company. Unlike term life insurance, which provides coverage for a specific period, whole life insurance covers you for your entire life and includes a cash value component.2- Build Cash Value

As you make premium payments on your whole life insurance policy, a portion of these payments go towards building cash value within the policy. This cash value grows over time on a tax-deferred basis, similar to a savings account.3- Access Cash Value

Once your policy has accumulated sufficient cash value, you can begin to borrow against it. This is typically done through a policy loan, where you use your cash value as collateral. The loan is not dependent on credit checks or approval from a bank.4- Repay the Loan

When you borrow from your policy, you’re essentially borrowing from yourself. You can choose to repay the loan on your own terms, including the interest, which is typically lower than what you’d pay to a traditional lender. Repaying the loan restores the cash value to your policy, making it available for future use.5- Repeat the Cycle

As you repay the loan, the cash value in your policy continues to grow, creating a cycle of borrowing and repaying that can be used to finance various expenses or investments. Over time, this strategy can help you build wealth, achieve financial flexibility, and create a source of funding for future needs. Moreover, it allows you to take control of your finances by using the best whole life insurance policy for infinite banking to grow and access cash value, providing a level of financial security and flexibility that traditional banking may not offer. Best Whole Life Insurance for Infinite Banking

Best Whole Life Insurance for Infinite Banking

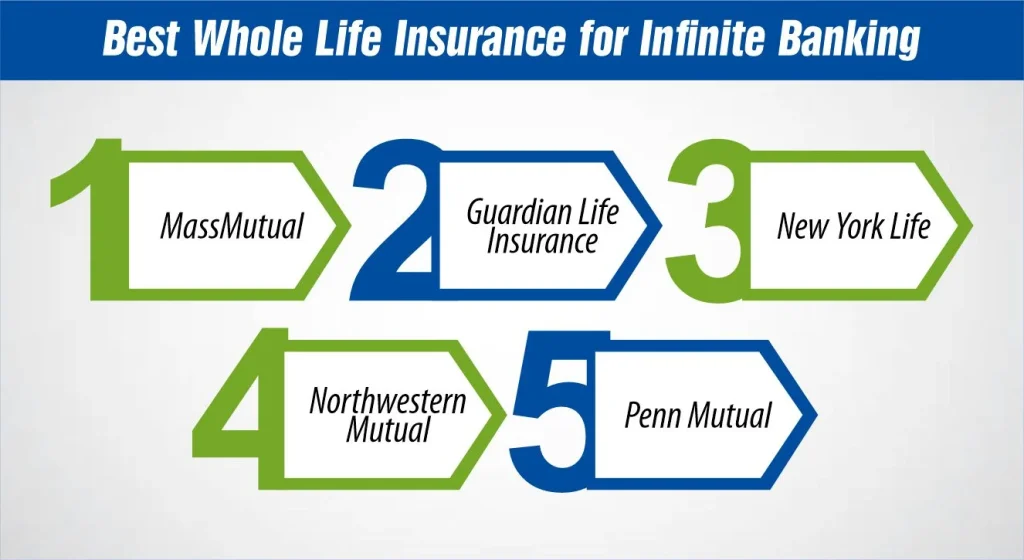

When considering the best whole life insurance for infinite banking, several factors come into play. These include the policy’s cash value growth potential, fees, loan provisions, and the financial strength of the insurance company. Here are some top options to consider:

1- MassMutual

MassMutual is known for its strong financial ratings and stable performance. Their whole life insurance policies offer competitive cash value growth rates and flexible loan options, making them ideal for infinite banking.2- Guardian Life Insurance

Guardian is another reputable insurance company that offers whole life insurance policies tailored for infinite banking. Their policies feature robust cash value accumulation and a variety of dividend options, providing policyholders with flexibility and control over their financial assets.3- New York Life

New York Life is a well-established insurance company with a long history of financial stability. Their whole life insurance policies offer competitive cash value growth and dividend options, making them a solid choice for infinite banking.4- Northwestern Mutual

Northwestern Mutual is known for its financial strength and customer service. Their whole life insurance policies offer competitive cash value growth rates and a variety of rider options, allowing policyholders to customize their coverage to meet their specific needs.5- Penn Mutual

Penn Mutual is a mutual insurance company known for its whole life insurance policies. Their policies offer competitive cash value growth and dividend options, making them a good choice for infinite banking. It’s essential to review the financial strength and reputation of the insurance company, to determine the best whole life insurance for infinite banking strategy. Consulting with a financial advisor who specializes in infinite banking can also help you make an informed decision.Benefits and Downsides of Best Whole Life Insurance for Infinite Banking

Best whole life insurance for infinite banking offers several benefits and downsides to consider before implementing this financial strategy.Benefits:

- Financial Control: Infinite banking allows you to become your own banker, giving you control over your finances and how you use your cash value.

