KeyTakeaways

- Temporary coverage option

- Easy approval process

- Budget friendly choice

- Great for the travellers

- Short-term job gap

- Free policy quotes

Short-term life insurance is becoming very popular because there are so many people who want quick, simple and temporary financial protection. If you only need coverage for a short term such as for your travelling, changing jobs or waiting for a long-term plan then a short-term life insurance policy can be a great choice for you.

In this guide, we will explain what short-term life insurance is, how it works and how much it will cost you. Also the difference between short-term versus long-term life insurance, their benefits and how to buy the best short-term life insurance policy. So let’s get started.

Simple Understanding Of What Is Short Term Life Insurance

Short-term life insurance is the type of life insurance that will give you financial protection for a limited time that is used from one month to 2 years. It is temporary, also very quick to get, affordable and easy to qualify for.

In simple terms a temporary life insurance plan that provide coverage for a short period to protect your family from financial loss if you pass away during that time

People can also call it with these words as well

- Life insurance short term

- Short term life insurance policy

- Short-term life insurance plans

- Temporary life insurance

- Short-term travel life insurance

Who Should Consider Short Term Life Insurance Policies

You might benefit from the short term coverage if you want short term life insurance plans between jobs , short term life insurance for travel, you need coverage quickly or you need the temporary protection. Let’s have a quick understanding of all these things.

- Short-term life insurance between jobs can help you to keep your family protected until your new job benefit start

- Short-term life insurance for travel gives peace of mind for international or risky trips

- There are so many plans who offer short-term life insurance without an exam it means that there is no medical test and there will be instant approval.

- Maybe you only need life insurance for a few months while waiting for a long-term policy to activate

Why People Buy Short Term Life Insurance

People buy short-term life insurance policies because they are easy to get, also affordable, good for emergencies, great for the temporary needs, flexible and they are approved very fast.

You can get short term life insurance quotes online within minutes and there are so many companies offering approval on the same day.

Types Of Short Term Life Insurance

There are so many types of short-term life insurance policies by getting the details of each you can understand better and you can get what you want

1. Short Term Life Insurance No Exam

Short-term life insurance does not require a medical test or any medical question. The approval is based on your age, simple health questions and lifestyle information. This plan is perfect if you need coverage or have health concerns.

2. Short Term Travel Life Insurance

Short-term travel life will protect your family if something happens to you while you are travelling abroad. It is very useful for international vacations, business trips, mission trips and adventure travel. It can also cover the accidents, emergencies and repatriation.

3. Temporary Bridge Coverage

This will cover you between your jobs, waiting for the employer life insurance and waiting for long-term coverage to start. This is one of the most common reasons people buy short-term life insurance plans.

4. Short Term Accidental Life Insurance

There are some of the policies that only cover accidental death. They are very affordable and simply to buy so the short-term accidental life insurance will help you for this.

Short Term Life Insurance Cost

Short-term life insurance is usually cheaper than the regular life insurance because the cover is last for a short time and the insurance company carries less long-term risk

I’ve just short term life insurance rates are given below and these are general examples in vary by the company

- $10 to $30 per month for younger adults

- $30-$50 per month for people over 40

- $50 $200 per month for seniors or smokers

Non-exam policies may cost slightly more because approval is faster than his hair. You can compare the prize easily with short-term life insurance quotes online.

How Much Does Life Isurance Cost?

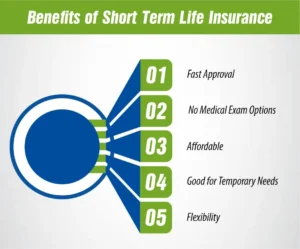

Benefits of Short Term Life Insurance

Let’s have a look at the benefits of short term life insurance so you can get the better understanding of why this is best and how it will benefit you.

Fast Approval

There are so many companies who approve you on the same day

No Medical Exam Options

This is great for people who want simple and quick coverage

Affordable

Short-term life insurance causes worse than the long-term insurance policies

Good for Temporary Needs

It is also perfect for travel, job changes or short-term responsibilities.

Flexibility

You can choose coverage from one month to 2 years.

Best Short Term Life Insurance Uses

There are the most common smart ways that people use these plans

- Short-term life insurance port travel will make sure that your family is beneficial safe during the trip

- Shorten life insurance between jobs can protect your income gap until your new benefits start

- Short-term coverage during life changes like buying a house, starting a business or waiting for a permanent policy

- Short-term life insurance for younger adults can be very useful for the temporary protection

How To Buy Short Term Plan

Buying a short-term life insurance plan is very easy here as the step-by-step process that you can follow and get your plan

- First you have to choose how long you need the coverage like choosing a period for 30 days, three months, six month or pick what fits your situation

- Then you have to compare the short-term life insurance quotes from the different companies you have to check the premiums, amount, policy terms and option benefits

- If you want approval, then you have to pick the short-term life insurance with no medical exam

- Then you have to apply online. Most of the applications take 5 to 10 minutes.

- At last, you get the coverage immediately or within 24 hours.

Pros and Cons of Short Term Life Insurance

| Pros | Cons |

| Very fast approval | Not for long-term financial planning |

| Simple application | Limited coverage period |

| No medical exam options | May not offer high coverage amounts |

Final Thoughts

Shorter life insurance is one of the easiest and the fastest ways to protect your family during temporary situations. It is very simple, affordable and flexible and also perfect for people who need coverage without a long-term commitment. No matter you want shorter life insurance for travel, between your jobs are simply temporary peace of mind. This is best as it provides the protection you need at the price you can afford.

Need Coverage Now? Apply Today with M-life Insurance and Get Approved in Minutes!

FAQS

Short-term life insurance is the temporary life insurance plan that will protect your family for a short time that is usually one month or two years. If you pass away during that time your family will get the money.

Yes some companies offer you one month life insurance or month two month temporary coverage. This will help if you only need protection for a short trip, job change or temporary need. It is quick and easy to buy.

Short-term insurance means that you are covering for a short period not the long term. It is temporary and lasts only for the time you need it. For example, short of life insurance,short-term health insurance and short-term travel insurance.

Here are the four most common types of life insurance, the term life insurance, the whole life insurance, universal life insurance and short-term life insurance that is also called the temporary life insurance.

Joyce Espinoza, Expert Life Insurance Agent

Joyce Espinoza is a trusted life insurance agent at mLifeInsurance.com. She’s been in the insurance industry for over ten years, helping people, especially those with special health conditions to find the right coverage. At MLife Insurance, Joyce writes easy-to-understand articles that help readers make smart choices about life insurance. Previously, she worked directly with clients at Mlife Insurance, advising nearly 3,000 of them on life insurance options.