Key Points

- Health insurance protects you from high medical expenses

- Individuals and family plans offer the flexible coverage

- Marketplace and ACA plans will provide the subsidies

- PPO plans give Dr. flexibility

- High deductible plans lower the monthly cost

- Medicaid support the low income individuals

- Make sure to always compare the plans before buy

Choosing the right health insurance plan is one of the most important financial and the health decisions you can ever make in your life. This is because due to the rising medical costs, having the proper coverage will protect you from the unexpected expenses and also make sure that you can access quality healthcare. No matter if you are new and looking for the individual health insurance plan, you want it for your family or you want the coverage for a small business, understanding your options is very important.

For this, we are here with the detailed guide that will explain the different types of health insurance and individuals plans, you will get to know that how you can compare them and how to find the best health insurance plan for individuals based on your needs and budget

Basic Understanding Of Health Insurance Plan

Health insurance plans are simply understood in this way that these are the contracts that are signed between you and an insurance company so that in future it will help to cover the medical expenses such as your doctor visits, hospital stays, prescription medicines, and preventive care. In exchange for a monthly premium the insurance company will pay a portion of your healthcare costs.

There are so many types of health plans for individuals, families, students, and businesses each of the plans are specially designed for different situations and financial needs.

Individual Health Insurance Plans

Individual insurance plans are specially designed for the people who don’t get coverage through an employer. These plans are best for the freelancers, self-employed professionals, retirees under 65 and other unemployed individuals.

Here are some of the benefits of individual health insurance plan that are given for the better understanding that how these plans give benefits to the individuals

- Personalized coverage options

- Choice of doctors and hospitals

- Available through private insurance companies or the marketplace

- Eligible for the subsidies under ACA health plans

There are so many people who prefer private health plans because they offer flexibility and provider networks.

Best Health Insurance Plans for Individuals

Getting deep into the topic, the best health insurance plan for individuals depends on the factors like income, health condition and the preferred doctors. Here are some of the popular plan types that include

PPO Health Insurance Plans

PPO means prefer provider organization, these plans allow you to visit the specialist without referrals and see out of network doctors at the higher prices. These plans are best for the people who want flexibility.

Health Insurance Plans High Deductible

Health plans, high deductible options offer the lower monthly premiums, but can be the higher out-of-pocket costs. They are best for healthy individuals and they can be prepared with health savings accounts.

Affordable Health Insurance Plans

If the budget is one of your main concerns then the cheap health insurance plans or affordable health insurance plan through the marketplace can offer the subsidies that are based on income.

Marketplace Health Insurance Plans (ACA Plans)

Marketplace health insurance plan that are also known as ACA health plans. These plans are available to the government exchanges. These plans must cover the important health benefits, and they cannot deny the coverage due to the pre-existing conditions.

Here we are looking at the key features that these plans are especially helpful for those who are looking for the health insurance plans for individuals with predictable coverage and legal protection

- Income based subsidies

- Preventive care included

- Coverage for mental health and prescriptions

- Options for individuals and families

Family Health Insurance Plans

Family and insurance plans are designed to cover the multiple members under the one policy. These plans often come with a lower cost than the separate plans.

Here are some of the few reason reasons that why you choose a family health insurance plan

- One deductible for the whole family

- Simplified billing

- Coverage for children’s healthcare needs

- Access to preventive and pediatric care

Student Health Insurance Plans

A student health insurance plan is specifically made for the college and university students. These plans are often affordable and they also meet the school requirements.

These plans usually cover the following things

How Much Does Life Isurance Cost?

- On campus and off campus medical care

- Mental health services

- Emergency treatment

Short Term Health Insurance Plans

Short-term health plans provide the temporary coverage for the people between jobs, also for the ones who are waiting for the enrollment periods or the coverage. Lets have a quick look at the table for the pros and cons.

| Pros | Cons |

| lower premiums | limited benefits |

| quick approval | no coverage for pre existing conditions |

Small Business Health Insurance Plans

Small business health plans are there to help the employers to provide the coverage to employees while receiving the tax benefits.

Benefits include the employee retention, tax, credit, group rates, and the better coverage options.

Most of the time these are offered as a group health insurance plan, which typically have the lower premiums as compared to the individual plan.

Medicaid Health Insurance Plans

Medicaid health plans are the government funded programs for the low income, individuals and families

- These plans have low or no monthly premiums

- It covers the important health services

- It has the eligibility varies by the state

State-Specific Health Insurance Plans

There are some of the people who search for coverage by location in the United States, such as Texas health plans, and health insurance plans. You just have to keep one thing in mind that each state has its own marketplace options, Medicaid rules, and the insurance providers. The availability of coverage, the prices and the benefits can be different in each state so it is very important to compare the plan based on your state.

How to Compare Health Insurance Plans

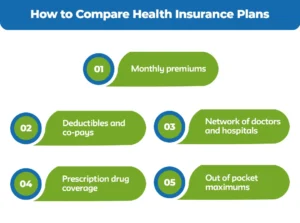

Before choosing a policy, it is very important to compare the health insurance plans very carefully. You must have to look for the following things.

- Monthly premiums

- Deductibles and co-pays

- Network of doctors and hospitals

- Prescription drug coverage

- Out of pocket maximums

Private Health Insurance Plans Vs Group Health Insurance Plans

| Feature | Private Health Insurance Plan | Group Health Insurance Plan |

| who buys it | individuals and families | employers |

| cost | higher premiums | lower group rates |

| flexibility | more plan choices | limited options |

| eligibility | anyone | employees only |

Final Verdict

Finding the ideal insurance plan does not have to be very confusing. It’s not a problem that you are searching for the individual health insurance plan, if you are looking for the family or the small business health insurance plan, it is very important to understand your options and this is the only thing that makes all the difference.

By comparing private health plans, marketplace plans, and the group health insurance plan you can choose the coverage that will best for both of your health and your budget. The right plan to take and protect your health.

Protect your health and budget today, choose M-life Insurance affordable, reliable health insurance plans that are specially designed to your needs.

FAQS

The top five usually best health insurance companies are United Healthcare, Blue Cross, Blue Shield, Aetna, Cigna, and Humana because they offer a wide range of coverage options and large doctors networks.

United Healthcare, Blue Cross Blue Shield and Aetna are often ranked as the top three best health insurance companies because they have affordable plans and many doctors nationwide.

There are four main types of health plans that are HMO, PPO, EPO and POS. These types are different in doctor choices, referrals and prices.

United Healthcare usually has a bigger network while the Blue Cross is stronger than some of the states. The better choice depends on where you live.

United Healthcare, Aetna and CIGNA are considered as the best private health insurance providers for the flexible plans and options.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.