- Tax Advantages: The cash value growth within a whole life insurance policy is tax-deferred, meaning you don’t pay taxes on the growth until you withdraw it.

- Asset Protection: Cash value within a life insurance policy is typically protected from creditors in many states, providing an additional layer of asset protection.

- Stable Growth: Whole life insurance policies offer guaranteed cash value growth, providing a stable and predictable asset in your financial portfolio.

- Flexible Access to Funds: You can borrow against the cash value in your policy at any time, for any reason, without approval from a bank or credit check.

- Legacy Planning: Life insurance death benefits provide a tax-free inheritance for your beneficiaries, helping you leave a financial legacy.

Downsides:

- Cost: Whole life insurance policies can be more expensive than term life insurance, especially in the early years.

- Complexity: Implementing infinite banking requires a good understanding of insurance and financial concepts, which can be challenging for some individuals.

- Risk of Policy Lapse: If you don’t manage your policy properly, there’s a risk that it could lapse, causing you to lose your cash value and coverage.

- Opportunity Cost: The cash value growth in a whole life insurance policy may be lower than potential returns from other investments, depending on market conditions.

- Loan Repayment: While you can borrow against your policy’s cash value, you’ll need to repay the loan with interest to restore the cash value and avoid negative consequences.

What Type of Life Insurance Policies can be used for Infinite Banking?

Infinite banking typically involves using a whole life insurance policy as the foundation for the strategy. However, you can also use certain types of permanent life insurance policies depending on your financial goals and risk tolerance. Here are the main types of life insurance policies you can use for infinite banking:1- Whole Life Insurance

Whole life insurance provides coverage for your entire life and includes a cash value component that grows over time. This cash value can be accessed through policy loans, making it a popular choice for infinite banking.2- Indexed Universal Life Insurance (IUL)

IUL policies offer flexibility in premium payments and death benefits, as well as the opportunity to earn interest based on the performance of a stock market index. While IUL policies can be used for infinite banking, they come with more complexity and risk compared to whole life insurance.3- Universal Life Insurance (UL)

UL policies also offer flexibility in premium payments and death benefits, but they do not offer the same guarantees as whole life insurance. UL policies can be used for infinite banking, but they require careful monitoring and management to ensure the policy remains sustainable.4- Variable Universal Life Insurance (VUL)

VUL policies allow you to invest the cash value portion of your policy in sub-accounts that are similar to mutual funds. While VUL policies offer the potential for higher returns, they also come with more risk and complexity compared to other types of life insurance policies.Is Infinite Banking Legitimate?

Yes, infinite banking is a legitimate financial strategy that has been used by individuals and businesses for many years. The concept is based on using a whole life insurance policy as a financial tool to create a pool of cash that can be accessed for various purposes, such as financing investments, purchasing assets, or funding retirement. Infinite banking grounds itself in the principles of dividend-paying whole life insurance, a staple in the insurance industry for over a century. Insurance companies and financial professionals who understand the mechanics of whole life insurance and its proper benefits support the strategy. However, it’s essential to approach the best whole life insurance for infinite banking with a clear understanding of how it works and the risks involved. Like any financial strategy, infinite banking has its pros and cons, and it may not be suitable for everyone.What are Alternatives to Best Whole Life Insurance for Infinite Banking?

There are several alternatives to infinite banking, each with its own advantages and disadvantages. Here are some common alternatives:-

Traditional Banking

-

Investment Accounts

-

Real Estate Investing

-

Retirement Accounts

-

Peer-to-Peer Lending

Final Verdict

In conclusion, whole life insurance plays a crucial role in the infinite banking strategy, providing a stable foundation for wealth accumulation and financial flexibility. By choosing a policy with high cash value growth potential, favorable loan provisions, and a reputable insurance provider, you can maximize the effectiveness of your infinite banking strategy and achieve financial independence sooner. So, take the first step towards unlocking your financial freedom today by selecting the best whole life insurance for infinite banking.References:

https://www.nerdwallet.com/article/insurance/infinite-banking https://www.marketwatch.com/guides/insurance-services/infinite-banking/

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.