Important Points

- AD&D insurance covers only accidental death or injuries

- Life insurance covers most causes of death

- Basic life and AD&D insurance is often provided by the employer

- Voluntary coverage allows you to buy more protection

- Supplemental AD&D strengthens accident benefit

- AD&D should never replace life insurance

- Combining life and AD&D offers proper protection

Understanding insurance can sometimes feel very confusing, especially in terms like what is ad and d life insurance, life insurance, basic, voluntary, and supplemental coverage are used together. There are so many people who are thinking about all these plans and thinking about how these plans work, and how it differs from life insurance.

In this guide, we will explain everything in simple terms from discussing accidental death and Dismemberment insurance to the difference between life insurance and AD&D insurance including the employer provided options and supplemental life and AD&D insurance. Let’s have a deep dive to get a better understanding.

Basic Idea Of What Is Ad And D Insurance

AD&D insurance stands for accidental death and this Dismemberment insurance. This client provides a benefit if the insured person dies due to a covered accident or suffers a serious injury, such as loss of limb, eyesight, speech or hearing.

The plan is not like the traditional life insurance, AD&D insurance only pays for accidents, not natural causes or any other illnesses.

So whenever you think about AD&D insurance the answer is very simple: this is a policy that pays benefits only when death or injury is caused by an accident.

Life Insurance and AD&D Insurance – Basic Understanding

Life insurance and insurance are often bundled together, especially in the workplace benefits. But you have to get the understanding of both to make the better decision.

- Life insurance pay is a death benefit, regardless of whatever the cause of death was.

- AD&D insurance protects only if death or injury results from an accident

Whenever these are combined, this coverage provides broad protection, like life insurance covers more deaths, while AD&D adds extra benefits for accidental situations.

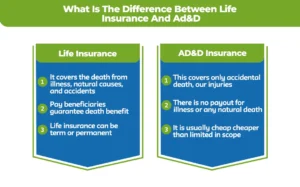

What Is The Difference Between Life Insurance And Ad&D

You always get confused by the difference between life insurance and AD&D insurance and here are the key difference we are discussing

Life Insurance

- It covers the death from illness, natural causes, and accidents

- Pay beneficiaries guarantee, death benefit

- Life insurance can be term or permanent

AD&D Insurance

- This covers only accidental death, our injuries

- There is no payout for illness or any natural death

- It is usually cheap cheaper than limited in scope

Providing the information in general, life insurance is broader while AND is accident specific.

Another way to look at the difference between AD&D and life insurance is reliability. Life insurance is dependable for long-term family protection. AD&D insurance is supplemental and should never replace life insurance because most that are not accidental.

What Is Basic Life and AD&D Insurance

Basic life and AD&D insurance is commonly offered by the employers at no cost or sometimes at very low cost to the employees. This usually includes.

- A basic life insurance benefit most of the time 1x annual salary

- AD&D coverage for accidental deaths or serious injuries

This coverage is a great starting point, but not often enough on its own for the full financial protection.

What Is Voluntary Life Insurance And Ad&D

Voluntary life insurance, and AD&D allows the employees to buy extra coverage through their employer. Here are some of the advantages that it gives.

- Lower group rates

- Payroll deduction convenience

- Option to increase coverage beyond basic limits

This is very useful if your basic coverage does not meet your family’s financial needs.

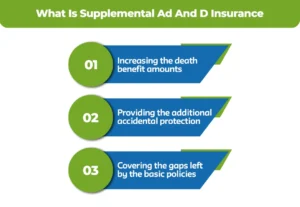

What Is Supplemental Ad And D Insurance

If you are searching for what is supplemental life and ad & d insurance, then here is the simple explanation so that you can understand. Supplemental life and AD&D insurance is an extra coverage that is purchased to strengthen the basic benefits. This will help you.

- Increasing the death benefit amounts

- Providing the additional accidental protection

- Covering the gaps left by the basic policies

This option is popular for the employees with dependants are higher financial applications

How Much Does Life Isurance Cost?

What Is Life and AD&D Insurance Used For

Life and AD&D and insurance is best to use to protect the family income, it also helps to cover the funeral and final expenses, and it provides extra support after accidental injuries. Together they create a more complete safety net.

Importance – Is AD&D Insurance Worth It

AD&D and Life insurance can be very helpful if you work in a high risk occupation, if you travel frequently or you already have a strong life insurance coverage. But remember that this is not sufficient alone and you should always compliment life insurance.

Who Should Consider Supplemental or Voluntary AD&D

You can consider this plan if your employers offer low-cost group coverage, if you want extra protection or you already have adequate life insurance.

Final Thoughts

AD&D insurance is a helpful add-on, but it should never replace life insurance. While a AD&D covers accidental death and serious injuries, life insurance provides you broader, more financial protection. Combining the basic, voluntary or supplemental life and AD&D and the insurance create a strong financial security for you and your loved ones.

Protect your family’s future with confidence.M-Life insurance offers reliable life and AD&D coverage plans that are specially designed to your needs and budget. Let’s get expert guidance, flexible plans, and peace of mind today. Request your free quote from life insurance now and secure what matters the most.

FAQS

AD & D insurance will cover the death or serious injury. Only if it happens by any accident like a car crash or workplace injury. It does not cover any illness or natural death.

Yes, an extra protection. This is worth it. AD & D is low cost and helpful for accidents, but it should only be added on the top of life insurance, not used as a loan.

Yes, having both is better. Life insurance covers most of the deaths while AD&D adds extra money if death or injuries caused by any accident.

AD&D insurance does not cover the death from any illness, old age, and natural causes are the risky activities. It only pays you when there is an accidental death.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.