Key Points

- Affordable temporary coverage

- Rates increase with age

- Terms options like 10 to 30 years

- Best For protection

- No medical exam options

Life insurance program that will help you to protect your loved ones financially in case something unexpected happens to you in future it can be health related and finance related. Here comes the time life insurance that is simple as in the most affordable option. This plan provides you coverage for the second number of years you can choose 10, 20 or 30 years. Your family will get the death benefit when you pass away during that time.

If you are thinking about how much it will cost and how the age affect the monthly premiums, so then this guy will walk you through everything you need to know about the term life insurance rates by age, you would also find the examples of popular plans like 10 years in 30 years terms and also you can go through the senior life insurance rates

What Is Term Life Insurance?

Term life insurance is the type of temporary life insurance policy that will provide you coverage for a fixed number of years. The years can be 10, 20, 30 years. If the person who buys the policy ties during this time then the policy will pay the dead benefit to their family or the beneficiary. If the term ends and the person is still alive then the coverage will stop and you have to renew it or convert to another plan or stay with this plan.

How Age Affect Term Life Insurance Rates

Your Age plays a very big role in law or high term life insurance monthly rates. Generally if you are younger, you have to pay less premiums because of your good health. Rates can also increase every year as you grow. After the age of 60, the monthly premiums will go up due to the high risk of health problems.

Let’s have a look at some of the sample term life insurance states charts by age so you can better understand how Cost very from each different groups

Term Life Insurance Rates By Age Chart – Average Monthly Cost

| Age | Male (monthly) | Female (monthly) |

| 25 | $18 | $15 |

| 30 | $20 | $17 |

| 35 | $23 | $20 |

| 40 | $33 | $28 |

| 45 | $50 | $42 |

| 50 | $75 | $60 |

| 55 | $120 | $95 |

| 60 | $185 | $140 |

| 65 | $290 | $210 |

| 70 | $470 | $360 |

10 Year Term Life Insurance Sample Rates By Age Chart

A 10 year term life insurance policy is best for short-term needs such as if you want to cover your lawn, home loans, or any business application. Let’s have a look how the rates will look like

| Age | Male (monthly) | Female (monthly) |

|---|---|---|

| 30 | $9 | $8 |

| 40 | $12 | $10 |

| 50 | $20 | $17 |

| 60 | $45 | $35 |

| 70 | $110 | $90 |

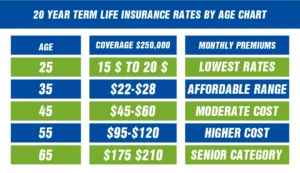

20 Year Term Life Insurance Rates By Age Chart

If you want to buy a 20 year term and life insurance plan then remember that this plan will provide you long-term protection to cover the income replacement all children’s education expenses let’s have a look how the 20 year term life insurance rate by age.

30 Year Term Life Insurance Rates By Age Chart

If you want long-term stability then a 30 year term life insurance policy is the best option for you just have a look at the monthly rates

| Age | Male (monthly) | Female (monthly) |

| 25 | $27 | $23 |

| 30 | $30 | $26 |

| 35 | $38 | $32 |

| 40 | $55 | $46 |

| 45 | $85 | $70 |

| 50 | $240 | $110 |

AARP Term Life Insurance Rate Chart By Age

AARP life insurance offers you the term life insurance plan that is specially made for the people who are in their 50s to 80s. The premiums are very high because there is no medical exam in this plan.

| Age | Male (monthly) | Female (monthly) |

| 50 | $30 | $25 |

| 55 | $45 | $35 |

| 60 | $65 | $50 |

| 65 | $90 | $70 |

| 70 | $125 | $95 |

Senior Term Life Insurance Rates by Age Chart

For people who are over 60 years, then the senior down life insurance will help them to cover their funeral cost and they also leave a small legacy

| Age | Coverage $100,000 | Monthly Premiums |

| 60 | $70-$90 | moderate cost |

| 65 | $95-$120 | higher range |

| 70 | $130-$160 | expensive but possible |

| 75 | $180-$220 | limited options |

Term Life Insurance Rates Chart by Age – No Medical Exam

There is a term life insurance plan that has a no medical exam to qualify this term life insurance approval based on simple health questions so the rates are higher than the regular policy but it provides the fast coverage

| Age | Male (monthly) | Female (monthly) |

| 30 | $25 | $23 |

| 40 | $38 | $33 |

| 50 | $65 | $55 |

| 60 | $120 | $95 |

How Much Does Term Life Insurance Cost For A 65 Year Old?

For 65 years old for September life insurance will cost you that will depend on the coverage and term length

Let’s have a look at what are the possible prices

- a one hundred thousand dollar policy will cost you around $95-$120 per month

- $500,000 policy can cost you around $320-$380 per month

A 10 year term life insurance is the most affordable option at that age.

How Much Is a $500,000 life insurance policy for a 60 year old man?

A healthy 60 year-old man can expect to pay around $240-$280 per month for a $500,000 coverage for the 20 year term policy plan. The people who are smoking and they also have some medical conditions so they have to pay up to double of this amount per month.

How much does a colonial pen pay out for $9.95 a month?

The colonial Penn famous $9.95 per month life insurance plan will provide unit based coverage and there is no fixed amount. Generally, one unit offers you $1000 – $2000 in coverage and that totally depends on your age. So $9.95 per month will equal about $1600-$1800 in that benefit for a 65 year old man.

What is a reasonable amount to pay for the term life insurance?

A reasonable monthly premium is the one that will fit your budget and also fulfil your coverage needs. There are so many people who pay between $20-$50 per month for $250,000-$500,000 coverage if they are under 40 years.

How Much Does Life Isurance Cost?

The older adults in the age of over 60 years have to pay $100 to $300 per month and that is totally depending on their health and term length.

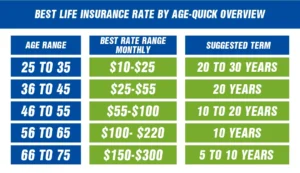

Best life insurance rate by age-quick overview

Tips to get the best term life insurance rate

We are here to give you some useful tips so that you can get the best term life insurance rates. So lets have a look and get your future secured with best rates

- Always buy your policy in early age, so if you are younger then your premiums will be lower

- Always maintain your health because good health also lower your monthly rates

- Make sure to compare the different prices from the different insurance companies, this will also help you to see the lower prices possible

- Always avoid smoking because the tobacco will double the premiums

- Make sure to look at the length of your term plan because the shorter term life cost you less per month

Final Verdict

Understanding the term life insurance stated by a chart will help you to make a better decision no matter what your age is you can be in your 30s what is 60s buying the early plan is the best option. You just have to make sure to compare the prices and options from the different insurance companies so that you will find the best fit for you and your family. And also choose between the term length after seeing your financial goals and your family needs.

If you want to buy an insurance plan or the final expense plan, then you have to get the free quotes from M-life insurance, so that they can provide you the best rates

FAQS

For healthy adults who are in the age of 40 they will have to pay $20-$40 monthly for $500,000 coverage, and is a reasonable price . Seniors can also pay $100 or more depending on their age and health.

On average, the plan will cost you $240-$280 per month for a healthy non-smoker who is buying a 20 year term plan. Smokers or those with health issues have to pay more or even double premiums.

A 65-year-old roughly have to pay $95-$120 per month for $100,000 coverage or $320-$380 per month for $500,000 coverage. The prices are depending on the policy type and the insurance company.

Colonial pens $9.95 policy will cover around $1600-$1800 depending on the age. This plan is best for the seniors who are looking for the small guaranteed issue coverage.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.